Is ARR’s Dividend Focus a Signal of Resilience or a Sign to Rethink Growth Priorities?

- On November 14, 2025, ARMOUR Residential REIT, Inc. released a presentation sharing updates on its financial position and operational strategy, emphasizing ongoing management of a diversified mortgage-backed securities portfolio and a focus on maintaining common share dividends.

- This update included details about improved book value and economic returns, reflecting the company’s approach to supporting shareholder value despite sector risks.

- We’ll explore how ARMOUR Residential REIT’s commitment to dividend stability shapes its investment narrative following these financial disclosures.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is ARMOUR Residential REIT's Investment Narrative?

Owning a piece of ARMOUR Residential REIT hinges on an investor’s confidence in its disciplined management of a diversified mortgage-backed securities portfolio and its ongoing focus on common share dividends, which remain central to its story. The recent presentation update reinforces this theme, highlighting improvements in book value and economic returns, which may reduce uncertainty around near-term catalysts like dividend continuity and book value stability. While these developments provide some clarity, the biggest risks, such as high payout ratios not well covered by earnings or cash flow, relatively expensive valuation compared to peers, and pressures on profit margins, still linger. The November 14 news, by emphasizing positive short-term results and a dividend focus, modestly calibrates these risks but doesn’t fundamentally alter them. Recent price moves suggest the news is being absorbed as a routine update rather than a game-changer.

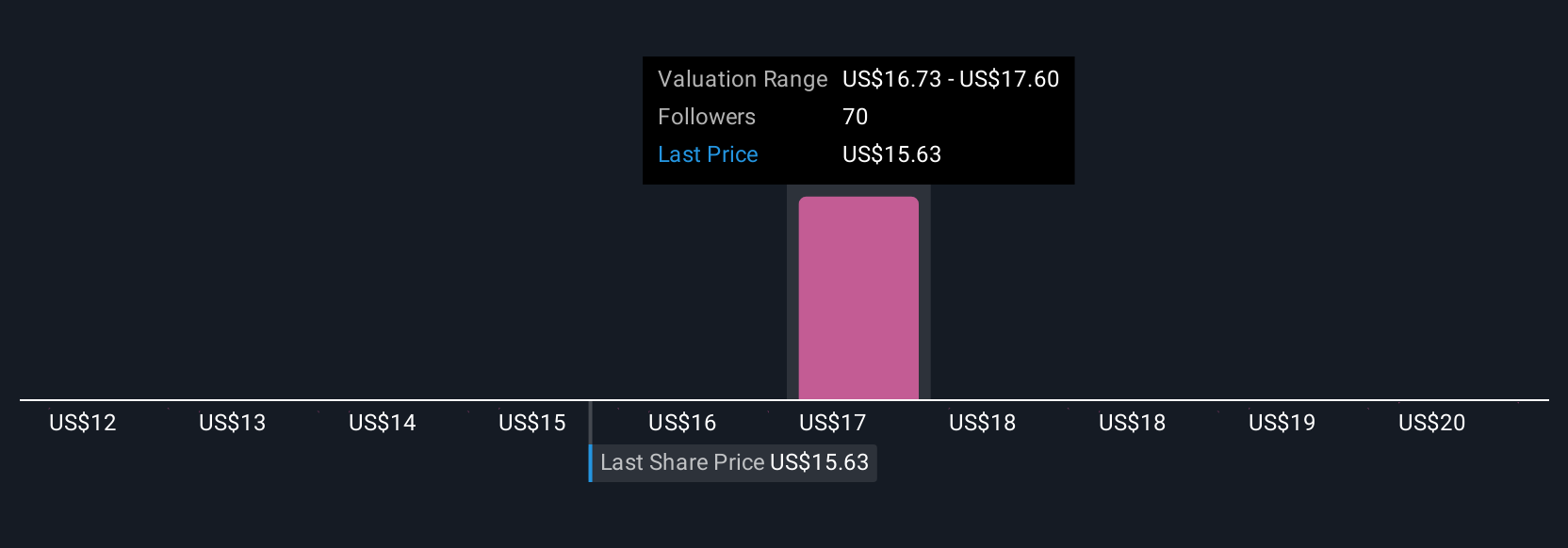

But investors shouldn’t overlook the challenge of sustaining dividends in the face of earnings headwinds. The valuation report we've compiled suggests that ARMOUR Residential REIT's current price could be inflated.Exploring Other Perspectives

Explore 8 other fair value estimates on ARMOUR Residential REIT - why the stock might be worth as much as 24% more than the current price!

Build Your Own ARMOUR Residential REIT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ARMOUR Residential REIT research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free ARMOUR Residential REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ARMOUR Residential REIT's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal