Will Synaptics' (SYNA) Qualcomm Partnership Redefine Its Edge in AI-Enhanced Biometrics?

- On November 12, 2025, Qualcomm Technologies announced a partnership with Synaptics Incorporated to jointly advance touch and fingerprint sensor technology across mobile and computing devices, targeting seamless integration for OEMs in the rapidly growing OLED and AI PC markets.

- This collaboration brings together Synaptics’ AI-ready sensing technologies and Qualcomm’s compute and biometric security offerings, aiming to simplify device integration while enabling secure, AI-enhanced user experiences at the edge.

- We'll examine how the Qualcomm partnership could strengthen Synaptics’ positioning in next-generation AI and biometric interface solutions.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Synaptics Investment Narrative Recap

To be a shareholder in Synaptics, you need to believe in the company's ability to lead in human interface and edge AI solutions, capitalizing on fast-growth markets like OLED displays and AI PCs. The Qualcomm partnership could enhance Synaptics’ competitive positioning and expedite integrated product offerings, but the most important near-term catalyst remains converting this technical momentum into scalable revenue, while the biggest risk still lies in execution around ramping sales channels and efficiently focusing its broad portfolio, neither appears materially changed by this news so far.

Among recent announcements, Synaptics' Q1 2026 earnings report stands out: sales rose to US$292.5 million, but the company remained unprofitable, with a net loss of US$20.6 million. This ongoing loss level is highly relevant, as successful monetization of new partnerships and technologies is critical for shifting from technical leadership to financial improvement.

However, investors should also be aware that portfolio focus and channel execution risks remain unresolved, especially if the collaboration ...

Read the full narrative on Synaptics (it's free!)

Synaptics' outlook anticipates $1.4 billion in revenue and $199.2 million in earnings by 2028. This relies on annual revenue growth of 9.6% and a $247 million increase in earnings from the current level of -$47.8 million.

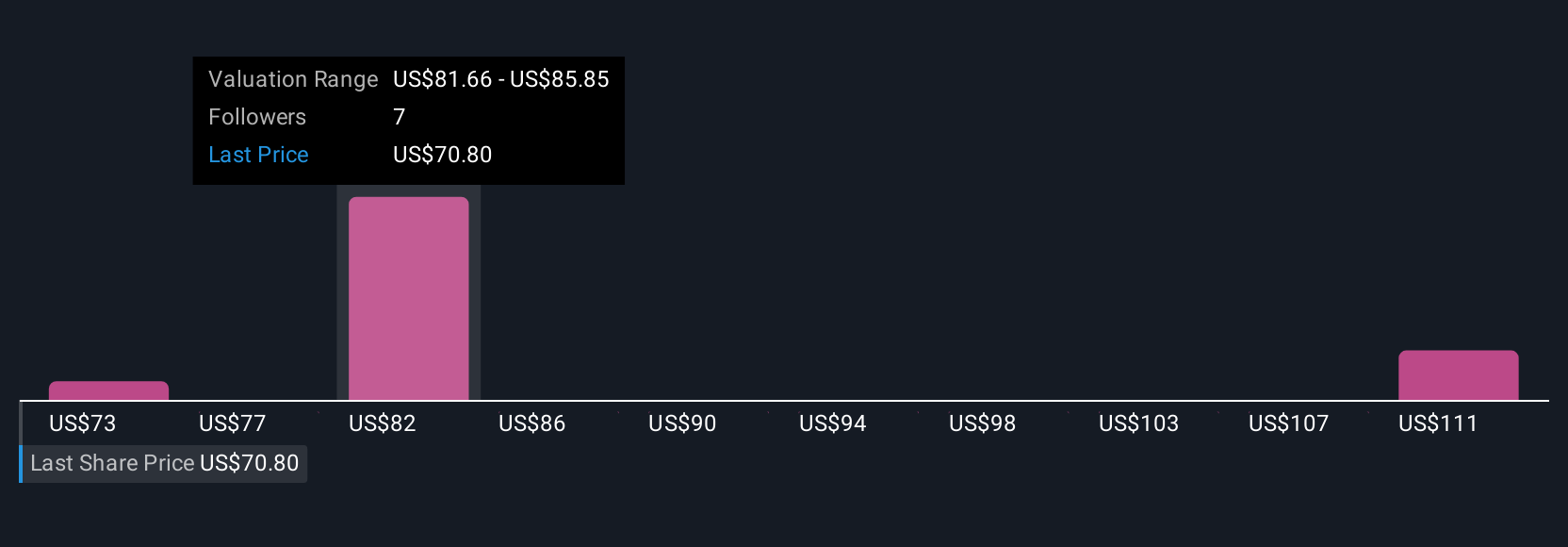

Uncover how Synaptics' forecasts yield a $82.25 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Synaptics’ fair value between US$53.25 and US$84.49, based on four independent analyses. With channel expansion and scalable customer acquisition still an open question, your viewpoint could differ sharply from others, see how your expectations compare to the community and analyst outlooks.

Explore 4 other fair value estimates on Synaptics - why the stock might be worth as much as 40% more than the current price!

Build Your Own Synaptics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Synaptics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Synaptics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Synaptics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal