A Fresh Look at RH (RH) Valuation Following Recent Share Price Decline

See our latest analysis for RH.

RH’s sharp 18% one-month share price decline follows wider market hesitation, with the 1-year total shareholder return now down over 55%. The persistent slide since January suggests momentum is still fading, even as some investors watch for a turnaround or a value reset.

If you’re weighing what’s next after RH’s latest moves, it could be a good time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares deeply discounted and revenue still growing, is RH now trading below its true value? Or does the market see more challenges ahead, leaving little room for upside? Is this a true buying opportunity, or has future growth already been priced in?

Most Popular Narrative: 45.7% Undervalued

At $142.50, RH trades far below the narrative’s fair value estimate. This creates a dramatic gap between analyst expectations and today’s beaten-down price. This divergence is fueling debate, but what’s really driving these high hopes for RH’s true worth?

RH’s platform expansion, including the opening of 7 Design Galleries and 2 Outdoor Galleries in 2025, is expected to create new opportunities for revenue growth and brand exposure across multiple markets, potentially boosting overall sales revenue.

Want to know the hidden lever behind this eye-opening valuation? What’s the make-or-break financial assumption that turns current losses into future riches? Discover the growth forecast and bold profit leap that anchor the fair value, plus the tension between bullish expansion plans and today’s market gloom, by diving into the rest of this narrative.

Result: Fair Value of $262.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, issues such as ongoing housing market weakness and RH's sizable debt from past stock repurchases could weigh on any expected recovery.

Find out about the key risks to this RH narrative.

Another View: Looking Beyond Analyst Targets

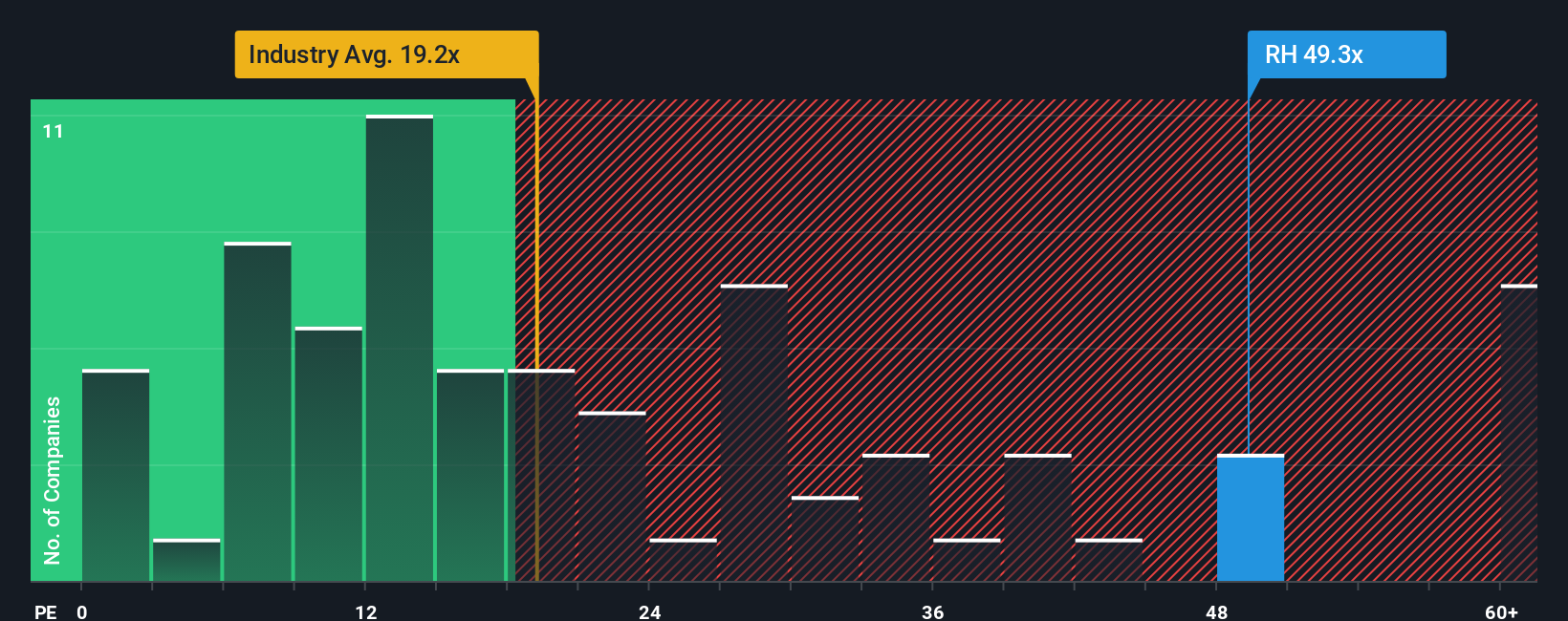

Not all valuation lenses tell the same story for RH. On earnings-based metrics, the company trades at a price-to-earnings ratio of 25x, which is significantly higher than both its peers at 15.8x and the broader US Specialty Retail average of 17x. Even compared to its fair ratio of 32.4x, RH sits at a discount. The gap could narrow if the market regains confidence, or widen if profitability lags. Is this a hidden value play, or a warning of risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock more options to level up your portfolio. If you only follow headlines, you could miss out on opportunities most investors never see.

- Capture tomorrow’s winners early by searching these 894 undervalued stocks based on cash flows, which stand out for their solid fundamentals and attractive valuations.

- Supercharge your watchlist by targeting future disruptors with these 27 AI penny stocks, leading the way in artificial intelligence innovation.

- Boost your potential returns with these 18 dividend stocks with yields > 3%, offering reliable income from high-yielding stocks favored by income seekers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal