How Investors Are Reacting To Waystar Holding (WAY) AI-Powered Solutions Driving Upbeat Q3 and Higher Guidance

- Waystar Holding recently reported strong third-quarter results, highlighting double-digit growth driven by increased transaction volume, new client wins, and broadening adoption of its AI-powered claims denial solutions.

- Management noted that the integration and cross-selling of Iodine Software played a significant role in surpassing consensus expectations and prompted an upward revision of full-year guidance.

- Next, we’ll explore how rising adoption of AI-driven claims denial tools may influence the outlook for Waystar’s growth and margins.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Waystar Holding Investment Narrative Recap

To be a shareholder in Waystar Holding, you need confidence that digitization and AI adoption in healthcare revenue cycle management will keep driving high-margin, recurring growth, even as sector competition and client consolidation increase. The strong Q3 performance, fueled by new client wins and wider use of AI-powered claims denial tools, materially supports the most important short-term catalyst: successful Iodine Software integration and cross-sell. The largest near-term risk remains whether robust client volume persists against possible shifts in patient healthcare utilization.

Among recent developments, Waystar’s Fall Innovation Showcase unveiling new AI-powered denial prevention and reimbursement tools is especially relevant. These product enhancements directly link to the uptick in transaction volume and positive surprise in the latest quarter, underscoring how rapid innovation could help sustain margin expansion even as peers race to catch up technologically.

However, it’s important to remember that if volume trends reverse due to seasonality or macro conditions, investors could face...

Read the full narrative on Waystar Holding (it's free!)

Waystar Holding's narrative projects $1.3 billion in revenue and $248.3 million in earnings by 2028. This requires 9.3% yearly revenue growth and a $162.4 million earnings increase from current earnings of $85.9 million.

Uncover how Waystar Holding's forecasts yield a $50.38 fair value, a 43% upside to its current price.

Exploring Other Perspectives

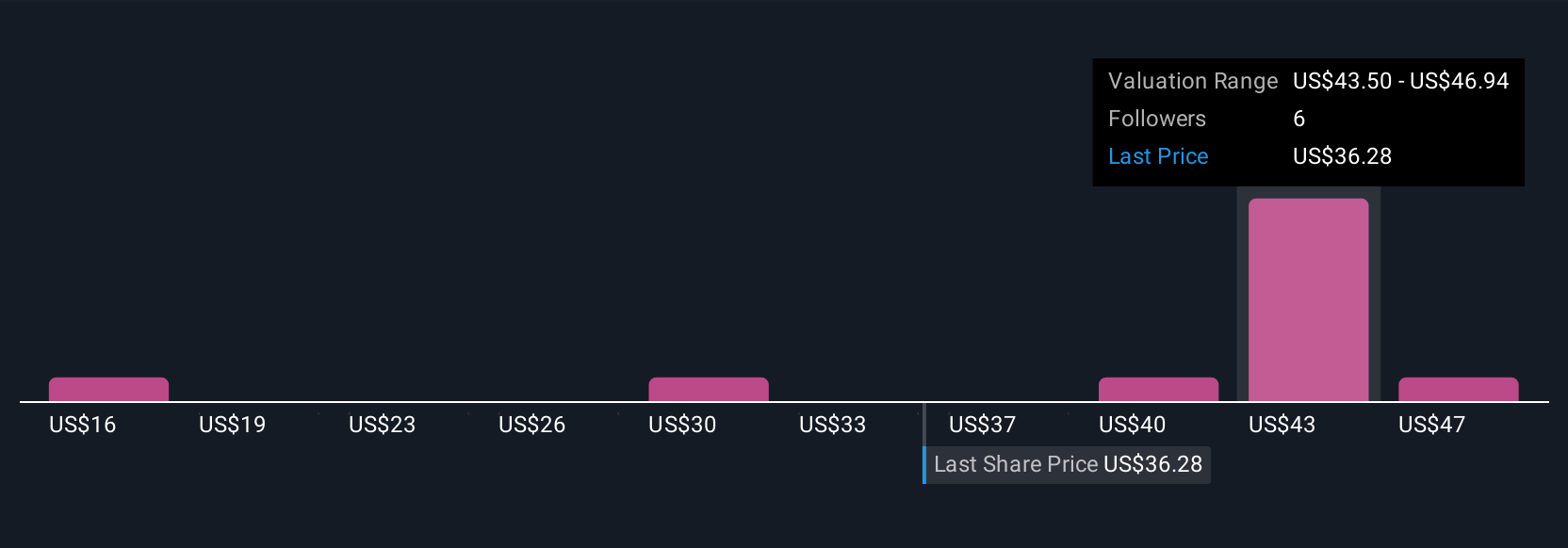

Seven private investors in the Simply Wall St Community estimate Waystar’s fair value from as low as US$15.96 to US$50.38. While these opinions vary widely, recent success with the Iodine integration shows how short-term execution can impact future performance, prompting you to consider multiple viewpoints on the company’s prospects.

Explore 7 other fair value estimates on Waystar Holding - why the stock might be worth as much as 43% more than the current price!

Build Your Own Waystar Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waystar Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Waystar Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waystar Holding's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal