Could Fabrinet’s (FN) Aggressive Buybacks and Upbeat Outlook Reveal a Shift in Capital Allocation Priorities?

- Fabrinet recently reported first quarter sales of US$978.13 million and net income of US$95.93 million, alongside providing second-quarter revenue guidance between US$1.05 billion and US$1.10 billion and completing a multi-year share buyback program totaling over 3.87 million shares for US$360.28 million.

- An interesting aspect is that after consistently executing its share repurchase plan, Fabrinet now anticipates higher revenue and earnings per share, reflecting an optimistic outlook for its ongoing business performance.

- We'll explore how Fabrinet's strong quarterly results and significant share repurchase completion could influence its future investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Fabrinet Investment Narrative Recap

To be a Fabrinet shareholder, you need to believe in ongoing demand for high-speed optical components and the company’s ability to capitalize on continued AI and data center growth, despite its high customer concentration. While Fabrinet’s recent completion of a major share buyback and stronger-than-expected revenue guidance are supportive of near-term optimism, they do not materially reduce the risk posed by reliance on just a few large customers, still the biggest potential source of volatility for earnings and revenue in the short term.

Among the most relevant recent announcements, Fabrinet’s guidance for second-quarter revenue between US$1.05 billion and US$1.10 billion stands out, as it reflects management’s confidence in robust customer demand for next-generation datacom solutions. This heightened outlook, along with the share repurchase completion, highlights the current catalyst of resolving supply bottlenecks and scaling production to capture the shift toward higher-value 800G and 1.6T transceivers.

However, investors should also be mindful that, despite positive quarterly results, Fabrinet’s substantial exposure to single customers like NVIDIA and Cisco means...

Read the full narrative on Fabrinet (it's free!)

Fabrinet's outlook anticipates $5.4 billion in revenue and $537.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 16.3% and an earnings increase of $204.8 million from the current earnings of $332.5 million.

Uncover how Fabrinet's forecasts yield a $479.25 fair value, a 16% upside to its current price.

Exploring Other Perspectives

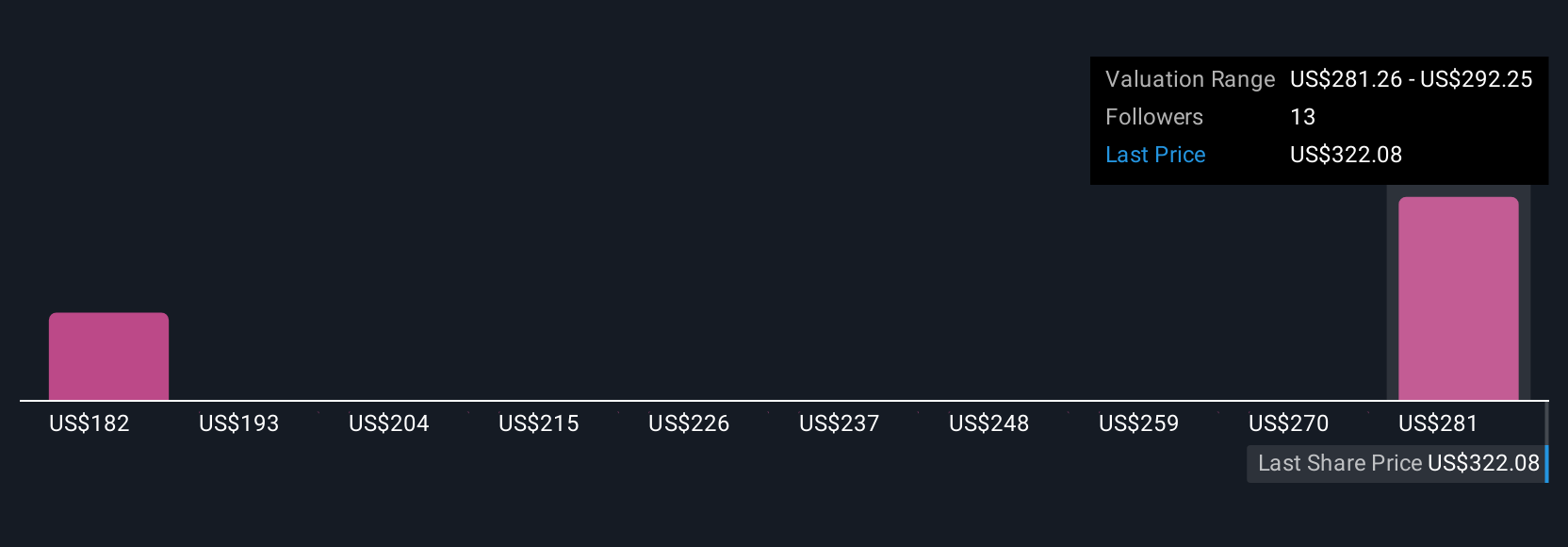

Four unique fair value estimates from the Simply Wall St Community range from US$292.01 to US$479.25 per share. While some anticipate continued growth driven by demand for next-generation optical products, be aware opinions can differ widely, explore multiple viewpoints to better understand Fabrinet’s evolving story.

Explore 4 other fair value estimates on Fabrinet - why the stock might be worth as much as 16% more than the current price!

Build Your Own Fabrinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fabrinet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fabrinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fabrinet's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal