Does Boot Barn (BOOT) See More Value in Physical Expansion or Digital Growth?

- Boot Barn Holdings, Inc. recently marked a major expansion milestone with the opening of its 500th store, now operating across 49 states.

- This achievement underscores the retailer’s rapid nationwide growth while also reflecting ongoing physical store investment even as digital sales and omni-channel capabilities expand.

- We'll examine how Boot Barn’s 500-store milestone further emphasizes the company’s ongoing focus on nationwide expansion and market reach.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Boot Barn Holdings Investment Narrative Recap

To own Boot Barn Holdings, you need to see ongoing physical store expansion as the key engine for future growth and brand longevity, while recognizing that rapid footprint growth can also elevate risks of oversaturation or underperformance in new markets. The recent 500th store opening highlights the short-term growth catalyst of expanding national reach, but does not significantly diminish the most crucial risk: execution challenges and returns on newly opened locations in less proven regions.

Of the company’s recent announcements, the updated business expansion plan to open 65 to 70 new stores in fiscal 2026 directly adds context to this milestone, signaling a continued commitment to growth via its core brick-and-mortar strategy. This planned pace of expansion continues to underpin revenue growth forecasts but also amplifies the importance of location selection and efficient store ramp-up to avoid margin pressures from cannibalization or higher occupancy costs.

Yet, despite the momentum, investors should also be aware that aggressive expansion can quickly become a liability if...

Read the full narrative on Boot Barn Holdings (it's free!)

Boot Barn Holdings is projected to reach $2.8 billion in revenue and $264.7 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 12.5% and represents a $69.3 million increase in earnings from the current $195.4 million.

Uncover how Boot Barn Holdings' forecasts yield a $227.31 fair value, a 24% upside to its current price.

Exploring Other Perspectives

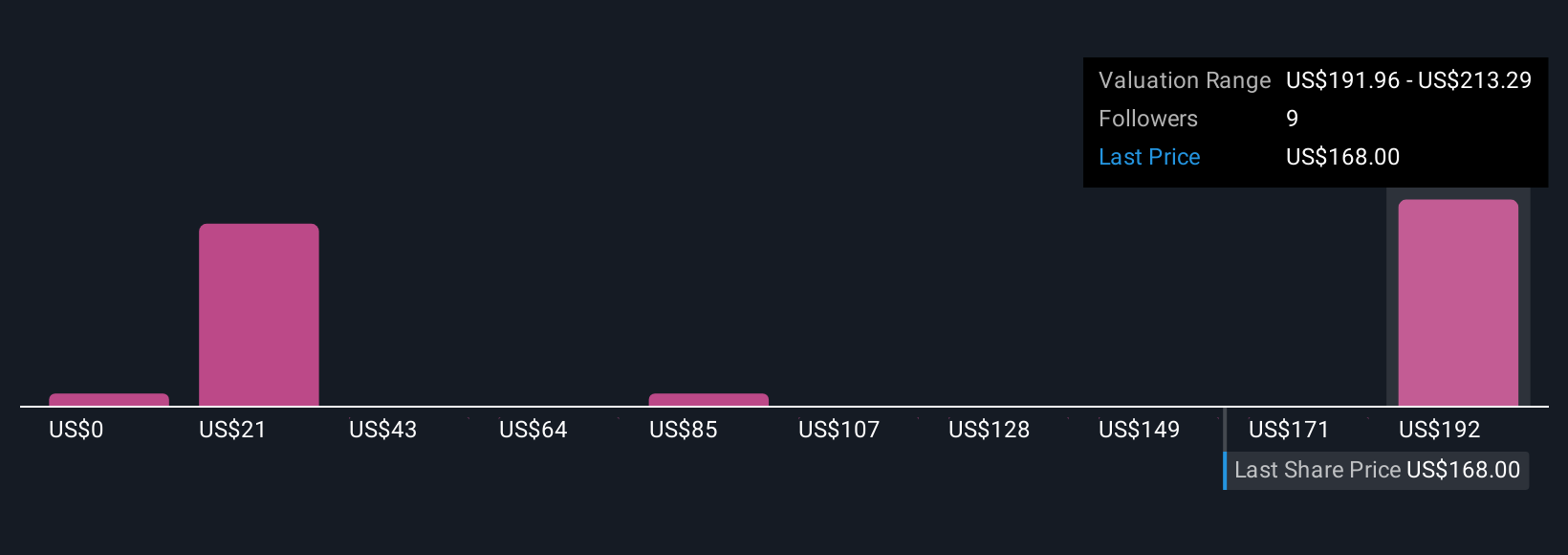

Six recent fair value estimates from the Simply Wall St Community span from US$22.73 up to US$227.31 per share. With such a range of opinions, consider how sustained store growth will shape both future opportunity and the risk of overextension.

Explore 6 other fair value estimates on Boot Barn Holdings - why the stock might be worth as much as 24% more than the current price!

Build Your Own Boot Barn Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boot Barn Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boot Barn Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boot Barn Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal