Qorvo (QRVO): Exploring Valuation After Recent Pullback in Semiconductor Stocks

See our latest analysis for Qorvo.

While Qorvo's shares have slid nearly 8% in the last month, this is more a pause than a reversal when set against its 22% share price return since the start of the year and a 30% total shareholder return over the past twelve months. The recent pullback reflects shifting sentiment in semiconductors, but long-term holders have still enjoyed notable gains even as momentum appears to be cooling.

If you’re reviewing the latest swings in chipmakers like Qorvo, it’s a smart move to see what else is out there. Check out See the full list for free.

With Qorvo trading below analyst targets and showing solid revenue and income growth, investors face an important question: is there still hidden value in the stock, or is the market already looking ahead?

Most Popular Narrative: 16.5% Undervalued

Qorvo’s most widely followed valuation narrative puts fair value well above its recent close, suggesting room for upside if forecasts hold true. The analysis weighs major sector and company catalysts to reach its price estimate.

Material improvements in operational efficiency, such as the exit from legacy low-margin Android businesses, consolidation of manufacturing footprint (closure of North Carolina and Costa Rica sites), and product portfolio rationalization, are projected to drive sustainable cost savings and support higher operating margins starting late fiscal '27.

What hidden assumptions could drive this price target higher? The story behind this fair value hangs on bold cost cuts, profit expansion and ambitious future growth. These forecasts hinge on key financial leaps and a shakeup of Qorvo’s business model. Want the full picture? The narrative’s underlying numbers may surprise you.

Result: Fair Value of $101.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a single major customer and uncertainty from global trade tensions could quickly challenge these optimistic forecasts and valuation assumptions.

Find out about the key risks to this Qorvo narrative.

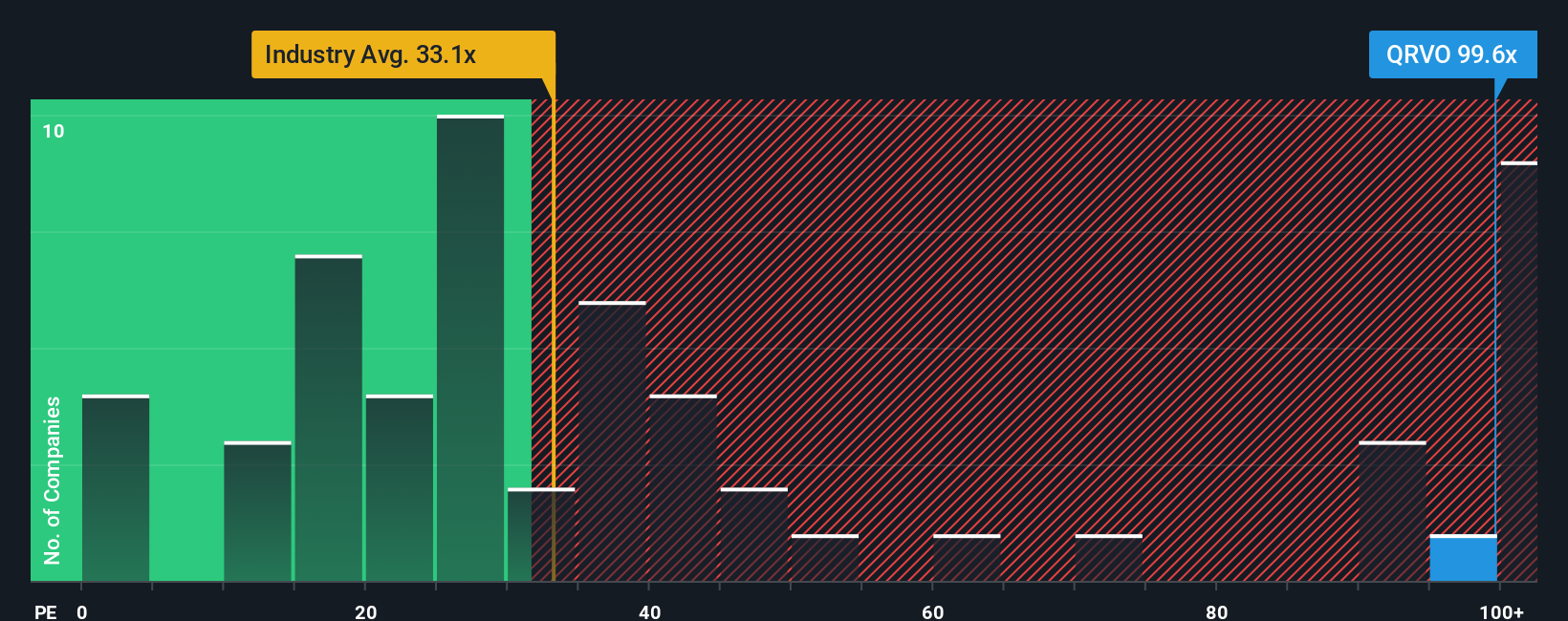

Another View: Earnings Multiple Sends a Different Signal

Looking at Qorvo through its price-to-earnings ratio tells a more expensive story. The stock trades at 36 times earnings, higher than both the industry average of 34.7x and its own fair ratio estimate of 29x. This premium suggests the market may be pricing in a lot of optimism already. Will this rich valuation hold if results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qorvo Narrative

If you see the story from a different angle or want to reach your own conclusion, you can build your perspective in just a few minutes. Do it your way

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss out on the next breakout stock or sector. Supercharge your portfolio by checking out these powerful strategies on Simply Wall Street's screener.

- Capitalize on tomorrow’s tech by uncovering potential standouts among these 25 AI penny stocks, shaping artificial intelligence innovation right now.

- Grow your income steadily by reviewing these 16 dividend stocks with yields > 3% with strong yields and reliable payout histories.

- Take advantage of undervalued opportunities by tapping into these 886 undervalued stocks based on cash flows, where the numbers signal compelling entry points based on solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal