Does TXN’s Dividend Boost and Insider Sale Hint at Confidence or Caution in Its Growth Strategy?

- Texas Instruments recently reported third-quarter results, revealing a 14% year-over-year revenue increase, primarily from growth in its analog and embedded processing segments, and announced a 4% dividend raise while issuing a cautious outlook for the coming quarter.

- Senior Vice President Christine Witzsche sold 1,000 shares shortly after the earnings report, coinciding with the company’s focus on the industrial and automotive markets for future growth.

- We’ll explore how Texas Instruments’ strong performance in analog and embedded processing enhances its current investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Texas Instruments Investment Narrative Recap

To own Texas Instruments stock, you need to believe the company will continue leveraging its dominance in analog and embedded semiconductor markets, and that investments in industrial and automotive end-markets will drive sustainable growth. The recent insider sale by a senior executive, while newsworthy, does not materially impact the critical near-term factors: TI’s growth trajectory in core segments remains a key catalyst, and the primary risk is whether these areas may face future pricing pressure and cyclical volatility.

The 4% dividend increase is especially relevant. This move highlights TI’s ongoing commitment to returning capital to shareholders, despite a cautious near-term outlook and recent volatility. Supporting or growing the dividend can underscore management’s confidence in TI’s cash generation, even as the semiconductor cycle brings uncertainty to both revenue and margins.

Yet, in contrast, investors should be aware of how pricing pressure and margin compression in maturing chip markets could become an even greater risk as...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments is projected to achieve $22.3 billion in revenue and $7.9 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 10.1% and a $2.9 billion increase in earnings from the current level of $5.0 billion.

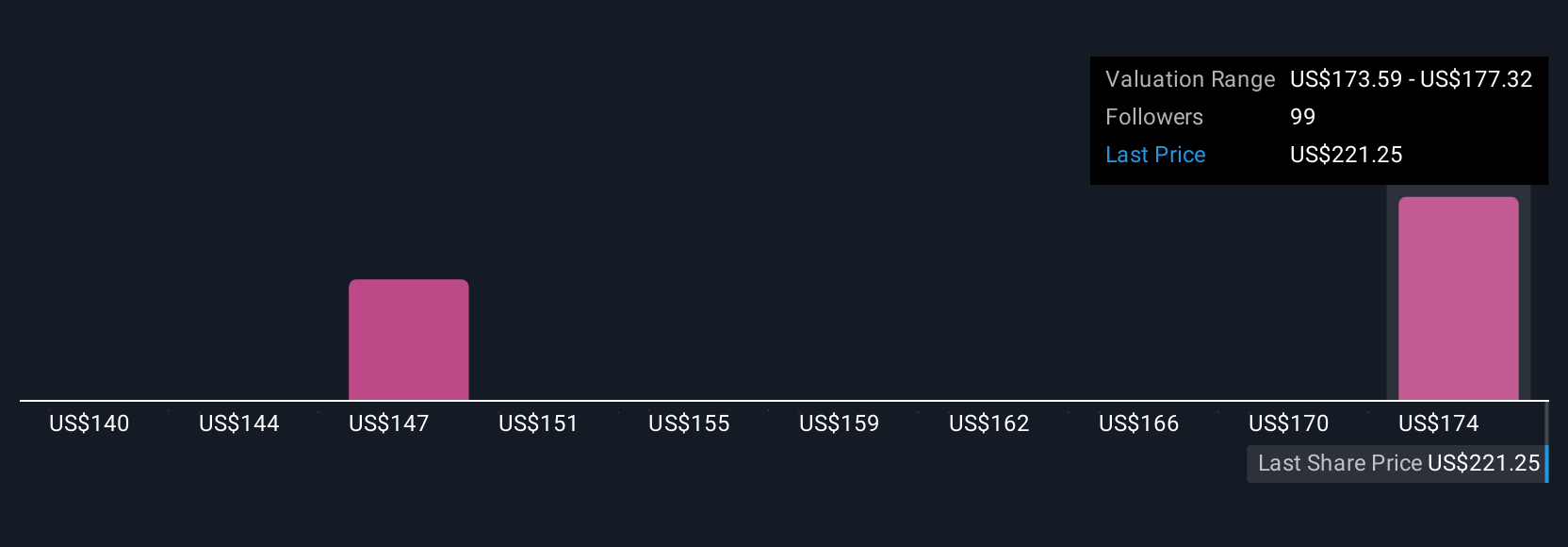

Uncover how Texas Instruments' forecasts yield a $189.56 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Some of the lowest analyst forecasts for Texas Instruments projected annual revenue growth of just 6.5 percent over the next three years and a profit margin drop to around 29 percent. These analysts highlight the risk that advancing competition and higher compliance spending could further pressure margins, painting a more cautious view than the consensus. Your opinion may differ, so consider how new developments could shift these perspectives.

Explore 6 other fair value estimates on Texas Instruments - why the stock might be worth as much as 24% more than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal