Bruker (BRKR): Assessing Valuation After Guidance Cut and Goodwill Impairment

Bruker (BRKR) shares drew investor attention after the company disclosed weaker third quarter earnings, a substantial goodwill impairment, and a cut to its full-year 2025 financial guidance. This signals caution about near-term performance.

See our latest analysis for Bruker.

Bruker’s stock has bounced back sharply in the short term, climbing nearly 15% over the past month and an impressive 24% in the past 90 days, even as the company reported a major goodwill impairment and revised its 2025 guidance lower. Despite this recent recovery in share price, the longer-term total shareholder return remains negative over one, three, and five years. This signals that momentum is only just starting to shift after a challenging stretch.

If the latest turnaround has you wondering what else is out there, now’s a great moment to discover fast growing stocks with high insider ownership.

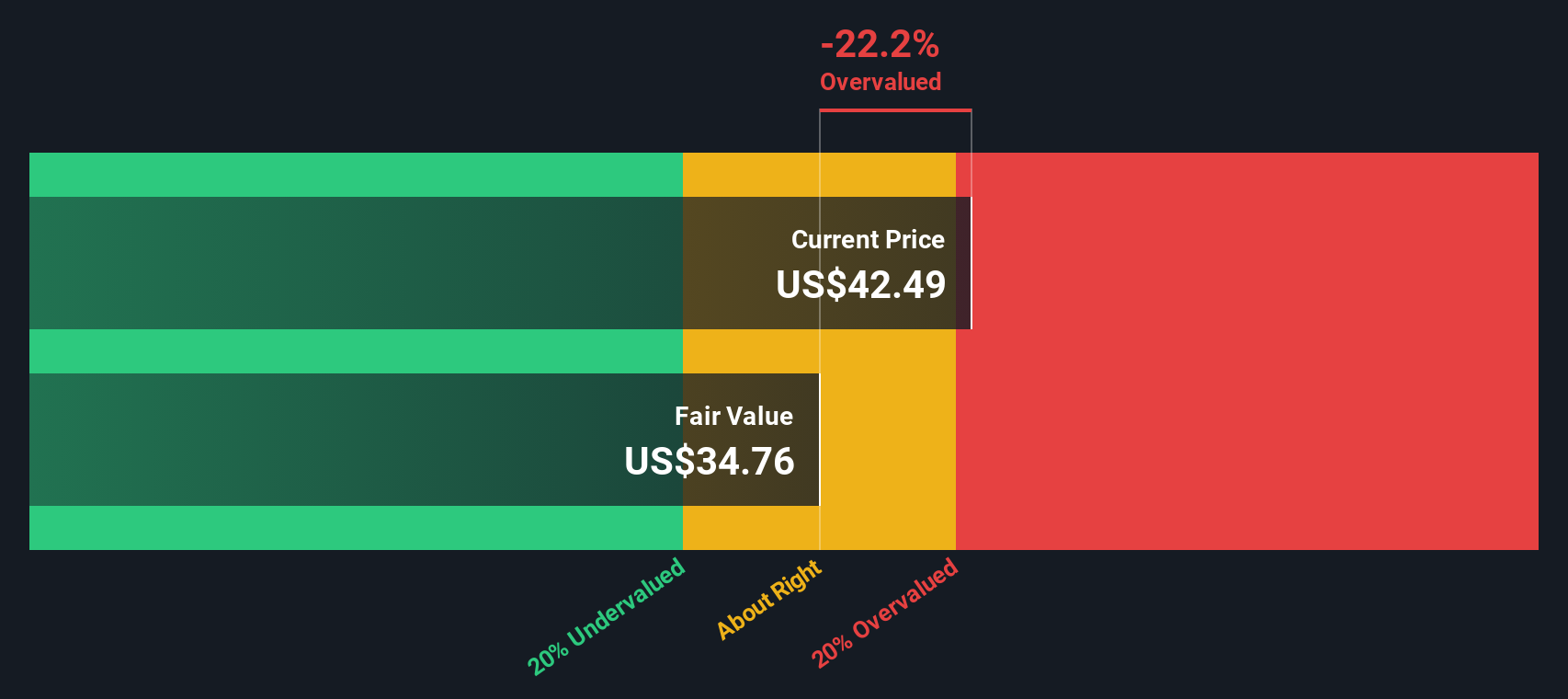

All eyes are now on Bruker’s valuation, as investors consider whether the recent selloff and rebound have created an attractive entry point or if the stock’s rapid recovery fully reflects any future growth ahead.

Most Popular Narrative: 13% Undervalued

Bruker's fair value is seen as 13% above the last close price, suggesting that the current rebound does not yet fully capture analysts' longer-term optimism. The most widely followed narrative draws on detailed projections for future growth and profitability, setting the stage for a closer look at assumptions driving the story.

Bruker's expanded cost reduction program (targeting $100 to $120 million of annualized savings, mainly realized in FY26) is set to drive at least 300 basis points of operating margin expansion and double-digit EPS growth even in a flat to muted revenue environment, improving net margins and earnings quality.

Curious what it will take for Bruker to hit this ambitious target? The narrative hinges on bolder margin expansion and rapid earnings acceleration, balanced with surprisingly moderate revenue expectations. Find out which key financial levers form the backbone of this upward revaluation.

Result: Fair Value of $47.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent funding headwinds and weak demand visibility in key markets could still undermine Bruker's ability to maintain its recent momentum.

Find out about the key risks to this Bruker narrative.

Another View: Discounted Cash Flow Model Perspective

To challenge the first valuation method, our SWS DCF model provides a second opinion. It currently suggests Bruker’s shares are trading above its fair value estimate, which implies the stock may be a bit overvalued when measured by long-term cash flow potential. Might the recent rally have already priced in future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bruker for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bruker Narrative

If you see things differently or want to put your own analysis to the test, building a custom narrative only takes a few minutes. Do it your way.

A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next big move to pass you by. Get ahead and start finding tomorrow’s success stories today with screener-powered ideas designed to fit your goals.

- Pounce on emerging tech by zeroing in on these 25 AI penny stocks, which are poised to benefit from the AI revolution and rapid industry adoption.

- Maximize your income potential as you browse these 16 dividend stocks with yields > 3%, offering reliable yields above 3% to strengthen your portfolio’s cash flow.

- Capitalize on innovation and long-term disruption by targeting these 26 quantum computing stocks, found at the cutting edge of quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal