How Investors Are Reacting To Sensata Technologies (ST) Removing the Cap on 2029 Notes Purchases

- Earlier this week, Sensata Technologies announced the early tender results of its cash tender offers and removed the US$300 million cap on STBV 2029 Notes purchases, resulting in tenders exceeding the maximum and a pro-rata allocation set at 38.2349%.

- This shift in the company's capital allocation approach may influence investor sentiment and affect the supply-demand balance for Sensata’s outstanding notes.

- We will examine how the removal of the purchase cap for STBV 2029 Notes could alter Sensata’s investment narrative and near-term outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sensata Technologies Holding Investment Narrative Recap

To believe in Sensata Technologies Holding as a shareholder right now, an investor must have confidence in the company’s ability to recapture growth and improve earnings amid cyclicality and competitive pressures in core end markets like automotive and HVOR. The company’s removal of the US$300 million cap on its 2029 notes tender offer streamlines its capital structure, but this move does not materially alter the biggest near-term catalyst, ramping new energy vehicle partnerships in China, or the key risk stemming from margin compression due to intense price competition and share loss among local OEMs.

Among the latest relevant announcements, Sensata’s Q3 2025 earnings highlighted a goodwill impairment charge of US$225.7 million alongside falling revenue and a rising net loss. While the cap removal may improve financial flexibility, persistent earnings pressure and muted sales growth reinforce the importance of the company’s planned margin initiatives as it attempts to stabilize returns ahead of anticipated business wins in China.

However, with net leverage still elevated, investors need to consider what could happen if...

Read the full narrative on Sensata Technologies Holding (it's free!)

Sensata Technologies Holding's outlook forecasts $4.2 billion in revenue and $495.4 million in earnings by 2028. This implies annual revenue growth of 3.6% and a $384.1 million increase in earnings from the current $111.3 million.

Uncover how Sensata Technologies Holding's forecasts yield a $39.07 fair value, a 30% upside to its current price.

Exploring Other Perspectives

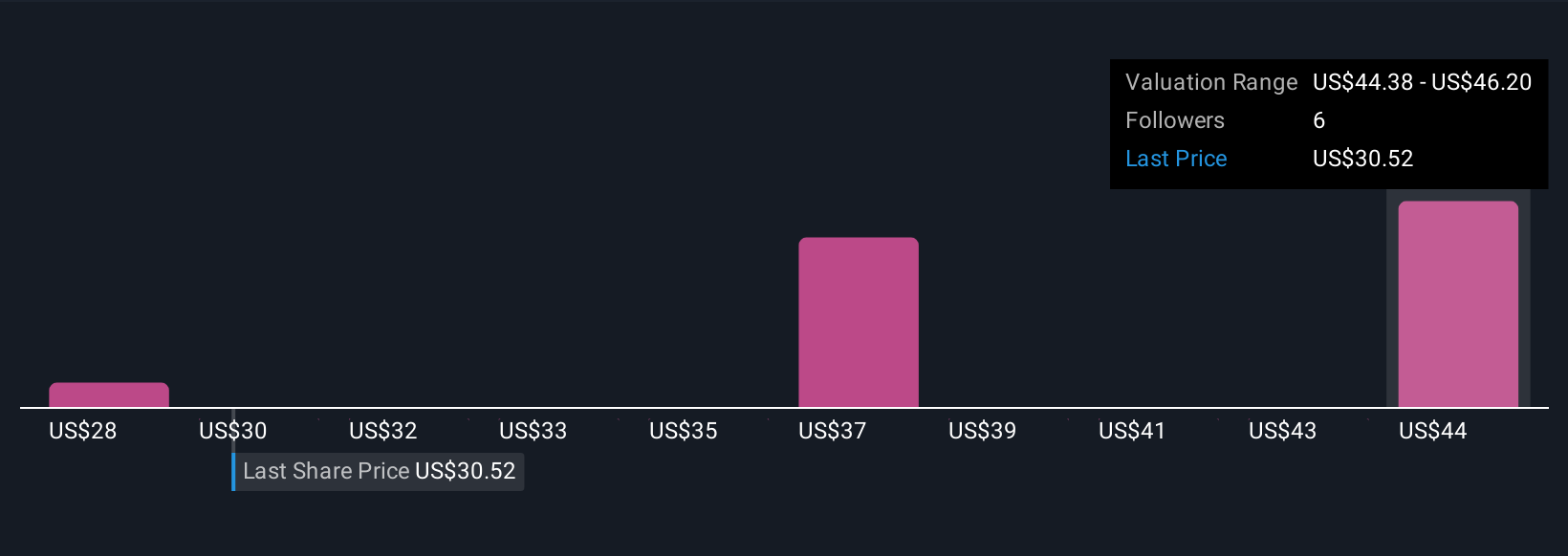

Three members of the Simply Wall St Community valued Sensata between US$27.98 and US$39.65, reflecting a broad range of fair value opinions. Meanwhile, margin pressures from intense competition remain a central risk that could influence expectations for sustained recovery and future profitability.

Explore 3 other fair value estimates on Sensata Technologies Holding - why the stock might be worth as much as 32% more than the current price!

Build Your Own Sensata Technologies Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sensata Technologies Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sensata Technologies Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sensata Technologies Holding's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal