Could OSI Systems’ (OSIS) Move to Convertible Debt Reflect a Shift in Long-Term Capital Strategy?

- OSI Systems recently completed a US$500 million private offering of 0.50% senior unsecured convertible notes due in February 2031, using part of the proceeds for share repurchases and debt repayment.

- The offering, initially set at US$400 million and upsized in response to demand, introduced convertible securities which prompted investor focus on potential future dilution despite the announced buyback.

- We'll assess how the introduction of convertible bonds could alter OSI Systems' earnings outlook and future share count assumptions.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

OSI Systems Investment Narrative Recap

To own shares in OSI Systems today, an investor needs confidence in the enduring growth of global infrastructure and security spending, and the company’s ability to capitalize on large, recurring government contracts. The recent US$500 million convertible note issue introduces some short-term uncertainty around future share count, but is unlikely to materially affect the primary near-term catalyst: a robust contract backlog and strong pipeline tied to major US and international infrastructure programs. The biggest immediate risk, exposure to delayed pay cycles from sovereign customers, remains unchanged and should stay top of mind for shareholders.

Among recent events, the company’s raised earnings guidance for FY 2026, announced in October, stands out as directly relevant. The upgraded revenue range, paired with fresh capital from the convertible notes, reflects management's expectation that large contract wins and ongoing government security initiatives will drive resilient performance despite evolving capital structure considerations.

But while the capital raise helps position OSI for growth, investors should be aware that ongoing working capital volatility from slow-paying customers could...

Read the full narrative on OSI Systems (it's free!)

OSI Systems' outlook anticipates $2.0 billion in revenue and $199.7 million in earnings by 2028. This implies a 5.6% annual revenue growth rate and a $50.1 million earnings increase from the current $149.6 million.

Uncover how OSI Systems' forecasts yield a $286.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

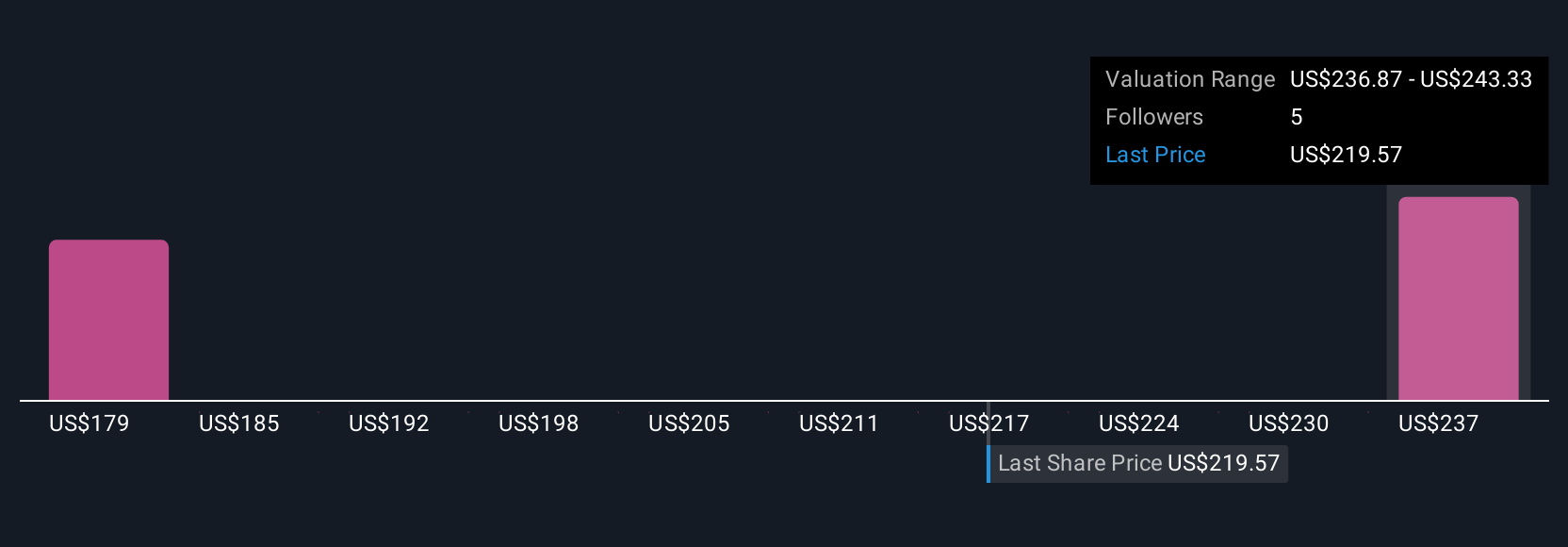

Simply Wall St Community members have set fair value estimates for OSI Systems between US$194.68 and US$286, capturing a wide span of outlooks from three contributors. As government payment cycles remain a significant risk, consider how opinions vary on the impact these delays could have on liquidity and future results.

Explore 3 other fair value estimates on OSI Systems - why the stock might be worth 22% less than the current price!

Build Your Own OSI Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OSI Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OSI Systems' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal