Will RH’s (RH) Supply Chain Moves Outpace New Tariff Risks for Its Brand Strategy?

- Earlier this week, President Trump announced a major tariff investigation on furniture imports into the United States, potentially affecting companies like RH, while RH confirmed plans to replace Banana Republic with a new store in Shadyside and is seeking a Vice President, Brand Creative & Interior Design to elevate its brand environments.

- RH has previously shifted much of its manufacturing from China to Vietnam and its own North Carolina factory to help manage tariff exposure and supply chain risks.

- We'll explore how potential new tariffs and RH's efforts to mitigate supply chain risks may influence its future investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

RH Investment Narrative Recap

To be an RH shareholder, you have to believe in the company’s ability to grow its luxury brand and expand its gallery platform, even amid market uncertainty. This week’s news about a new tariff investigation on furniture imports raises the company’s near-term risk profile, but initial analysis suggests that RH’s prior moves to reshape its supply chain may limit any immediate material impact on its most important catalyst: gallery expansion and related revenue growth.

Among the recent updates, RH’s confirmation of a new Shadyside store stands out. This continues their focus on enhancing the physical retail experience, which remains central to driving traffic, building prestige, and unlocking incremental sales, a key short-term driver as they look to offset potential tariff pressure.

However, what investors may not realize is that, despite management’s proactive supply chain changes, higher or unpredictable tariffs could still impact cost structures and demand for...

Read the full narrative on RH (it's free!)

RH’s outlook anticipates $4.3 billion in revenue and $442.6 million in earnings by 2028. This assumes 9.6% annual revenue growth and an earnings increase of $358.5 million from the current $84.1 million.

Uncover how RH's forecasts yield a $262.25 fair value, a 79% upside to its current price.

Exploring Other Perspectives

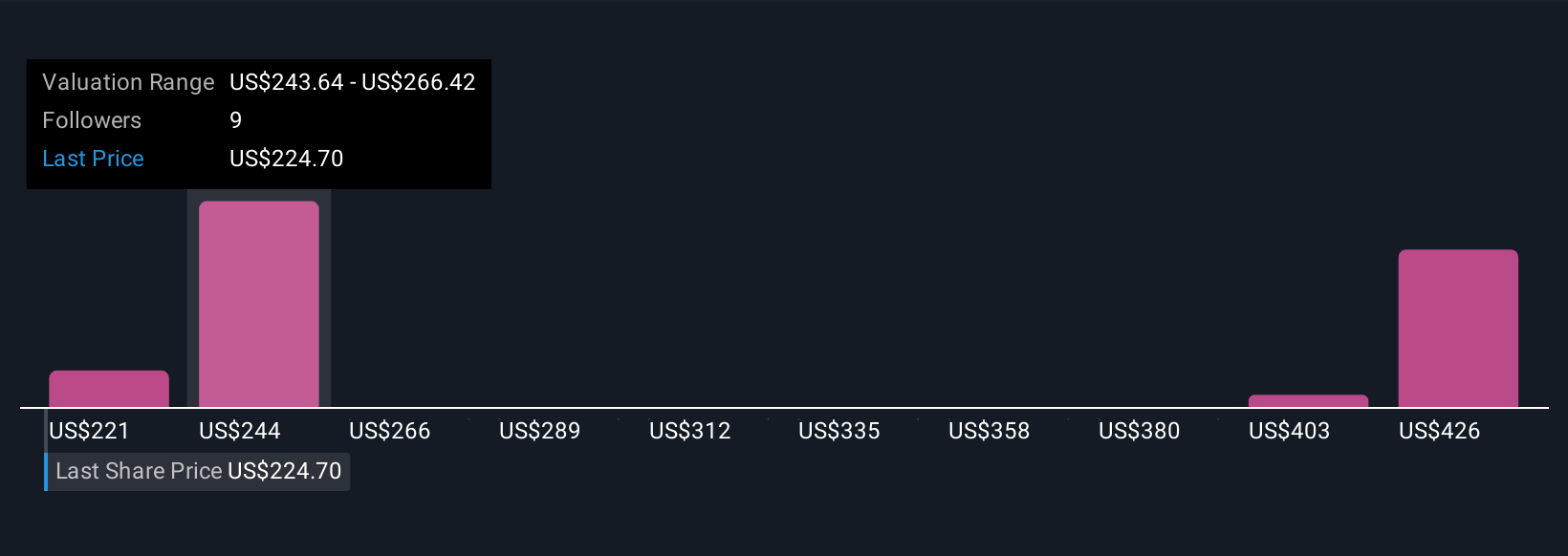

Six fair value estimates from the Simply Wall St Community span US$179 to US$420.02 per share, reflecting a wide spread of individual outlooks. While new tariff risks are front and center in recent headlines, these varying perspectives show how much opinions can differ on RH’s future, so it’s worth exploring multiple viewpoints on what may drive or threaten the company’s performance from here.

Explore 6 other fair value estimates on RH - why the stock might be worth just $179.00!

Build Your Own RH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free RH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RH's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal