Can Dillard's (DDS) Massive Special Dividend Reveal Its True Capital Allocation Priorities?

- Dillard’s, Inc. recently declared both a quarterly cash dividend of US$0.30 per share and a special dividend of US$30.00 per share, with both payments scheduled for early 2026 following its third quarter earnings report.

- The announcement of such a substantial one-time distribution to shareholders comes shortly after modest year-over-year growth in revenue and net income for the quarter ended November 1, 2025.

- We'll explore what the special dividend means for Dillard's investment story, especially given its timing after steady third quarter results.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Dillard's Investment Narrative?

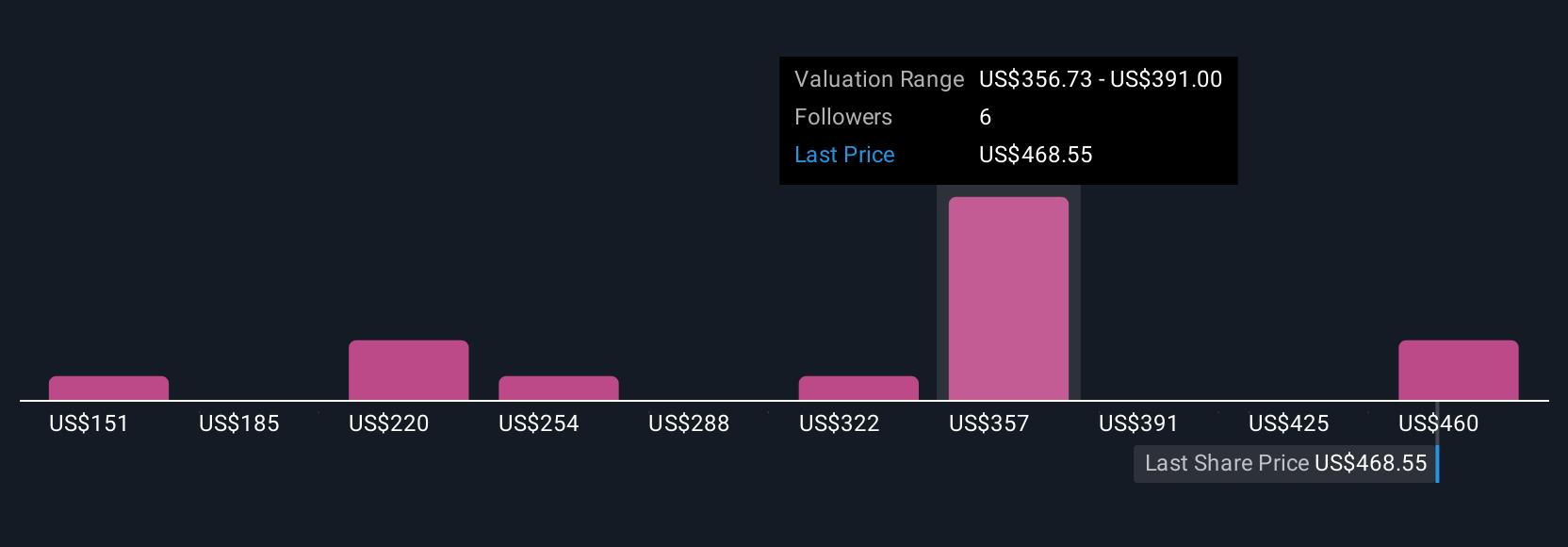

To own Dillard’s stock, an investor needs to see value in a business that delivers steady profitability, operational discipline, and strong capital returns, even as it faces declining revenue and earnings forecasts. The recently announced US$30.00 per share special dividend instantly becomes a defining short-term catalyst, rewarding shareholders and potentially influencing sentiment in the near term. Yet, it also raises questions about whether this move hints at a lack of compelling reinvestment opportunities or future growth ambitions for the company. Previously, the major risks included expected profit declines and a price premium relative to consensus targets, which may be amplified by a one-time payout of this magnitude. While short-term enthusiasm for the dividend could temporarily offset these risks, the underlying business outlook remains unchanged and still demands careful attention from shareholders. However, pressure from declining profit trends remains a key concern for the longer term.

Dillard's share price has been on the slide but might be up to 12% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 8 other fair value estimates on Dillard's - why the stock might be a potential multi-bagger!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal