Is Intuitive Surgical Still Worth Considering After Recent Stock Price Rally in 2025?

- Curious if Intuitive Surgical is still a compelling investment or if the stock’s price tag leaves you questioning its value? You are not alone. This is a hot topic among investors right now.

- Intuitive Surgical’s share price recently climbed 2.2% over the past week and is up 6.6% over the last month. This hints that the market may be reassessing growth potential or risk factors. Over the past year, however, the stock has only returned 2.5% despite impressive longer-term gains.

- Recent headlines have focused on the continued adoption of robotic surgery and the company’s expansion into new international markets. This wider recognition in the healthcare industry has driven interest among investors, even if the rally has not matched longer-term growth rates.

- If you want the quick take, Intuitive Surgical currently scores 0 out of 6 on our undervaluation checks. As we dive into different ways to approach valuation in the sections to come, you might be surprised by the new perspectives available at the end of this article.

Intuitive Surgical scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

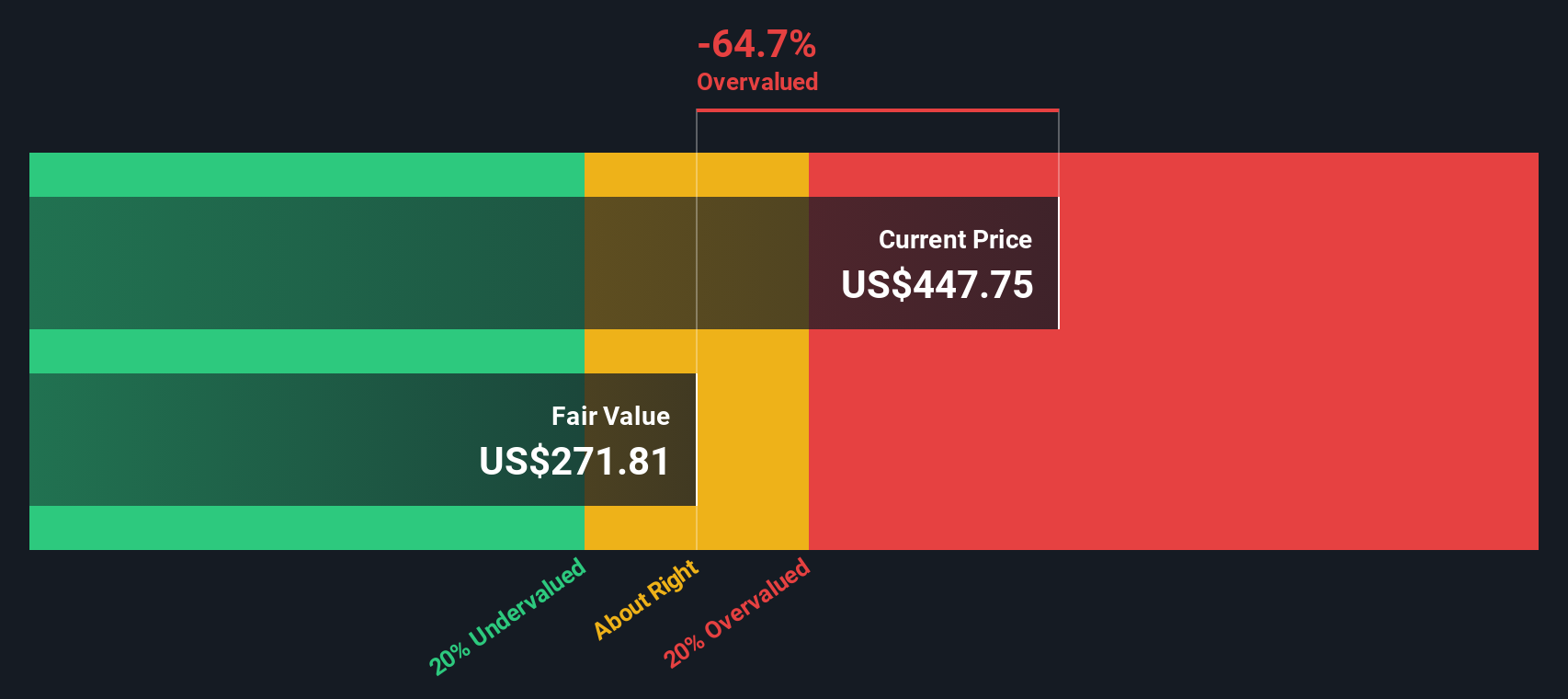

Approach 1: Intuitive Surgical Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. For Intuitive Surgical, this model relies on analysts’ expectations for the next five years, with further projections based on trend extrapolation.

Currently, Intuitive Surgical generates about $1.90 billion in Free Cash Flow (FCF). Analysts expect this to rise substantially, with projections reaching over $5.3 billion by 2029. Beyond 2029, Simply Wall St extrapolates further increases, ultimately projecting more than $7.1 billion in annual FCF by 2035. All cash flow figures are reported in US dollars.

Using these projected cash flows, the calculated fair value for Intuitive Surgical is $329.41 per share. However, based on the current share price, the DCF implies an intrinsic discount of negative 70.5 percent. This indicates that, according to the model, Intuitive Surgical stock is trading well above its estimated fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuitive Surgical may be overvalued by 70.5%. Discover 917 undervalued stocks or create your own screener to find better value opportunities.

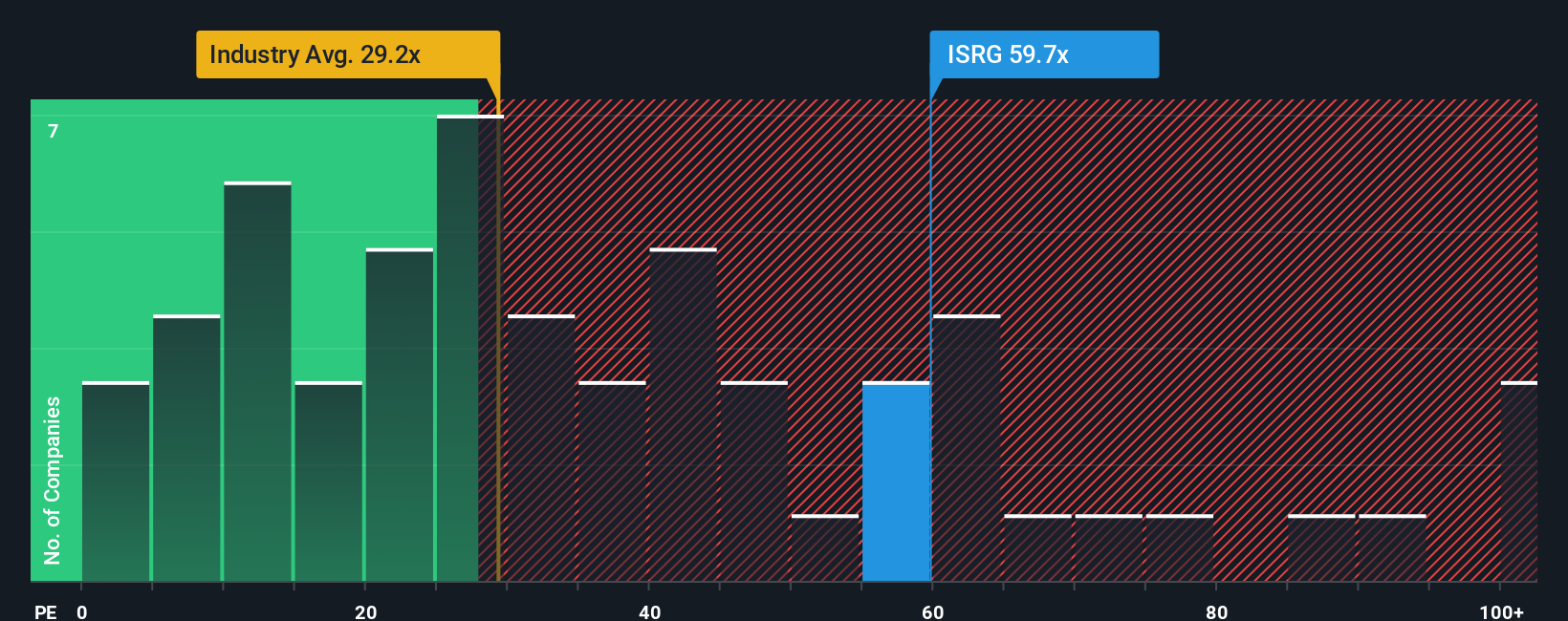

Approach 2: Intuitive Surgical Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for evaluating mature, profitable companies like Intuitive Surgical. It tells us how much investors are willing to pay today for a dollar of current earnings. Strong earnings provide a solid foundation, making PE a particularly meaningful measure.

It is important to keep in mind that growth prospects and risk play a major role in determining what constitutes a "normal" PE ratio. Fast-growing or low-risk companies tend to trade at higher PE multiples, while slower growth or higher risk companies generally trade at lower levels.

Currently, Intuitive Surgical trades at a PE ratio of 72.48x, which is well above both the Medical Equipment industry average of 27.99x and its peer group average of 35.79x. However, purely comparing these numbers can be misleading, especially for innovative companies with strong competitive advantages and growth runways.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. This metric blends factors such as earnings growth, profit margins, risk profile, industry, and market capitalization. Unlike a simple peer or industry comparison, the Fair Ratio aims to reflect what an informed investor should be willing to pay given the company’s full financial and strategic picture. For Intuitive Surgical, the Fair Ratio is 39.75x, which is significantly below the company’s actual multiple.

This large gap between the current PE and the Fair Ratio suggests the stock is trading at a premium that does not appear supported by its fundamentals or expected performance.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

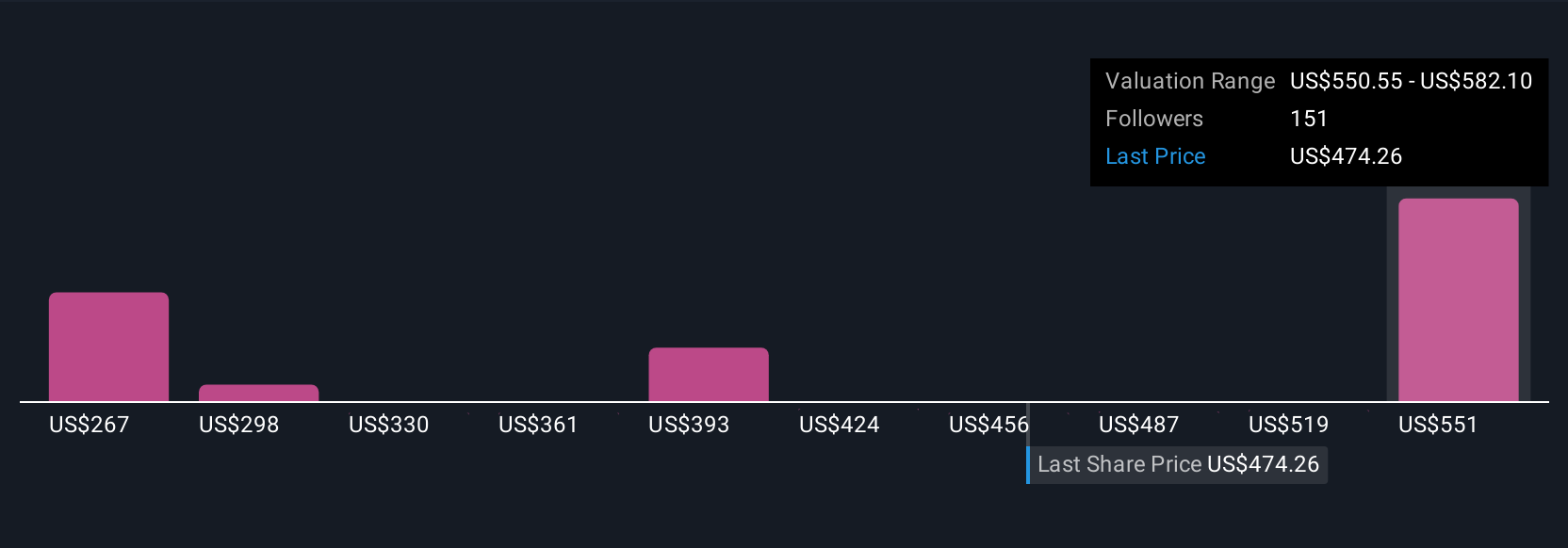

Upgrade Your Decision Making: Choose your Intuitive Surgical Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you tell your own “story” about a company by combining your assumptions about future growth, earnings, and margins with your fair value estimate to create a personal investment thesis that is rooted in both facts and perspective.

Rather than just relying on traditional valuation models or analyst targets, Narratives directly link the company’s current story to your financial forecast and a calculated fair value. On Simply Wall St’s Community page, millions of investors can access and create Narratives, making it easy for anyone to test their ideas or see how others are thinking.

When you publish or view a Narrative, it instantly compares the fair value from your story to the current share price, helping you decide whether to buy, hold, or sell. Since Narratives update automatically when key news or new earnings are released, your perspective can stay timely and relevant with minimal effort.

For example, some investors believe Intuitive Surgical’s fair value is as high as $592.96 if you see strong long-term growth and robust margins. Others take a more cautious view, estimating fair value closer to $325.55, which shows how the right Narrative can reflect each investor’s unique insights and risk appetite.

For Intuitive Surgical, we will make it really easy for you with previews of two leading Intuitive Surgical Narratives:

🐂 Intuitive Surgical Bull Case

Fair Value: $592.96

Undervalued by 5.30% (based on current price of $561.61)

Revenue Growth Rate: 13.48%

- Strong global adoption of robotic-assisted surgeries, expanding into new markets and diverse procedures, is fueling recurring revenues and long-term competitive advantages.

- Robust product innovation, AI and digital tools, and increasing regulatory support are helping reduce adoption barriers, drive higher earnings, and reinforce leadership despite heightened competition.

- Analyst consensus points to double-digit revenue and earnings growth, but warns international constraints, intensifying competition, and U.S. reimbursement risk could limit upside if unmanaged.

🐻 Intuitive Surgical Bear Case

Fair Value: $400.91

Overvalued by 40.10% (based on current price of $561.61)

Revenue Growth Rate: 12.02%

- Intuitive Surgical has pioneered robotic-assisted surgery, building a high-margin, subscription-like recurring revenue model from its growing installed base of da Vinci systems.

- Although the company continues to expand, share prices rarely offer compelling value, with the stock now trading well above fair value and offering only modest annual returns at current prices.

- Even as a resilient market leader, recent share price declines have not created a clear buy opportunity, leaving patient investors waiting for a rare, deeper pullback.

Do you think there's more to the story for Intuitive Surgical? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal