Will KLA's (KLAC) Governance Refresh Shape Its Edge in a Rapidly Evolving Sector?

- Earlier this month, KLA Corporation's Board approved amendments to its By-laws designed to modernize governance, enhance procedures for director nominations and shareholder proposals, and refine disclosure requirements for nominating shareholders.

- The company also updated corporate governance practices and made committee leadership changes, indicating a broader commitment to transparency and evolving industry standards.

- We’ll examine how KLA’s refreshed governance approach may influence its investment narrative amid sector changes and analyst optimism.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

KLA Investment Narrative Recap

To be a KLA shareholder, you need to believe that the company can continue to benefit from the rising complexity and capital intensity of semiconductor manufacturing, harnessing secular growth in process control and advanced packaging. The recent board-approved changes to KLA's By-laws, while improving governance standards, have little direct impact on the near-term catalysts, such as advanced packaging revenue growth, or the most significant current risk, which remains ongoing challenges and exposure in the China market.

Among recent announcements, KLA’s latest quarterly earnings stood out, with revenue and net income both increasing compared to the prior year. While these results highlight the ongoing strength of demand for process control solutions in advanced logic and memory, they also remind investors that any disruption to market access or export controls, especially relating to China, could have material consequences for both growth prospects and profitability in quarters ahead.

Yet, despite these strengths, investors should be alert to any signs that escalating tariff exposure or more severe export controls may...

Read the full narrative on KLA (it's free!)

KLA's narrative projects $14.8 billion revenue and $5.3 billion earnings by 2028. This requires 6.9% yearly revenue growth and a $1.2 billion earnings increase from $4.1 billion today.

Uncover how KLA's forecasts yield a $1287 fair value, a 17% upside to its current price.

Exploring Other Perspectives

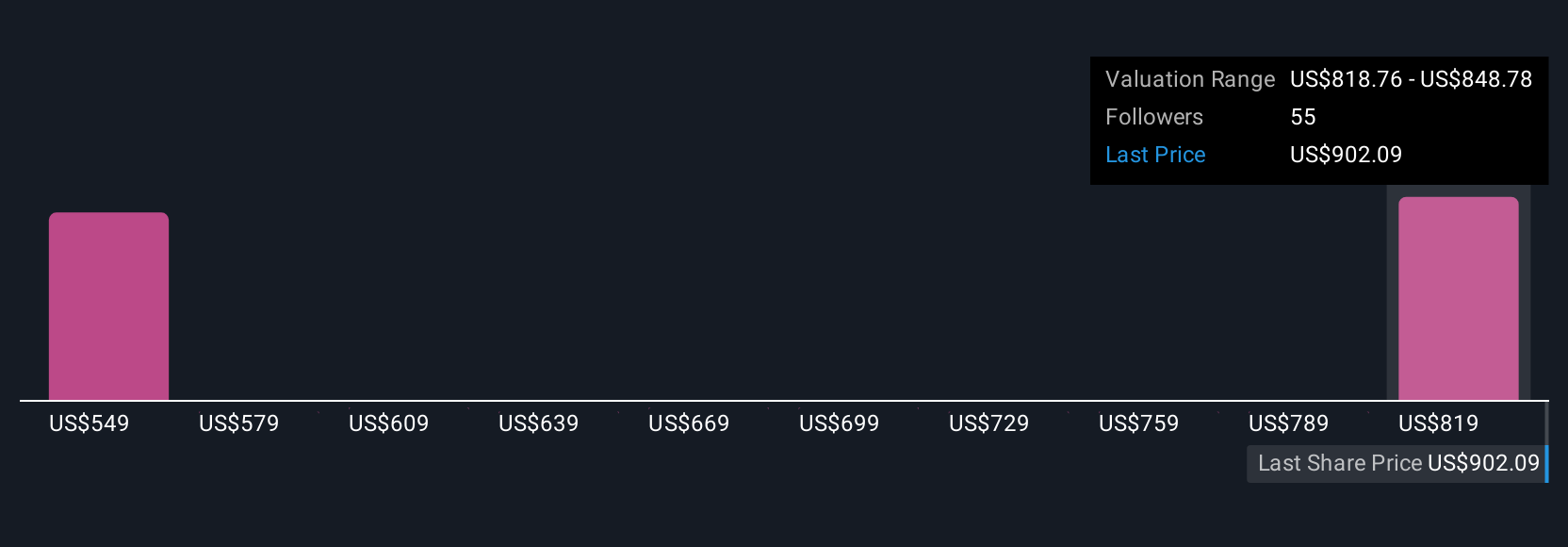

Six different Simply Wall St Community members estimated KLA’s fair value between US$648 and US$1,287 per share. With China market risk top of mind for analysts, these diverse investor viewpoints highlight how future performance could swing on external policy developments.

Explore 6 other fair value estimates on KLA - why the stock might be worth 41% less than the current price!

Build Your Own KLA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KLA research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free KLA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KLA's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal