Group 1 Automotive (GPI): Reassessing Valuation After Boosted Buyback and Sustained Dividend

Group 1 Automotive (GPI) just announced an increase to its equity buyback plan, raising the authorization to $500 million, and reaffirmed its quarterly dividend of $0.50 per share. These moves highlight management’s focus on returning value to shareholders.

See our latest analysis for Group 1 Automotive.

Group 1 Automotive’s latest move to boost its buyback authorization comes after a year in which the stock has seen mixed momentum. There was a strong 2.94% share price gain in just the past day, but a challenging 10.87% drop over the last month. While momentum has faded recently, the company’s 3-year total shareholder return of 113.3% and 5-year total shareholder return of 240.6% keep its long-term track record among the best in its sector. This hints at enduring growth potential even through short-term volatility.

If you’re looking to broaden your search after this news, it’s a great time to explore See the full list for free.

With buybacks rising, a healthy dividend, and a multi-year track record of strong returns, the key question is whether Group 1 Automotive’s stock is undervalued at current levels or if investors have already priced in future growth potential.

Most Popular Narrative: 17% Undervalued

Group 1 Automotive’s narrative sets its fair value at $483.38 per share, far above the latest closing price of $399.27. This suggests there could be substantial room for growth if current expectations are met. This estimate is based on recent margin improvements and a positive outlook on recurring revenue opportunities, presenting the main story driving sentiment today.

“Ongoing expansion of technician headcount, investments in service capacity, and focus on customer outreach to owners of older vehicles are set to further increase aftersales throughput. This is expected to provide earnings stability and margin growth less correlated to vehicle sales cycles.”

The narrative’s future relies on assumptions that are not always highlighted in the headlines. Is margin resilience and the growth of recurring revenue truly sufficient to explain this 17% valuation gap? Consider the forecasted earnings, analyst targets, and the transformation efforts supporting this price target. What are the numbers behind these high expectations?

Result: Fair Value of $483.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including intensifying competition from digital retailers and operational integration challenges. These factors could threaten margin resilience and future growth.

Find out about the key risks to this Group 1 Automotive narrative.

Another View: What Multiples Say

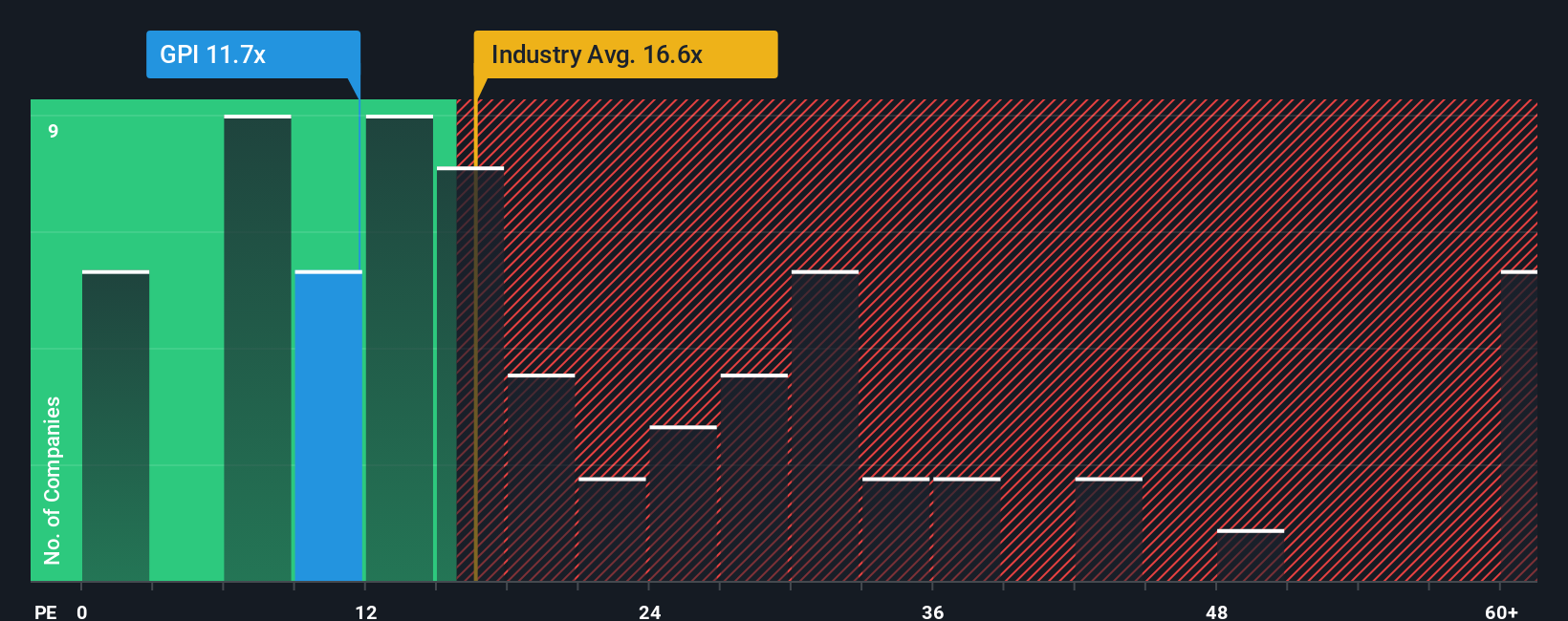

Taking a closer look using the price-to-earnings ratio, Group 1 Automotive trades at 13.3x, which is higher than its peer average of 11.1x, but lower than the US Specialty Retail industry at 17.5x. Notably, this is also below its fair ratio of 17.4x. This could suggest a possible value opportunity and also hint at investor caution. Does this difference reflect a hidden risk, or has the market simply overlooked the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Group 1 Automotive Narrative

If you have a different perspective or want to shape the story with your own analysis, you can get started in just a few minutes. Do it your way

A great starting point for your Group 1 Automotive research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more opportunities by tapping into fast-moving themes and unique growth trends with these handpicked stock ideas. Don’t let the next market winner pass you by.

- Capture the upside in alternative finance by checking out these 81 cryptocurrency and blockchain stocks, where companies are pushing boundaries in digital currencies and blockchain solutions.

- Discover opportunities for steady income and growth as you review these 17 dividend stocks with yields > 3%, featuring stocks that reward investors with yields above 3% and healthy fundamentals.

- Explore the surge of medical technology by looking into these 30 healthcare AI stocks, where advanced AI is driving healthcare forward with real-world innovations and impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal