Teledyne Technologies (TDY): Assessing Valuation After Space-Grade Sensor Launch and Middle East Expansion

Teledyne Technologies (TDY) is drawing attention after unveiling its latest space-grade CMOS image sensors and revealing plans to open a new regional headquarters in Riyadh. These developments highlight the company’s efforts to expand into advanced imaging solutions and grow its regional presence.

See our latest analysis for Teledyne Technologies.

Following these product launches and Teledyne’s expansion in the Middle East, recent momentum has softened, with the share price retreating 10.85% over the past month. Still, the bigger picture remains constructive as Teledyne’s 1-year total shareholder return is 6.6%, and over five years, investors have seen more than 31% in total returns. This reflects steady long-term value creation even as short-term sentiment cools.

If you’re looking to spot other promising innovators in aerospace and defense, it’s a perfect time to explore See the full list for free.

With Teledyne’s strong long-term returns and expanding global footprint, investors may wonder whether the recent share price dip presents a buying opportunity or if the market has already considered the company’s future growth potential.

Most Popular Narrative: 19.4% Undervalued

Teledyne Technologies' most widely followed narrative signals a fair value more than $120 above the last close, widening the gap for would-be buyers. The current valuation has caught the market’s eye as growth expectations and operational execution shape the path forward.

Strong international defense and unmanned systems demand (notably through FLIR and marine unmanned vehicles), coupled with record-high global defense and aerospace spending, is fueling robust long-cycle order growth and positioning Teledyne for continued revenue expansion and improved operating leverage in core segments.

What hidden levers are driving this high target? The narrative’s elevated fair value hinges on ambitious growth assumptions, rising margins, and a future earnings multiple that turns heads. See the full analysis to discover which bold projections are behind the scenes. This story is all about the numbers that push expectations higher.

Result: Fair Value of $621.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including weaker cash flow trends and potential ongoing margin pressure from recent acquisitions. These factors could weigh on Teledyne’s earnings momentum.

Find out about the key risks to this Teledyne Technologies narrative.

Another View: What Do Multiples Say?

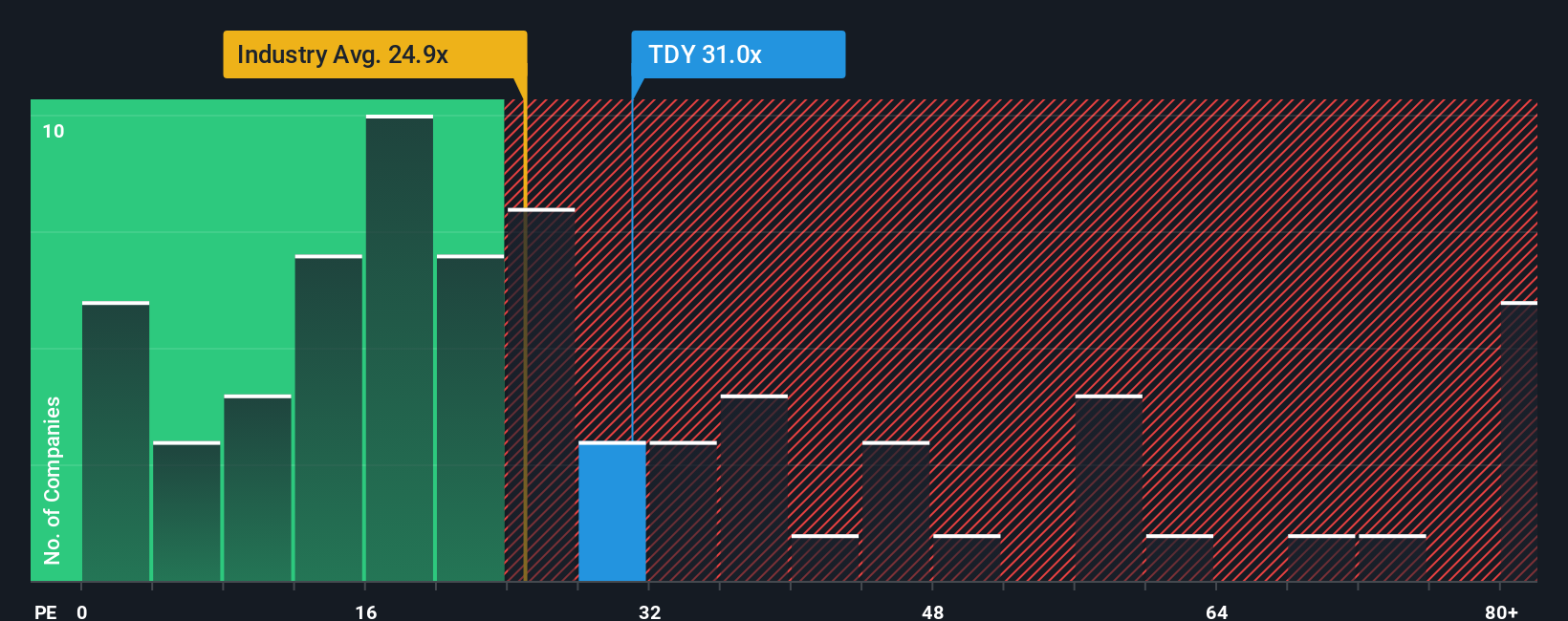

Taking a look at the company's price-to-earnings ratio provides a different perspective. Teledyne’s P/E stands at 28.8x, which is higher than both the US Electronic industry average of 23.7x and its own fair ratio of 25.9x. This suggests investors are paying a premium and adds an extra layer of valuation risk if market sentiment shifts. At the same time, compared to peer averages of 46.1x, it does not appear outrageously priced. Could this premium signal justified optimism, or does it leave less room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teledyne Technologies Narrative

If you prefer to follow your own insights or want to dig deeper into Teledyne’s numbers, you can easily create a personal narrative and analysis in just a few minutes, so why not Do it your way

A great starting point for your Teledyne Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don't let tomorrow's winners slip past, when powerful new ideas are just a click away. Now is the time to target your next potential breakouts.

- Spot overlooked bargains and unlock growth with these 894 undervalued stocks based on cash flows featuring strong cash flow potential.

- Tap into the future of medicine by checking out these 32 healthcare AI stocks as it transforms patient care through pioneering AI in healthcare.

- Catch high-yield performers for stable passive income with these 16 dividend stocks with yields > 3% which delivers impressive dividend returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal