How Fleet Renewal Moves and VLCC Orders Could Shape Scorpio Tankers' (STNG) Future Strategy

- In recent days, Scorpio Tankers Inc. announced agreements to sell four 2014-built MR product tankers for US$32.0 million each and to purchase four MR newbuilding resales with expected deliveries in 2026 and 2027, as well as signing letters of intent for two new Very Large Crude Carriers (VLCCs) in South Korea for US$128 million per vessel with deliveries planned for late 2028.

- This series of transactions signals a major step in Scorpio Tankers' fleet renewal and expansion efforts, potentially enhancing both operational efficiency and capacity in the coming years.

- With Scorpio Tankers committing to both new VLCC and MR vessel orders, we'll assess how this fleet modernization could shift its investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Scorpio Tankers Investment Narrative Recap

Scorpio Tankers appeals to investors who believe in a future where global refined product trade continues to expand, driven by shifting refinery hubs and persistent ton-mile demand. The recent commitment to both new MR and VLCC vessels is significant for long-term fleet modernization, yet its immediate impact on earnings remains limited; the primary short-term catalyst continues to be the resilience of day rates, while overcapacity risk from new deliveries remains the key issue to watch.

The November 6 announcement regarding the sale of four 2014-built MR product tankers for US$32.0 million each stands out, as it both aids fleet renewal and provides liquidity prior to bringing newbuilds online in 2026 and 2027. This move addresses rising operational costs from an aging fleet and could help prepare the balance sheet ahead of further expansion, tying directly into ongoing concerns about earnings volatility from future supply growth.

By contrast, investors should be aware that new vessel orders can also introduce the risk of overcapacity and lower...

Read the full narrative on Scorpio Tankers (it's free!)

Scorpio Tankers' narrative projects $972.2 million revenue and $302.6 million earnings by 2028. This requires 2.0% yearly revenue growth and a $56.4 million decrease in earnings from $359.0 million today.

Uncover how Scorpio Tankers' forecasts yield a $73.25 fair value, a 18% upside to its current price.

Exploring Other Perspectives

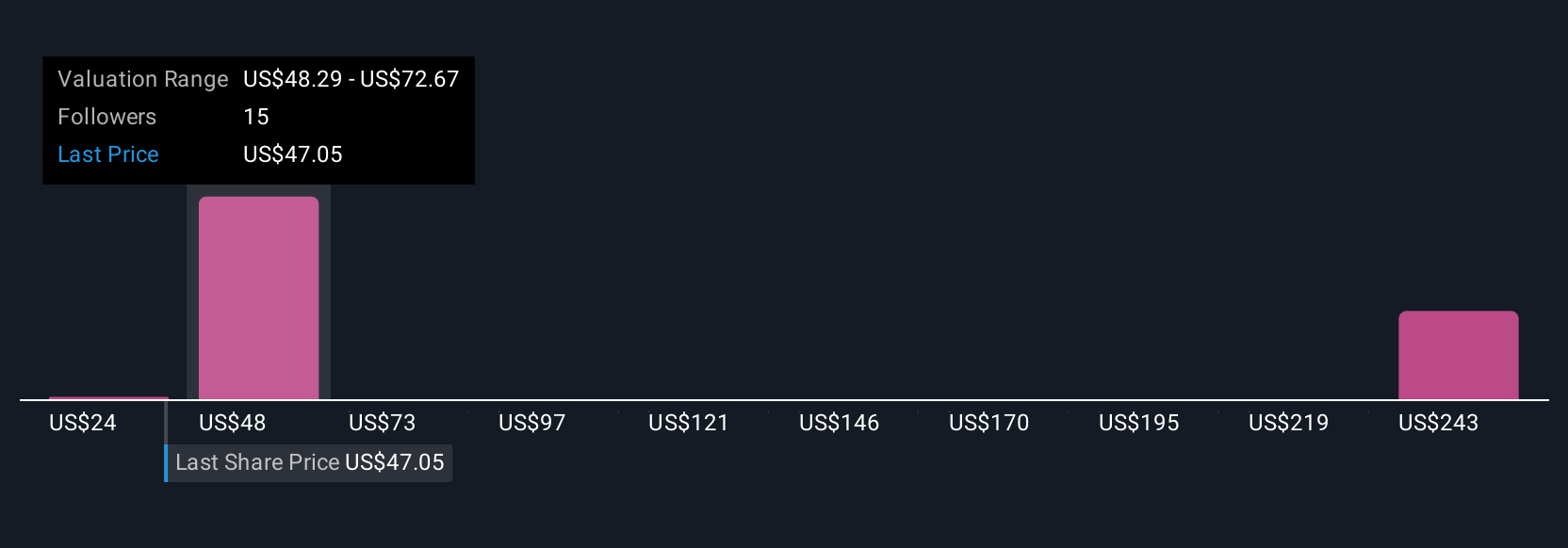

Four community members on Simply Wall St value Scorpio Tankers stock anywhere from US$23.90 up to US$304.37 per share. This wide dispersion comes as concerns around future overcapacity may shape different expectations for the stock’s profits and market value.

Explore 4 other fair value estimates on Scorpio Tankers - why the stock might be worth less than half the current price!

Build Your Own Scorpio Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scorpio Tankers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Scorpio Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scorpio Tankers' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal