A Look at Diversified Healthcare Trust’s (DHC) Valuation Following RBC Capital’s Upgrade and Q3 2025 Results

Following its third quarter 2025 results, Diversified Healthcare Trust (DHC) received an upgrade from RBC Capital. This helped drive the stock to a new 52-week high. The company reported higher revenue and expectations for improved leverage.

See our latest analysis for Diversified Healthcare Trust.

After a rocky start to the year, Diversified Healthcare Trust has staged an impressive comeback, with its share price up 103.96% year-to-date and hitting a fresh 52-week high following the RBC Capital upgrade. While the company’s latest results revealed a larger net loss, positive momentum has clearly built around improved revenue trends and optimism about the senior housing segment. Over the long haul, total shareholder returns have soared 373.39% over three years and 85.64% in the past twelve months. This underscores a significant turnaround story.

If the surge in DHC’s share price has you wondering what else the market is rewarding, take the next step and discover See the full list for free.

The question now is whether the recent rally leaves Diversified Healthcare Trust undervalued or if investor optimism has fully priced in future growth, making it less clear if there is still a buying opportunity at hand.

Most Popular Narrative: 11.8% Undervalued

According to the most widely followed narrative, the fair value for Diversified Healthcare Trust is $5.25, well above its last close price of $4.63. This significant upside comes as optimism grows around operational improvements and profit outlook.

Recent and ongoing upgrades and targeted capital investment in SHOP communities are resulting in notable NOI growth and margin expansion. As the portfolio rationalizes remaining deferred maintenance, future CapEx needs are expected to normalize, increasing distributable cash flow and reducing pressure on net margins.

Ready to dig into the details? The numbers behind this valuation hinge on upgraded profit margins and a striking shift in operating assumptions. What bold forecasts did analysts use to confidently land on a fair value well ahead of today’s price? Click to uncover the real drivers of this call.

Result: Fair Value of $5.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high leverage and rising interest expenses could squeeze margins. This may challenge the bullish narrative if market conditions become less favorable.

Find out about the key risks to this Diversified Healthcare Trust narrative.

Another View: SWS DCF Model Offers a Different Perspective

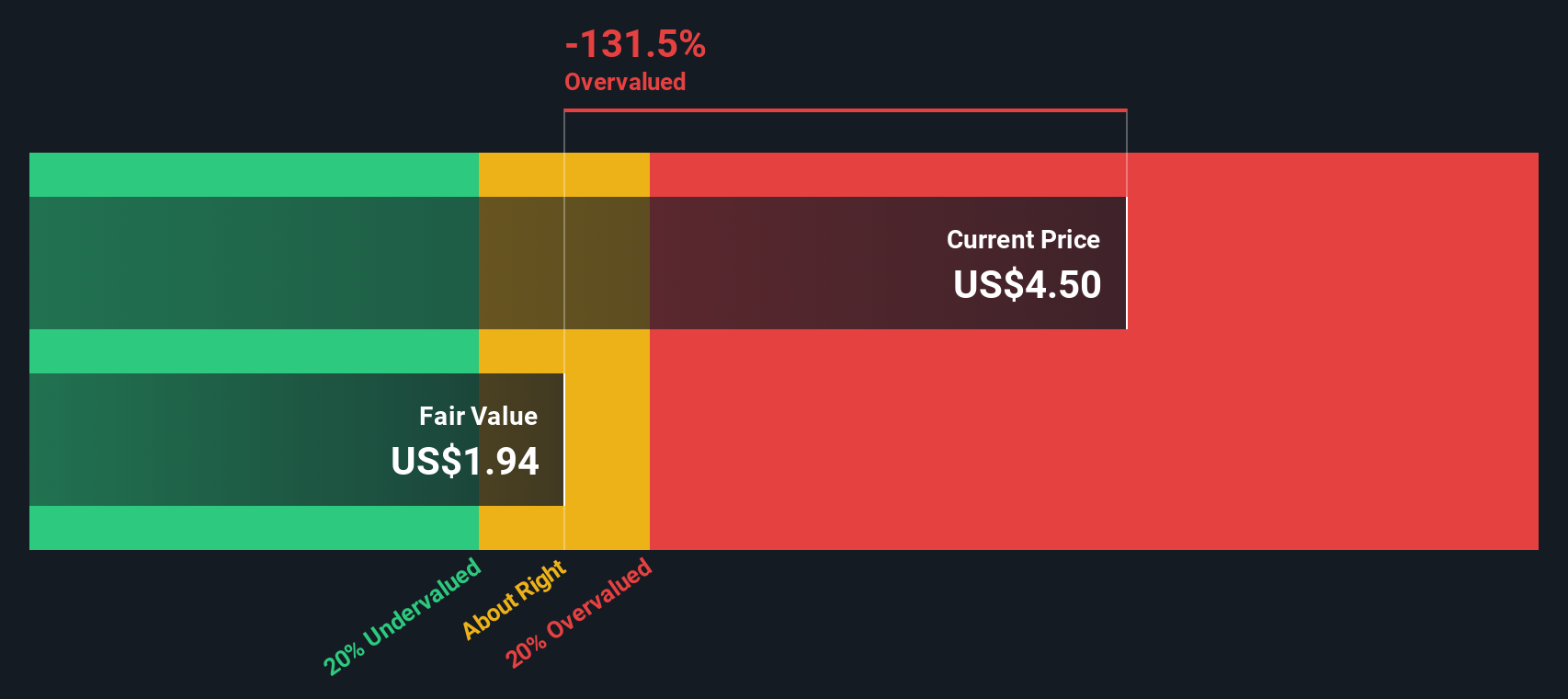

Taking a look at our SWS DCF model, a different story emerges for Diversified Healthcare Trust. According to this valuation, DHC is trading above its estimated fair value. While the first approach sees upside, the DCF view signals caution. Which model will the market eventually follow?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diversified Healthcare Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diversified Healthcare Trust Narrative

If you have a different take or want to chart your own course, dive in and shape your own view in just a few minutes. Do it your way

A great starting point for your Diversified Healthcare Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for More Winning Stock Ideas?

Don't let the next breakout pass you by. Make smarter moves by checking out top opportunities other investors are watching right now on Simply Wall Street.

- Unlock the potential of fast-growing tech with AI breakthroughs through these 26 AI penny stocks, which are set to transform entire industries.

- Capture reliable income with these 16 dividend stocks with yields > 3%, featuring strong yields and steady payout histories for your portfolio.

- Seize hidden gems by targeting these 906 undervalued stocks based on cash flows, which are poised for a rebound based on solid financials and attractive price points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal