Virtus Investment Partners (VRTS): Evaluating the Value Opportunity After Recent Share Price Weakness

Virtus Investment Partners (VRTS) shares have come under pressure over the past month, declining 16%. Investors are taking a closer look at the stock’s trajectory and considering potential catalysts that could shape its direction.

See our latest analysis for Virtus Investment Partners.

After a tough 30-day stretch for Virtus Investment Partners, with a share price return of -15.5%, the year-to-date slide has extended to -26.1%. Momentum looks decidedly challenged, and the past year’s total shareholder return of -28.3% places the stock well behind market averages. This hints at fading investor optimism, even though there have been no major news events grabbing headlines.

If you’re curious about what else the market has to offer, now could be the perfect opportunity to broaden your horizons and discover fast growing stocks with high insider ownership

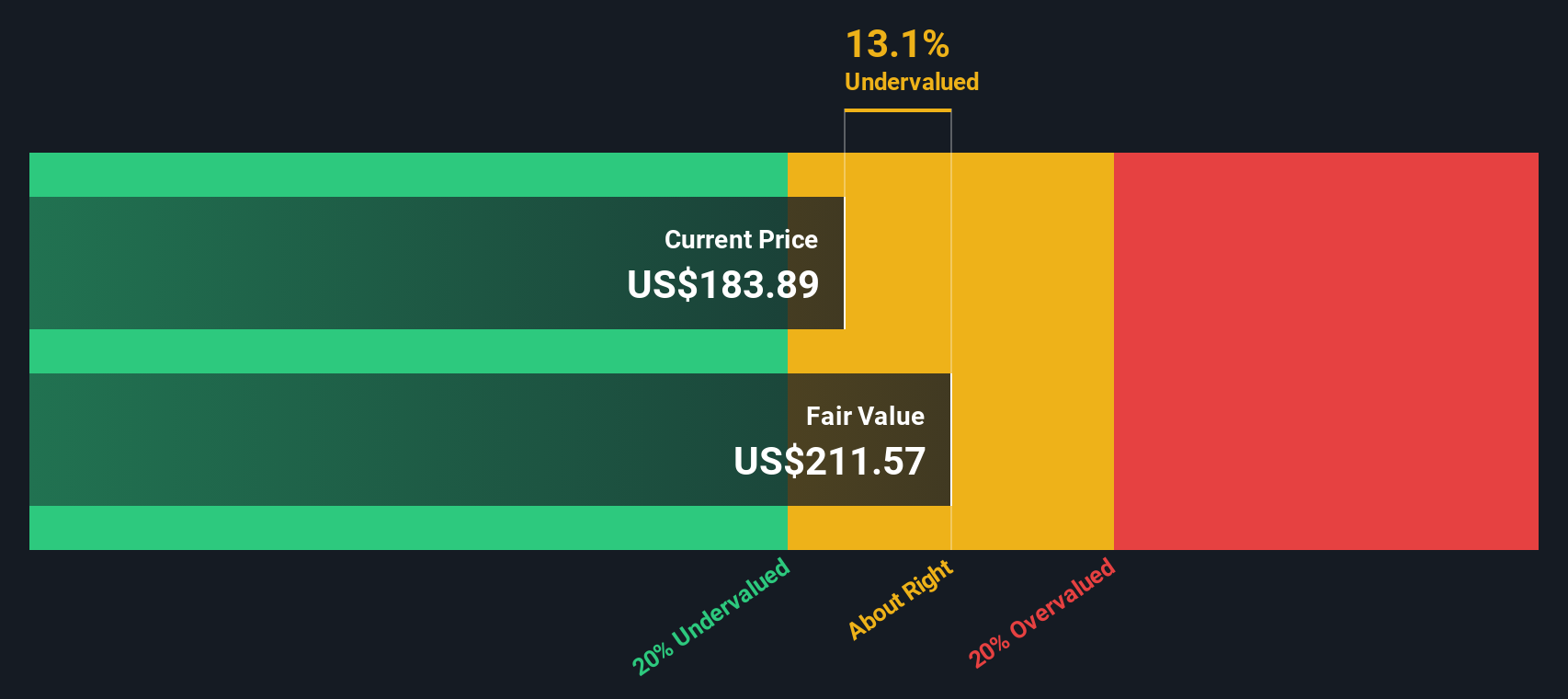

With shares trading below analyst targets and showing an intrinsic discount, does Virtus now offer an overlooked value? Or is the recent weakness simply the market factoring in slower growth ahead?

Price-to-Earnings of 8x: Is it justified?

Virtus Investment Partners is trading at a price-to-earnings (P/E) ratio of 8x, which is markedly lower than both its industry peers and the wider market. With a last close of $162.04, the stock looks inexpensive on this metric.

The price-to-earnings ratio measures what investors are willing to pay today for a dollar of the company’s earnings. For an asset manager in the capital markets sector, this metric is a key gauge of how the market is valuing both current profitability and future outlook. A low P/E can indicate undervaluation, but it also sometimes signals doubts about growth prospects.

Here, Virtus trades at a substantial discount not only to the US Capital Markets industry average of 24x, but also to its close peer group average of 24.5x. This contrast underscores how the stock may be overlooked or suggests skepticism about its declining revenue growth. There are currently no fair ratio signals available, so the market’s current discount stands out all the more.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8x (UNDERVALUED)

However, ongoing declines in revenue and the absence of clear net income growth raise concerns, as the low valuation could indicate persistent business challenges.

Find out about the key risks to this Virtus Investment Partners narrative.

Another View: Discounted Cash Flow Perspective

Looking at Virtus Investment Partners from a different angle, our DCF model suggests the stock is trading at a notable discount. With shares at $162.04 and our estimated fair value at $206.81, the gap could signal hidden value. Does this challenge how we think about current risks in the business?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Virtus Investment Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Virtus Investment Partners Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own story about Virtus with just a few clicks. It takes less than three minutes. Do it your way

A great starting point for your Virtus Investment Partners research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't settle for missing out on smarter opportunities when you could be growing your portfolio today. Take action and uncover standout stocks aligned with your goals:

- Boost your income and lock in reliable returns with these 16 dividend stocks with yields > 3% offering yields above 3%.

- Seize the potential of tomorrow’s tech leaders by tapping into these 25 AI penny stocks at the forefront of artificial intelligence innovation.

- Capitalize on value by targeting these 879 undervalued stocks based on cash flows that are primed for strong gains based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal