Is Jabil Still a Good Value After Recent 5% Pullback and New Partnerships?

- Ever wondered if Jabil shares are as good a deal as some investors say? If the value question is on your mind, you are definitely not alone.

- After a stellar 41.3% rise year-to-date and a jaw-dropping 449.4% gain over the past five years, Jabil's stock has caught the attention of seasoned analysts and newcomers alike, even with a recent 5.5% dip in the last week.

- Much of this price excitement has been fueled by Jabil’s ongoing push into high-growth end markets and major contract wins. Recent headlines highlight new partnerships and strategic investments that signal big ambitions beyond their legacy business.

- On our 6-point undervaluation scale, Jabil scores a solid 5 out of 6, suggesting the stock looks attractive at first glance. Let’s walk through the usual valuation playbook to see how those numbers stack up, and stick around to discover an even more powerful way to figure out what Jabil is really worth.

Approach 1: Jabil Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those amounts back to today’s value. This approach helps investors assess if the current price already reflects the business’s cash-generating potential or if there is real upside yet to be unlocked.

For Jabil, the latest twelve months’ free cash flow came in at $911.8 million. Looking forward, analysts forecast steady growth, with free cash flow expected to reach $1.35 billion by 2026 and $1.51 billion by 2028. Beyond those years, projections are extrapolated to show continued gains, climbing above $2.1 billion by 2035. All cash flow figures reflect US dollars.

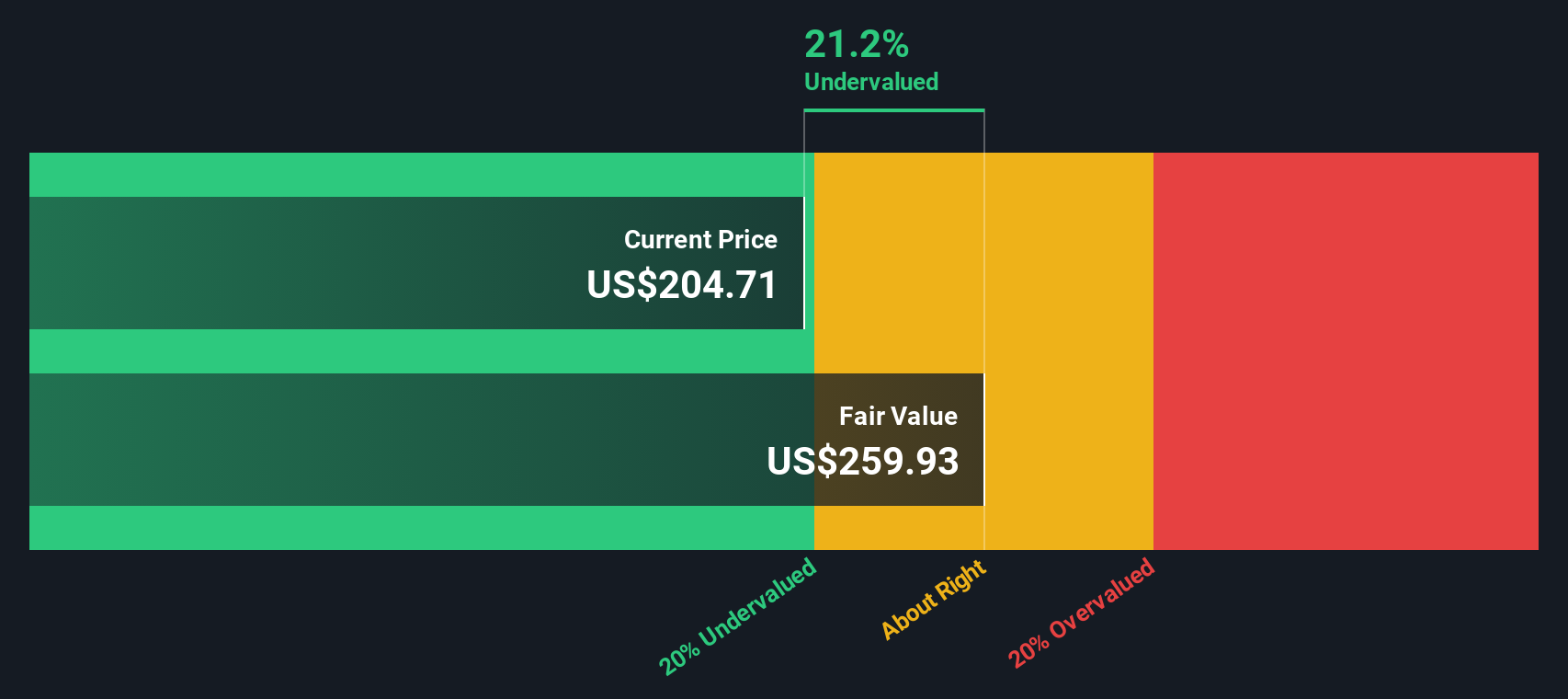

Based on these projections, the DCF model calculates Jabil’s intrinsic value at $258.43 per share. This figure is roughly 21.9% above the current share price, indicating Jabil is undervalued at the moment according to this method. The methodology used was a 2 Stage Free Cash Flow to Equity model, balancing near-term analyst forecasts and longer-term trend extrapolation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Jabil is undervalued by 21.9%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Jabil Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like Jabil, as it ties a company’s share price directly to its reported earnings. This makes it a practical, widely understood measure for comparing company valuations, especially when profits are steady and growing.

It’s important to remember that a “normal” or “fair” PE ratio isn’t the same for every company. Factors like how quickly a company is growing, its profit margins, and the risks it faces all play a big role. High-growth or lower-risk companies tend to command higher PE ratios, while lower-growth or riskier businesses trade at lower multiples.

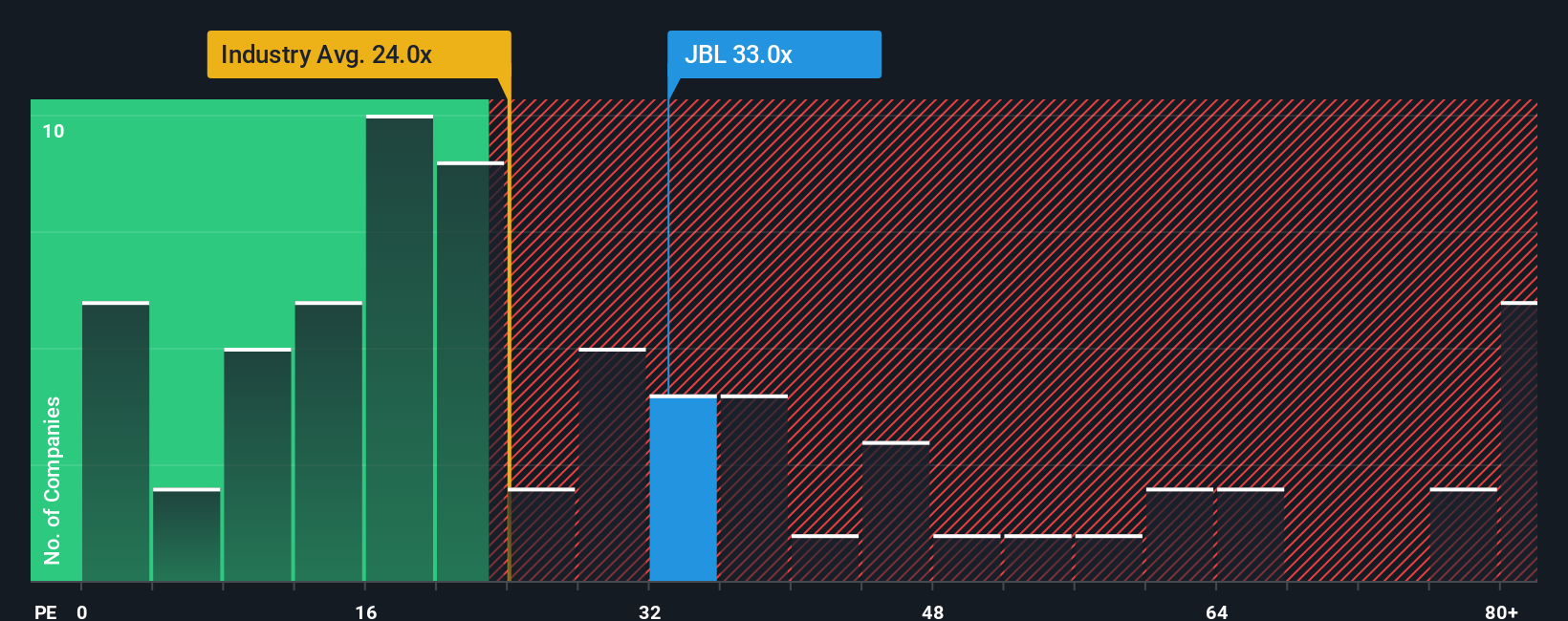

Jabil is currently valued at 32.8x earnings. Looking broader, the average PE ratio for similar companies in the Electronic industry sits at 23.7x, while peers average around 35.2x. Those figures suggest Jabil’s price tag is in the ballpark of its direct competitors and above the industry norm.

To refine the analysis, Simply Wall St’s proprietary “Fair Ratio” integrates not just peer and industry data, but also key factors like Jabil’s growth prospects, profit margins, market cap, and unique risks. Compared to simple benchmarks, this Fair Ratio offers a more tailored and arguably more accurate view of what Jabil’s valuation should be.

Jabil’s Fair Ratio is currently 34.0x, just marginally higher than its actual PE ratio. With such a small difference, this suggests Jabil’s stock is priced about right based on its fundamental outlook and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jabil Narrative

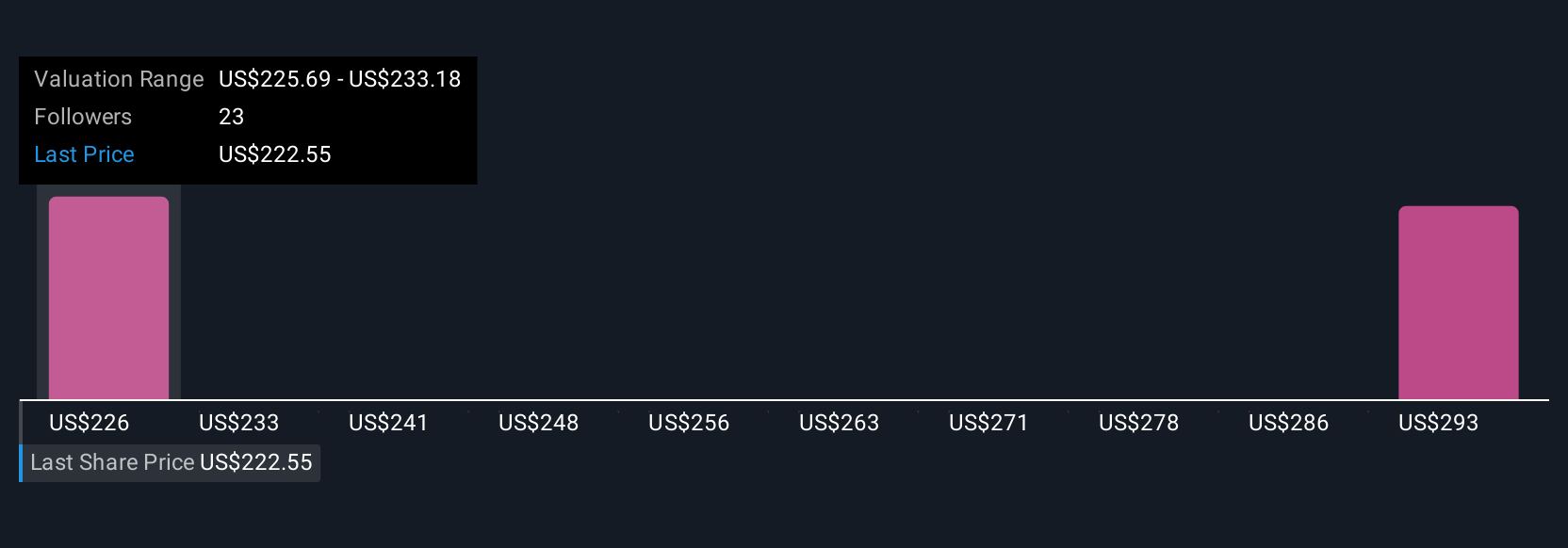

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects your own perspective on Jabil to concrete financial forecasts and, ultimately, to a fair value. It is your story about where the company is heading, supported by your assumptions for future revenue growth, profit margins, and key business drivers.

Narratives make valuation highly personal and practical by outlining why you believe Jabil will perform a certain way and turning those beliefs into numbers. Available right now on Simply Wall St's Community page, Narratives are easy to create and compare. They help millions of investors rethink how and when to buy or sell by showing how their fair value aligns with the latest share price.

As news or earnings come in, Narratives are dynamically updated, ensuring your investment theses always reflect what’s new. For example, the most optimistic Jabil Narratives forecast a fair value up to $256.00 per share, citing growth from AI initiatives and strong buybacks. The most cautious investors see potential downside with a fair value closer to $176.00, concerned about weakness in key segments and tariff risks.

Do you think there's more to the story for Jabil? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal