Will Diodes’ (DIOD) New Automotive LED Controller Strengthen Its Position in Vehicle Display Technology?

- Diodes Incorporated recently announced the launch of the AL3069Q, an automotive-compliant 60V boost controller designed for backlight applications in infotainment panels, instrument clusters, and heads-up displays, offering high-precision current sink channels and advanced safety diagnostics.

- This product highlights Diodes' expanding presence in automotive electronics by supporting larger, high-efficiency LED displays and integrating comprehensive protection features for system reliability.

- We'll examine how Diodes' focus on robust automotive LED controller solutions may reinforce its long-term growth opportunities outlined in the investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Diodes Investment Narrative Recap

To feel confident as a Diodes shareholder, you’d need to believe that the company can successfully expand beyond its cyclical consumer base and build a sustainable, high-margin automotive and industrial business. While the AL3069Q launch deepens Diodes’ position in automotive electronics, home to higher growth and potentially better margins, this alone does not materially shift the near-term catalyst, which remains the company’s ongoing transition to higher-value products and managing existing inventory risks.

Of Diodes’ recent updates, its Q3 earnings report stands out for showing both sales and net income growth year-over-year, despite a tough backdrop for consumer-focused names. This result aligns with the thesis that new product launches, especially automotive-qualified devices such as the AL3069Q, could help offset volatility from cyclical markets and add some resilience to earnings. However, the question remains whether product momentum can keep pace with...

Read the full narrative on Diodes (it's free!)

Diodes' narrative projects $1.8 billion revenue and $124.0 million earnings by 2028. This requires 8.7% yearly revenue growth and a $60.4 million earnings increase from $63.6 million.

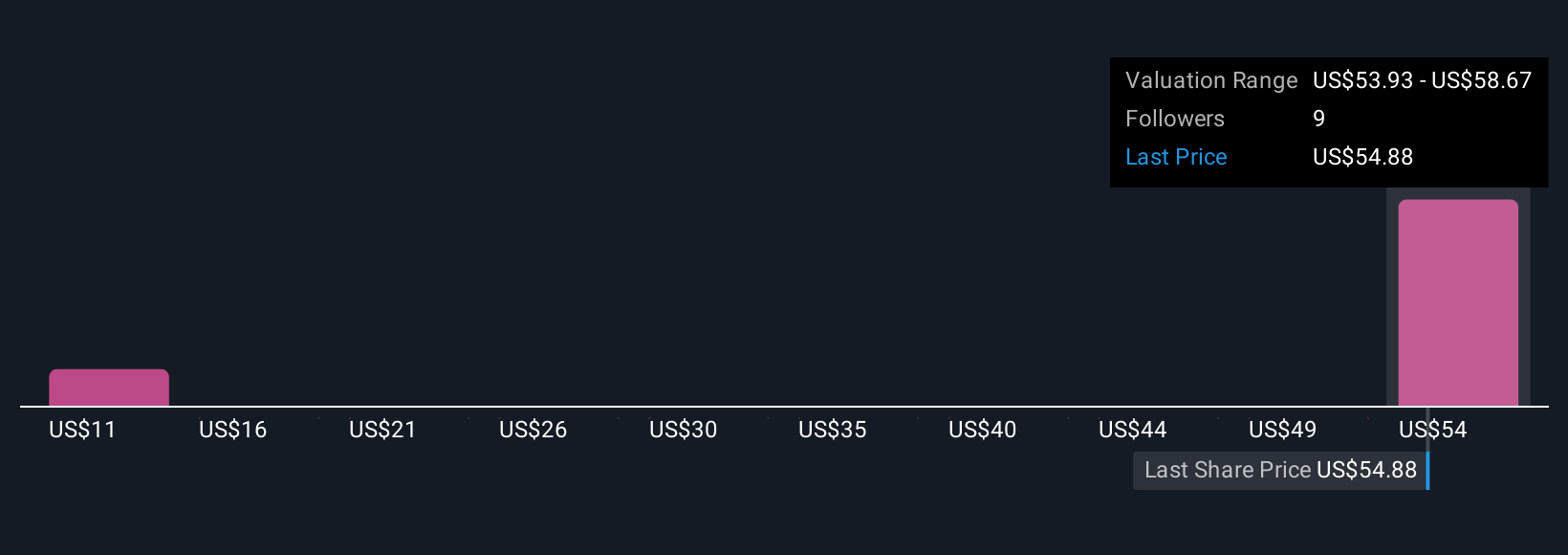

Uncover how Diodes' forecasts yield a $58.67 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Private fair value estimates from the Simply Wall St Community range from US$27.39 to US$58.67 based on two individual forecasts. With such a spread, keep in mind that execution risk around new product ramp and inventory remains a key focus for overall company performance.

Explore 2 other fair value estimates on Diodes - why the stock might be worth as much as 31% more than the current price!

Build Your Own Diodes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diodes research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Diodes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diodes' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal