Earnings Beat and Analyst Optimism Could Be a Game Changer for Extreme Networks (EXTR)

- Earlier this week, BofA Securities initiated coverage on Extreme Networks, highlighting its focus on WiFi-7, cloud, and SaaS-based offerings, and the company reported quarterly results above analyst expectations.

- This combination of analyst optimism and stronger-than-anticipated earnings reflects growing confidence in Extreme Networks’ ability to benefit from campus network upgrades and cloud adoption.

- We'll examine how the recent analyst coverage and earnings beat underscore Extreme Networks' position in the accelerating market for next-generation networking.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Extreme Networks Investment Narrative Recap

If you’re considering Extreme Networks, you need to believe the company can leverage upcoming wireless technology cycles, namely WiFi-7, and win more campus network upgrade projects, while evolving its recurring cloud and SaaS revenue streams. This week’s upbeat analyst coverage and the better-than-expected quarterly results reinforce optimism around Extreme’s execution on these opportunities, but the most immediate catalyst remains expanding enterprise WiFi-7 adoption. The biggest risk hasn’t changed: revenue volatility tied to a few unpredictable, large wins in APAC and EMEA, which could impact growth visibility from quarter to quarter. Of the recent announcements, the October update highlighting enterprise and higher education customers onboarding Extreme’s Wi-Fi 7 solutions stands out as most relevant. This adoption trend relates directly to the catalyst that investors are focused on, whether accelerated Wi-Fi 7 roll-outs will spark more predictable, higher-margin growth and help offset the lumpiness caused by sporadic government contracts. However, investors should also be alert to the risk that...

Read the full narrative on Extreme Networks (it's free!)

Extreme Networks' narrative projects $1.3 billion revenue and $18.1 million earnings by 2028. This requires 5.8% yearly revenue growth and a $25.6 million earnings increase from the current earnings of -$7.5 million.

Uncover how Extreme Networks' forecasts yield a $23.83 fair value, a 38% upside to its current price.

Exploring Other Perspectives

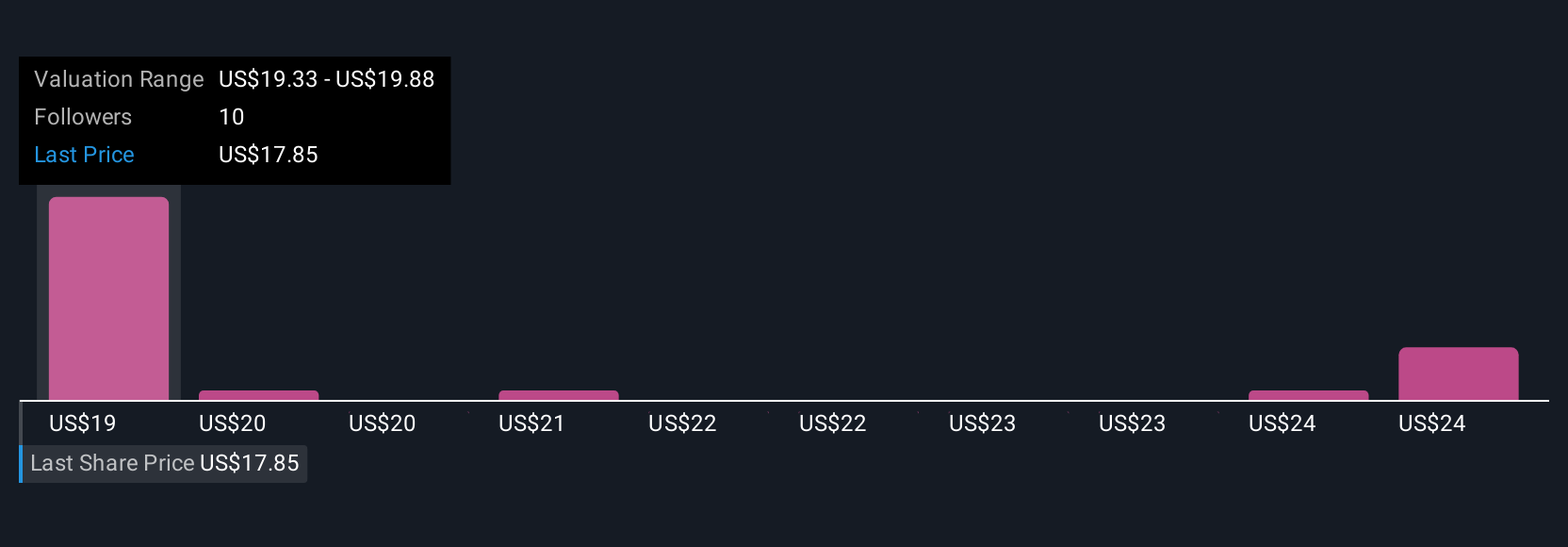

Simply Wall St Community members posted seven individual fair value estimates ranging from US$17.17 to US$37.11 per share. While market optimism surrounds Extreme’s WiFi-7 adoption, sharply differing views highlight how future growth could still be shaped by regionally concentrated wins and losses.

Explore 7 other fair value estimates on Extreme Networks - why the stock might be worth just $17.17!

Build Your Own Extreme Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Extreme Networks research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Extreme Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Extreme Networks' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal