A Look at Waters (WAT) Valuation Following Its Latest Detector Launch and Innovation Momentum

Waters (WAT) has just unveiled a new Charged Aerosol Detector engineered to work seamlessly with its Empower Software, further solidifying its leadership in chromatography technology. This launch addresses key challenges in analytical measurement workflows for labs.

See our latest analysis for Waters.

Waters' steady focus on innovation, as seen in the new detector and its upcoming presentation at the Jefferies London Healthcare Conference, seems to be resonating with investors. The past three months alone show a share price return of over 25%, outpacing the broader market. Meanwhile, the five-year total shareholder return of nearly 67% demonstrates the company’s ability to create long-term value even as shorter-term momentum builds.

If the momentum behind Waters has you thinking about other leaders in science and technology, now’s an ideal time to check out See the full list for free.

So with shares already up sharply and the company showing strong innovation and financial momentum, the question remains: does the current price reflect all future growth, or is there still a buying opportunity for investors?

Most Popular Narrative: 1.1% Undervalued

The most widely-followed narrative values Waters just above its latest close, suggesting the market is only beginning to catch up with analysts’ optimistic outlook. This perspective draws a clear distinction between recent innovation momentum and longer-term growth, hinting at substantial catalysts in the company’s operating environment.

“The planned combination with BD's Biosciences and Diagnostic Solutions business is expected to accelerate entry into biologics, precision medicine, and cell/gene therapy markets. These are segments with expanding analytical needs, unlocking new addressable markets and providing a multi-year revenue synergy opportunity that could directly impact future revenues and EPS growth.”

Curious what’s powering this almost bullish valuation? The narrative teases a profit surge driven by lasting earnings expansion and robust margin expectations. Get the details behind these surprisingly aggressive financial forecasts, and find out what hidden levers are driving this fair value with one click.

Result: Fair Value of $382.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from acquisitions or prolonged weakness in pharma and academic funding could easily shift Waters’ outlook, despite strong current momentum.

Find out about the key risks to this Waters narrative.

Another View: What Do the Market Ratios Say?

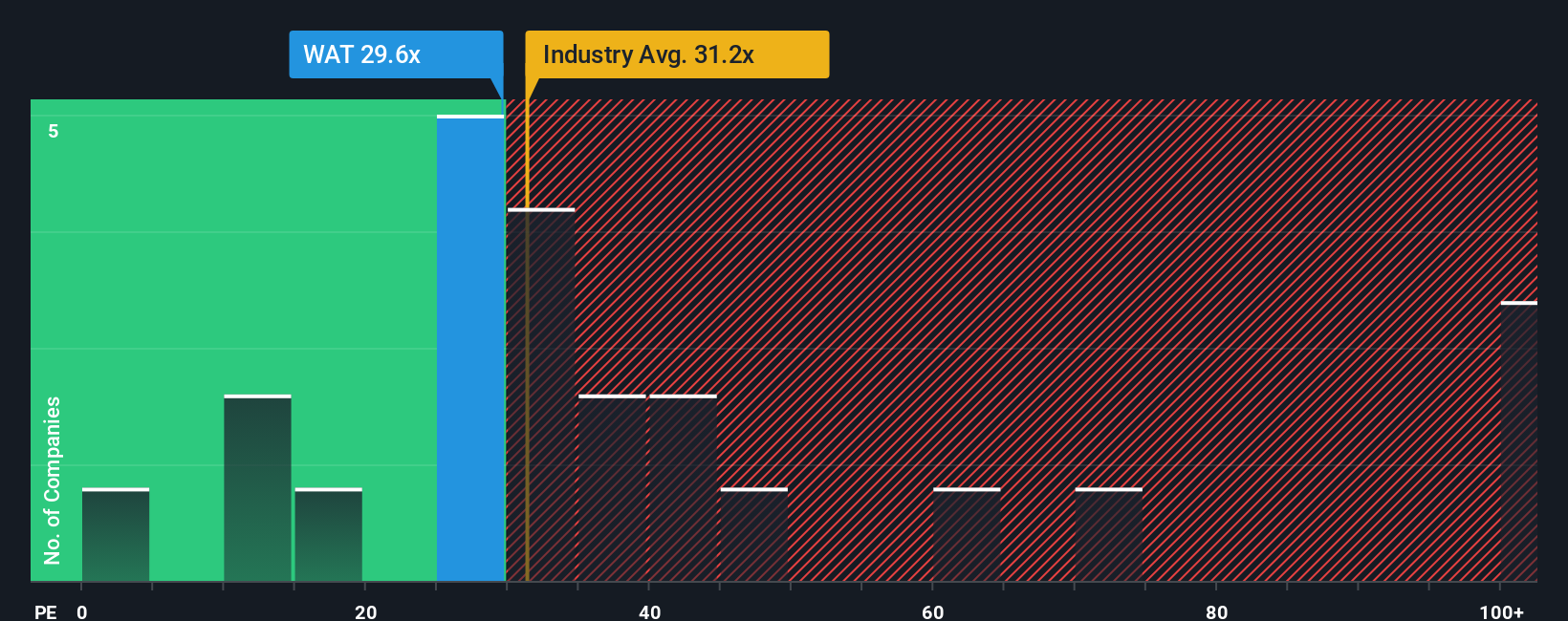

Looking at Waters through the lens of its price-to-earnings ratio offers a different perspective. The company trades at 34.7x earnings, above the industry average of 31.7x and well above its fair ratio of 24x. This hints at a valuation premium. Does this suggest higher risk if growth slows, or is the market expecting more good news?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waters Narrative

If you see the story differently or want to dig deeper into the numbers, it only takes a few minutes to develop your own perspective. Do it your way

A great starting point for your Waters research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their watchlist fresh with new opportunities. Don't let remarkable stocks with high-growth potential or unrecognized value slip past. This is your moment to get ahead.

- Tap into tomorrow’s trends by reviewing these 25 AI penny stocks, which are at the forefront of artificial intelligence innovation.

- Secure income possibilities with these 16 dividend stocks with yields > 3%, offering reliable yields above 3% for your long-term portfolio stability.

- Uncover market mispricings by scanning these 923 undervalued stocks based on cash flows, based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal