A Closer Look at Diodes (DIOD) Valuation Following Recent Share Price Declines

See our latest analysis for Diodes.

Diodes’ recent slide has investors taking note. With a 1-year total shareholder return of -17.2% and share price momentum fading sharply this past month, it is clear that sentiment has cooled compared to past periods of higher growth expectations. The latest price move could reflect shifting outlooks on industry demand or risk, making now an interesting time for value-focused investors to revisit the story.

If you’re watching the chip sector’s moves, it might be the perfect moment to explore discovery opportunities in tech and AI stocks. See the full list for free.

With Diodes’ shares down significantly and trading at a notable discount to analyst price targets, the key debate now is whether the recent decline represents a compelling entry point or if the market has already priced in future challenges.

Most Popular Narrative: 24% Undervalued

Diodes' narrative suggests substantial upside compared to its latest close. With analysts projecting a much higher fair value, expectations for the company's future are rising despite recent share price declines.

Rising demand for Diodes' solutions in AI-related computing and the broader ecosystem of connected devices (including data centers, servers, industrial automation, and IoT) is boosting revenue momentum and contributing to consistent market share gains. This is improving longer-term top-line growth visibility.

Curious what financial forecasts are fueling this optimism? The secret ingredients behind this number include ambitious targets for profit margins and a bold call on earnings. See which assumptions take the spotlight and how they shape the narrative's high fair value prediction.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on cyclical consumer markets and elevated inventory levels could quickly put pressure on Diodes’ margins if demand softens or if competition intensifies.

Find out about the key risks to this Diodes narrative.

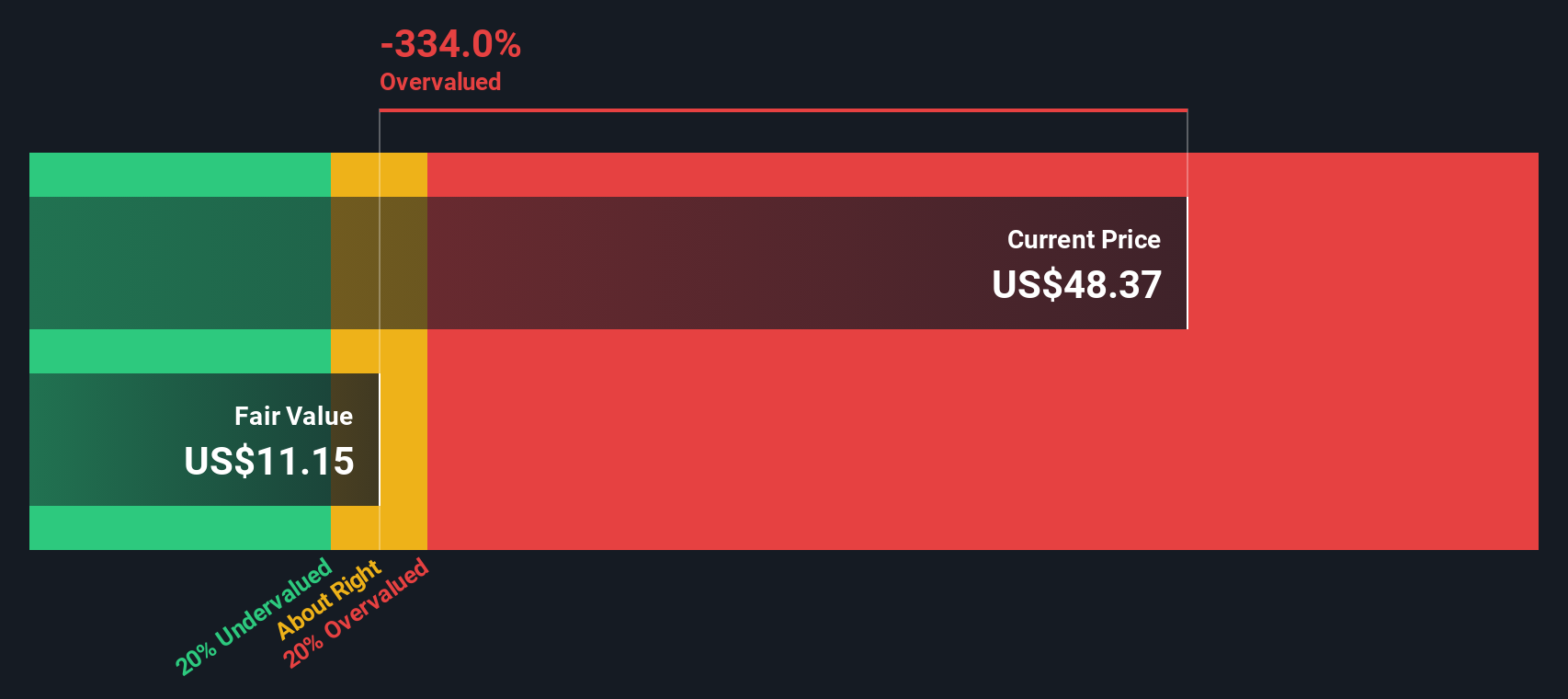

Another View: SWS DCF Model Flags Caution

While analysts see Diodes as undervalued based on its future earnings potential, our SWS DCF model presents a different perspective. The DCF approach indicates the stock price is currently well above fair value, which may signal potential downside risk if cash flows do not reach expectations. Should investors consider this warning or is the market factoring in more upside than fundamentals support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diodes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diodes Narrative

If you have a different angle or want to dive into the details on your own, you can shape your perspective in just a few minutes, and do it your way with Do it your way.

A great starting point for your Diodes research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't settle for a single stock play when transformative market shifts are creating new opportunities every day. Smart investors always look one step ahead. Here are three powerful ways to get an edge right now:

- Spot compelling bargains early and jump ahead of the pack by checking out these 905 undervalued stocks based on cash flows based on strong underlying cash flows and potential for upside.

- Claim your place at the forefront of the technological revolution by tracking these 26 AI penny stocks transforming industries with artificial intelligence innovation.

- Capitalize on stable income streams and financial resilience by learning which companies offer these 16 dividend stocks with yields > 3% for reliable returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal