Is Artivion's Upgraded Outlook and Trial Launch Reshaping the Investment Case for AORT?

- Artivion, Inc. recently reported strong third-quarter results, with revenue rising to US$113.39 million and turning to a net income of US$6.5 million compared to a net loss a year earlier, while also raising its full-year 2025 revenue and EBITDA guidance.

- This momentum was further supported by the initiation of the pivotal ARTIZEN trial for the Arcevo LSA stent graft system, signaling ongoing innovation and expansion in the aortic arch repair segment.

- We’ll examine how the raised full-year financial guidance and new clinical trial progress could reshape Artivion’s investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Artivion Investment Narrative Recap

Owning Artivion stock means believing in the company’s ability to deliver growth by launching innovative products and expanding its clinical pipeline, while managing costs and regulatory hurdles. The strong third-quarter earnings and raised 2025 guidance support the near-term catalyst of accelerating revenue from recent launches like AMDS and On-X valves, but do not materially reduce the ongoing risk that pipeline success or future regulatory approvals could face delays or setbacks.

The most relevant recent announcement is the first patient treated in the pivotal ARTIZEN trial for the Arcevo LSA stent graft system. This clinical milestone aligns directly with Artivion’s strategy of driving growth through pipeline expansion and could factor heavily in future top-line results if successful, reinforcing innovation as a critical catalyst in the company’s investment case.

On the other hand, investors should also be aware that even with progress in clinical trials, financial leverage remains elevated, constraining ...

Read the full narrative on Artivion (it's free!)

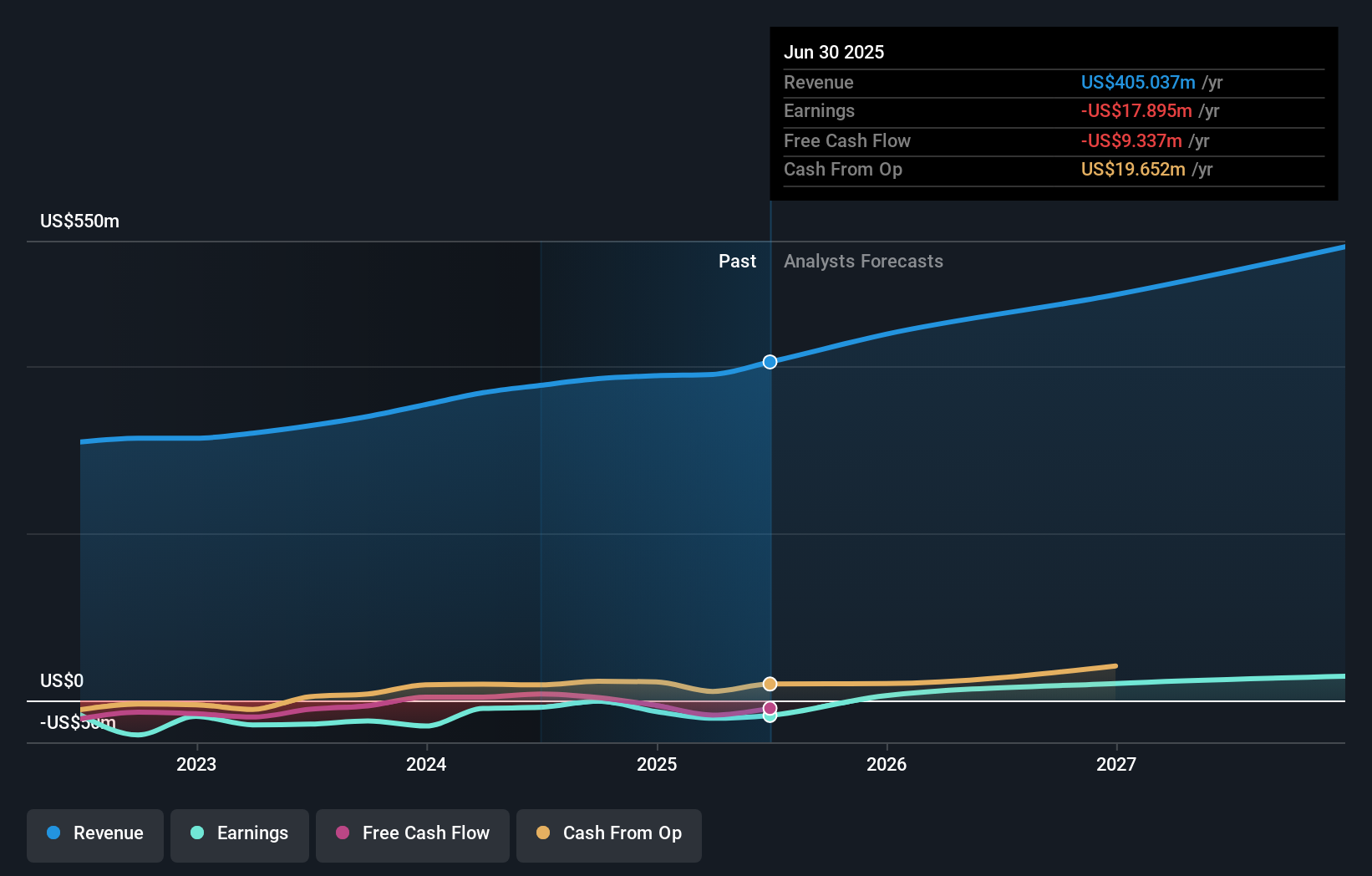

Artivion's narrative projects $571.4 million in revenue and $37.4 million in earnings by 2028. This requires a 12.2% annual revenue growth rate and a $55.3 million increase in earnings from the current level of -$17.9 million.

Uncover how Artivion's forecasts yield a $45.26 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from two members of the Simply Wall St Community range from US$16.78 to US$45.26 per share. These wide-ranging views reflect ongoing optimism around growth from new products, yet highlight just how differently investors interpret Artivion’s future and invite you to compare additional approaches.

Explore 2 other fair value estimates on Artivion - why the stock might be worth as much as $45.26!

Build Your Own Artivion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artivion research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Artivion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artivion's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal