Will Zebra Technologies’ (ZBRA) Push Into AI and RFID Reinvent Its Edge in Retail Operations?

- Earlier this month, Zebra Technologies released findings from its 18th Annual Global Shopper Study, highlighting the growing adoption of generative AI, automation, and RFID in retail loss prevention and inventory management, alongside the launch of new advanced inventory and retail media solutions.

- The study revealed consecutive declines in shopper satisfaction, with inventory challenges remaining a key concern, even as retailers increase investments in real-time tracking and digital engagement technologies to address consumer frustrations and profitability.

- We'll assess how Zebra's new AI-powered solutions and a pronounced retailer focus on inventory visibility may reshape its investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Zebra Technologies Investment Narrative Recap

For Zebra Technologies, the core investment thesis centers around the company's ability to lead retailers through broad digital transformation, particularly by addressing inventory visibility, automation, and AI adoption in a market still grappling with shopper dissatisfaction and operational inefficiencies. The latest Shopper Study and product launches reinforce Zebra’s focus on retail innovation, but the news is unlikely to materially shift the greatest near-term catalyst: accelerated digital adoption by retailers, nor does it alter the most pressing risk, margin pressure from the highly competitive, consumer-facing markets entered via the Elo acquisition. Among recent announcements, the acquisition of Elo stands out for its direct relevance, expanding Zebra’s reach in retail media networks and customer-facing solutions. As retailers increase investment in digital engagement and in-store technologies, integration risks and competition in these segments will remain front of mind for investors watching for signs of performance improvement or margin dilution. In contrast, investors should be aware of the risk that ongoing exposure to more competitive end markets may mean ...

Read the full narrative on Zebra Technologies (it's free!)

Zebra Technologies is projected to reach $6.2 billion in revenue and $855.4 million in earnings by 2028. This outlook assumes a 6.0% annual revenue growth rate and an increase in earnings of about $307 million from the current $548.0 million.

Uncover how Zebra Technologies' forecasts yield a $358.47 fair value, a 49% upside to its current price.

Exploring Other Perspectives

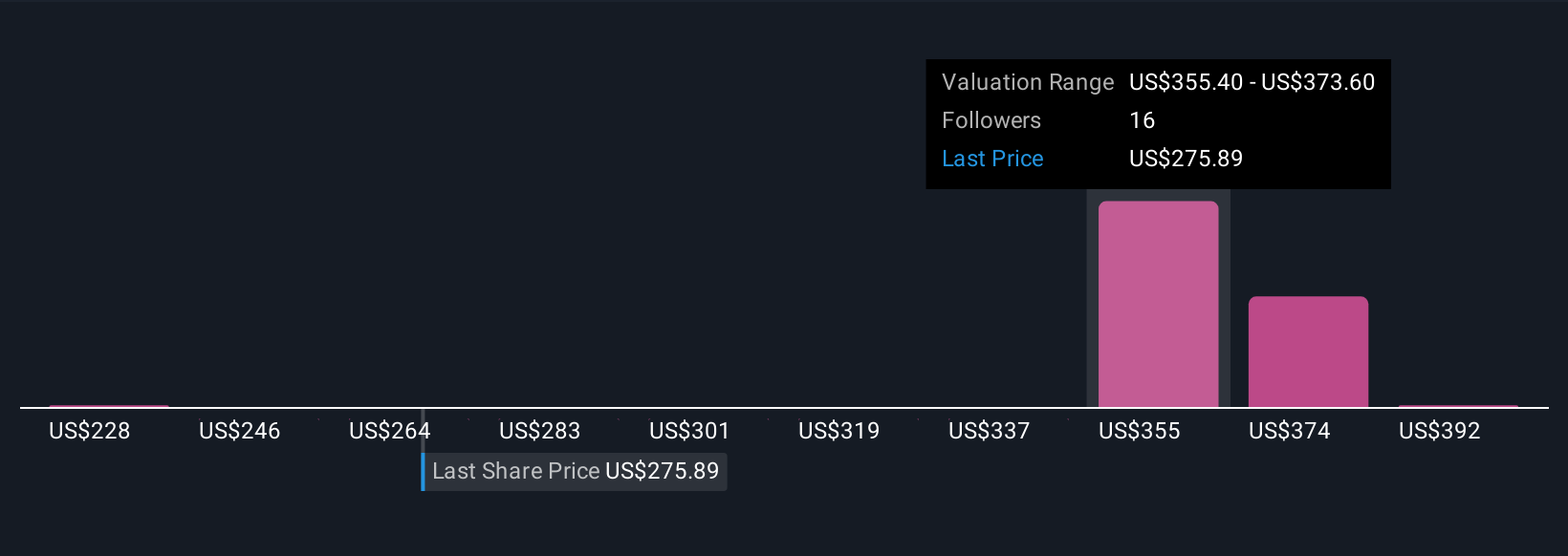

Five members of the Simply Wall St Community value Zebra between US$228 and US$410 per share, showing a wide span in fair value estimates. While views vary, many still see margin erosion in the Elo segment as crucial for understanding Zebra’s profit potential.

Explore 5 other fair value estimates on Zebra Technologies - why the stock might be worth 5% less than the current price!

Build Your Own Zebra Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zebra Technologies research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Zebra Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zebra Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal