How Arrow’s Expanded European Cybersecurity Partnership With Clavister May Shape ARW’s Growth Prospects

- Earlier this month, Clavister announced that Arrow Electronics expanded its distribution of Clavister’s full cybersecurity portfolio beyond Sweden into 11 additional European countries, including Belgium, the Netherlands, and Poland.

- This expansion leverages Arrow’s pan-European logistics and partner relationships, significantly broadening both companies’ reach and strengthening their presence in the cybersecurity market across Northern and Eastern Europe.

- We'll now consider how Arrow's broadened European cybersecurity distribution footprint could influence its prospects and analyst assumptions about future growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Arrow Electronics Investment Narrative Recap

To be a shareholder in Arrow Electronics, you need to believe the company can deliver solid earnings through its scale in technology distribution, ongoing demand for digital transformation, and its push into higher-margin service areas. The recent European cybersecurity portfolio expansion with Clavister represents an incremental growth opportunity and could support Arrow’s short-term catalyst of growing recurring revenue streams, but it does not materially change the biggest risk, which remains margin pressure from customer mix and supply chain normalization.

Of recent announcements, Arrow’s November 2 updates to its ArrowSphere cloud platform directly align with efforts to capture more recurring and higher-margin business. Combined with expanded European cybersecurity distribution, these moves reinforce Arrow’s focus on value-added services. Both initiatives feed the central growth catalyst: increasing the company’s exposure to digital infrastructure and managed services.

By contrast, investors should remain mindful of how a shift away from higher-margin mass-market customers could compress overall margins if recovery stalls or supply chain disruptions persist...

Read the full narrative on Arrow Electronics (it's free!)

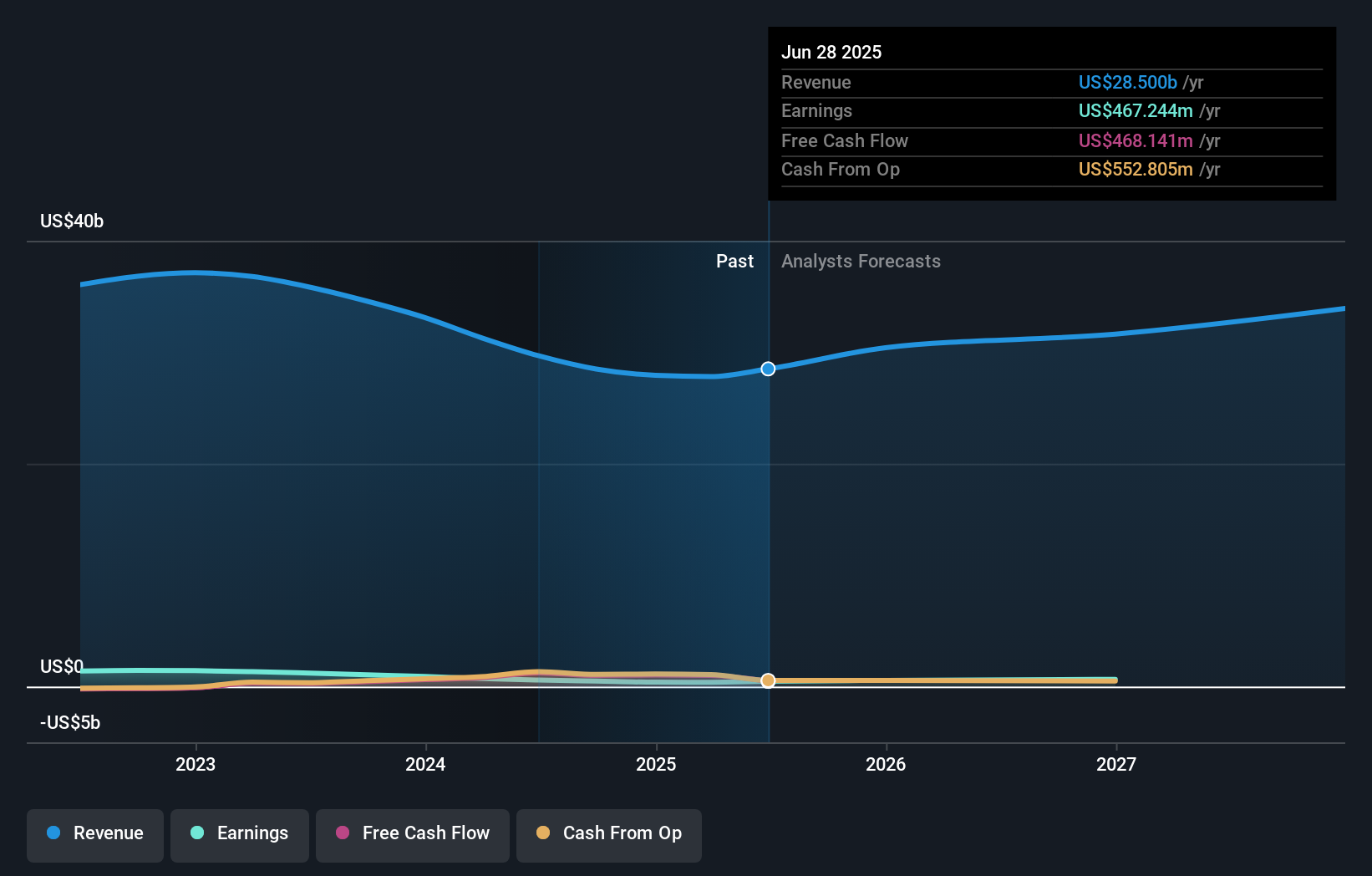

Arrow Electronics' outlook projects $35.2 billion in revenue and $734.1 million in earnings by 2028. This scenario requires 7.3% annual revenue growth and a $266.9 million increase in earnings from the current level of $467.2 million.

Uncover how Arrow Electronics' forecasts yield a $108.25 fair value, in line with its current price.

Exploring Other Perspectives

Two fair value perspectives from the Simply Wall St Community both set Arrow at US$108.25, giving a single consistent estimate. Recent actions to broaden Arrow’s European cybersecurity footprint may support growth, but ongoing risk around customer mix and margin compression remains a key factor that could influence future returns.

Explore 2 other fair value estimates on Arrow Electronics - why the stock might be worth as much as $108.25!

Build Your Own Arrow Electronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arrow Electronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arrow Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arrow Electronics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal