Did Piper Sandler’s Upgrade Signal a Turning Point for Edwards Lifesciences’ (EW) Innovation Strategy?

- In the days leading up to Edwards Lifesciences’ annual investor day, Piper Sandler reaffirmed its Overweight rating on the company, emphasizing the potential for growth in the U.S. TAVR franchise and TMTT program following stronger-than-expected quarterly results and analyst upgrades.

- This analyst optimism highlights increasing confidence in Edwards Lifesciences’ innovation pipeline and management strategy as key themes ahead of its investor event.

- We’ll explore what Piper Sandler’s renewed confidence in Edwards’ TAVR and TMTT outlook means for the company’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Edwards Lifesciences Investment Narrative Recap

To own shares of Edwards Lifesciences, investors generally need to believe in its leadership in heart valve therapies and trust that new innovations, such as the U.S. TAVR franchise and TMTT program, will drive long-term expansion. Piper Sandler's reaffirmed Overweight rating highlights positive sentiment but does not materially change the biggest short-term catalyst: approval and rollout of early TAVR indications, nor does it resolve looming risks from rising operating expenses and tariffs.

One recent announcement closely connected to this optimism is Edwards' raised full-year sales growth guidance to 9%–10%, following stronger-than-expected quarterly results. This uptick in guidance aligns with analyst confidence in the near-term growth potential of the company’s pipeline and sets the stage for upcoming regulatory milestones related to TAVR and TMTT therapies.

However, investors should also be mindful that, in contrast to the optimism, the risk of unforeseen regulatory delays in expanding TAVR indications could...

Read the full narrative on Edwards Lifesciences (it's free!)

Edwards Lifesciences' outlook forecasts $7.6 billion in revenue and $1.8 billion in earnings by 2028. This is based on an assumed 10.0% annual revenue growth rate and a $0.4 billion increase in earnings from the current $1.4 billion.

Uncover how Edwards Lifesciences' forecasts yield a $93.94 fair value, a 12% upside to its current price.

Exploring Other Perspectives

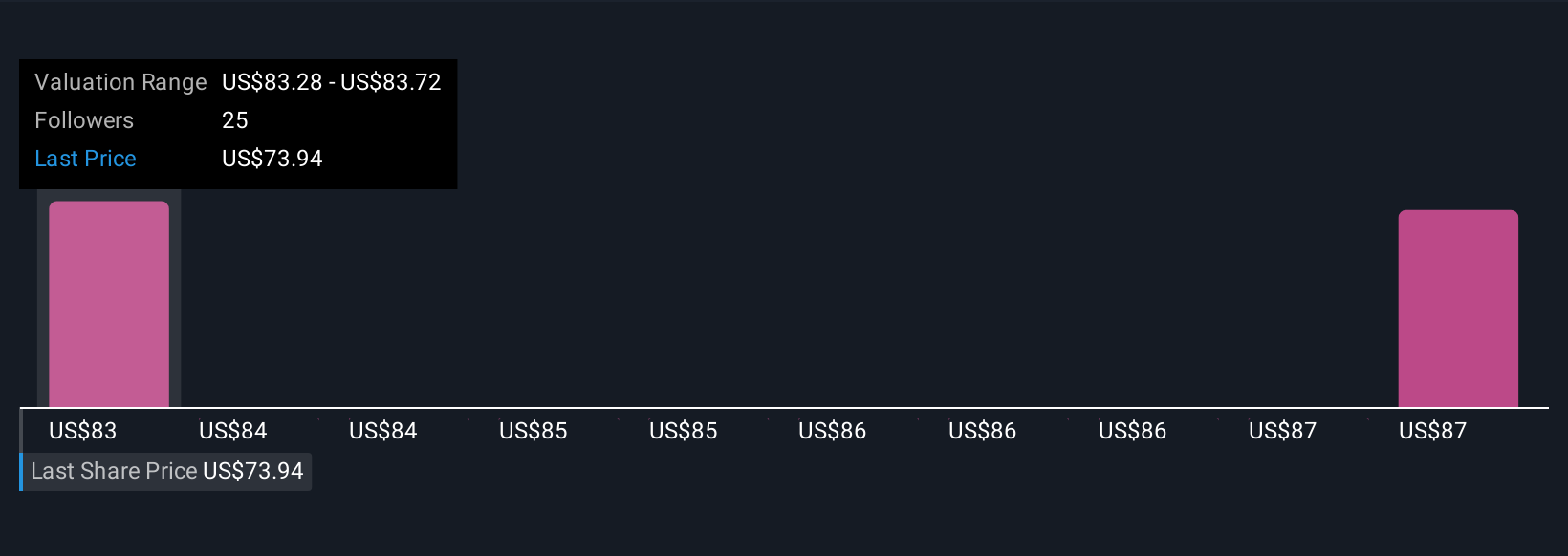

Fair value opinions from the Simply Wall St Community vary from US$82.13 to US$93.94 across 2 independent analyses. Against this backdrop, the upcoming early TAVR indication remains a focal point that could influence sentiment across these diverse viewpoints, inviting you to consider how differing growth expectations shape market behavior.

Explore 2 other fair value estimates on Edwards Lifesciences - why the stock might be worth as much as 12% more than the current price!

Build Your Own Edwards Lifesciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edwards Lifesciences research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Edwards Lifesciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edwards Lifesciences' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal