How the Evolv Contract Manufacturing Deal at Plexus (PLXS) Has Changed Its Investment Story

- Earlier this month, Evolv Technologies Holdings Inc. announced it entered into a contract manufacturing partnership with Plexus Corp. to scale production and enhance global supply capabilities.

- This collaboration combines Evolv's product expertise with Plexus' design and manufacturing strengths, creating new efficiencies and positioning both companies to access wider markets and improve operational resilience.

- We will examine how this major manufacturing partnership can impact Plexus' global expansion plans and long-term growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Plexus Investment Narrative Recap

To own shares in Plexus, investors need to believe in the company’s ability to use its manufacturing expertise and global reach to capture sustained demand as key sectors expand and digitize. The new partnership with Evolv could support Plexus’s short-term catalyst, new program wins in high-growth electronics markets, by extending its reach and scale, but it does not remove underlying risks linked to customer concentration and cyclicality in sectors like semiconductors and aerospace, which remain the largest challenges for stability. One recent announcement most relevant to this partnership is Plexus's strong Q4 results, featuring higher year-over-year revenue and net income, which underpinned management’s confidence in guidance for further revenue expansion. This reinforces the company's momentum in operational scale and customer onboarding, a trend the Evolv collaboration could further support if executed efficiently. However, investors should also be aware that, despite these growth drivers, exposure to unpredictable order cycles from major clients can still...

Read the full narrative on Plexus (it's free!)

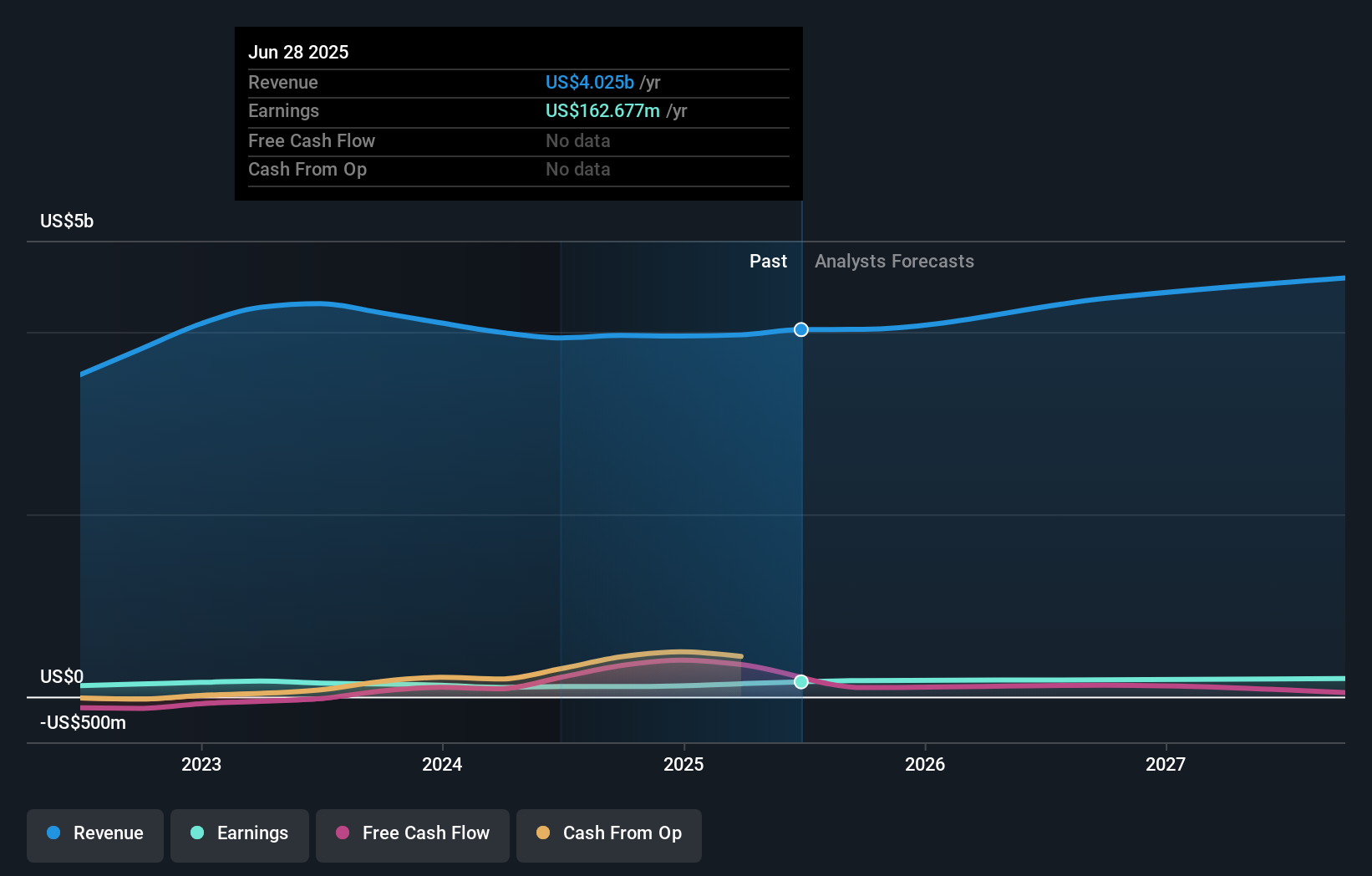

Plexus is projected to reach $4.8 billion in revenue and $202.1 million in earnings by 2028. This outlook assumes a 6.1% annual revenue growth rate and reflects an earnings increase of about $39 million from current earnings of $162.7 million.

Uncover how Plexus' forecasts yield a $159.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community forecasts a US$114.18 fair value for Plexus, suggesting a single viewpoint so far. In contrast, analyst coverage highlights ongoing risks around revenue volatility from program delays and customer dependence, prompting a careful look at differing outlooks and opportunities.

Explore another fair value estimate on Plexus - why the stock might be worth 19% less than the current price!

Build Your Own Plexus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plexus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Plexus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plexus' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal