FDA Clearance and Cardiac Diagnostic Expansion Could Be a Game Changer for QuidelOrtho (QDEL)

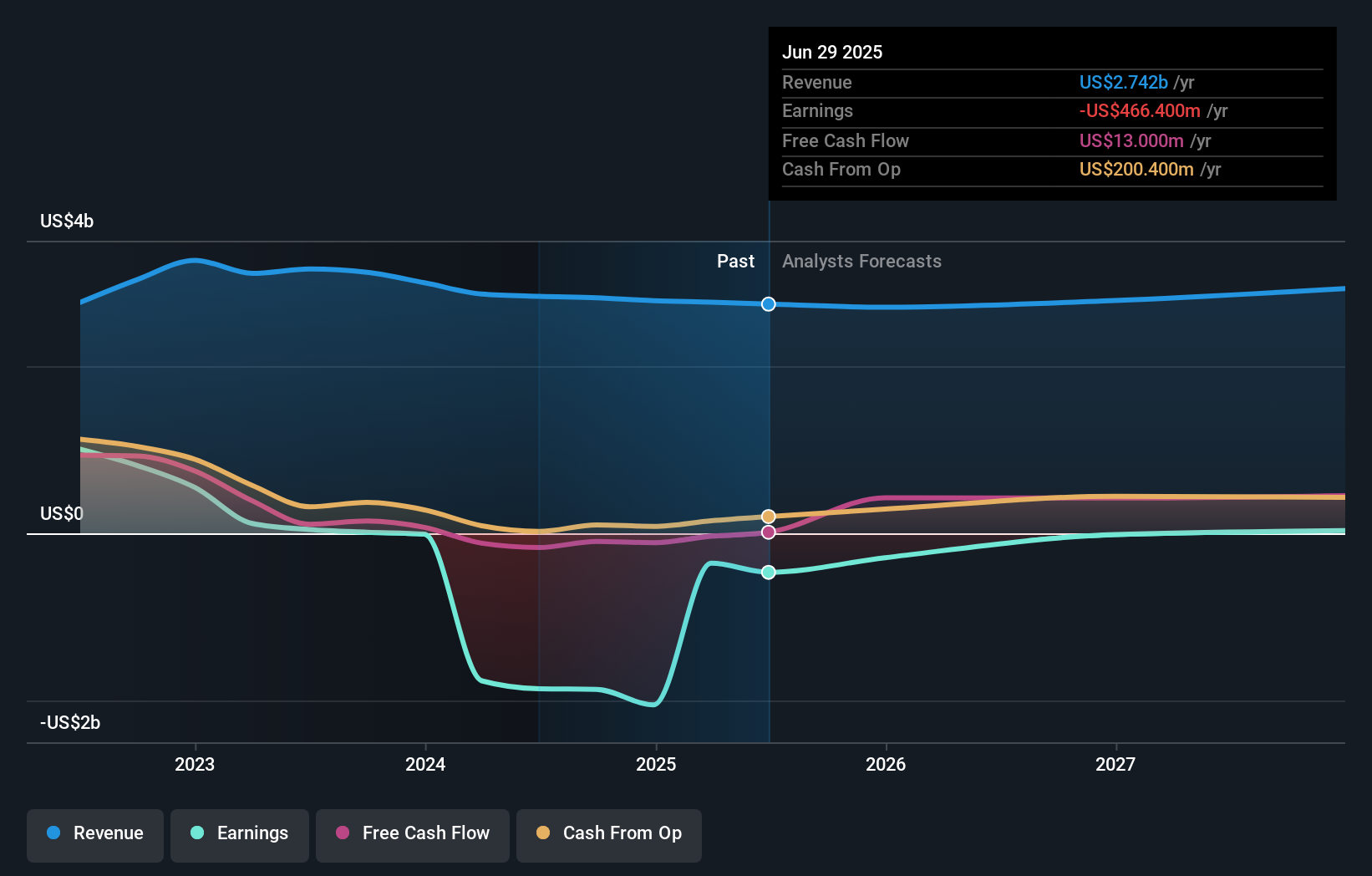

- Earlier this month, QuidelOrtho Corporation announced FDA clearance for its VITROS High Sensitivity Troponin assay, reported a quarterly net loss of US$733 million on sales of US$699.9 million, and issued 2025 guidance projecting total revenues between US$2.68 billion and US$2.74 billion.

- Alongside these financial disclosures, the company highlighted over US$140 million in recent cost savings and a product pipeline expansion into cardiac diagnostics, signaling ongoing efforts to improve efficiency and product mix.

- We'll explore how the FDA clearance of a key cardiac assay impacts QuidelOrtho's investment outlook amid its operational turnaround.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

QuidelOrtho Investment Narrative Recap

For shareholders, the core belief centers on QuidelOrtho’s potential to offset declining COVID testing revenues by expanding into higher-growth diagnostics and improving operational efficiency. While FDA clearance of the new VITROS cardiac assay bolsters the product pipeline and headlines short-term catalysts, its immediate impact on offsetting the persistent post-pandemic revenue drag is limited; persistent losses and shrinking top-line remain the most important risk to monitor. The most relevant recent development is the company’s 2025 revenue guidance of US$2.68 billion to US$2.74 billion, reaffirmed shortly after the VITROS approval. This guidance signals management's expectations despite ongoing normalization pressures, but the guidance band remains below previous highs and reflects ongoing challenges for topline stabilization. In contrast, the rising risk of further product discontinuations reducing future cash flows is something investors should be aware of...

Read the full narrative on QuidelOrtho (it's free!)

QuidelOrtho's outlook anticipates $3.0 billion in revenue and $17.2 million in earnings by 2028. This projection is based on an annual revenue growth rate of 2.6% and a $483.6 million increase in earnings from the current level of -$466.4 million.

Uncover how QuidelOrtho's forecasts yield a $37.67 fair value, a 77% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span US$37.67 to US$74.76 per share, highlighting a broad range of expectations. As operational losses persist amid the post-pandemic normalization, you can explore how your own perspective compares within such a wide field of opinions.

Explore 3 other fair value estimates on QuidelOrtho - why the stock might be worth just $37.67!

Build Your Own QuidelOrtho Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QuidelOrtho research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QuidelOrtho research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QuidelOrtho's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal