Exploring Group 1 Automotive’s Valuation After New Share Buyback and Dividend Announcement

Group 1 Automotive (NYSE:GPI) just announced a $500 million share repurchase program alongside its quarterly dividend. This signals strong conviction in its steady cash flow and long-term commitment to rewarding shareholders.

See our latest analysis for Group 1 Automotive.

Following the buyback and dividend news, Group 1 Automotive's stock has seen some volatility, with a recent 30-day share price return of -10.9% reminding investors that momentum has cooled since its strong multiyear run. Still, the company’s total shareholder return of 235% over five years shows the long-term growth story remains very much intact.

If you’re interested in finding what other auto dealers or manufacturers are up to, it’s a great moment to explore the broader sector with the full list of opportunities in our discovery tool: See the full list for free.

With shares now trading at a noticeable discount to analysts’ targets following recent declines, the question becomes clear: is this a rare buying opportunity, or is the market already reflecting all of Group 1’s future growth?

Most Popular Narrative: 18.9% Undervalued

Compared to the most widely watched fair value estimate of $483.38, Group 1 Automotive last closed at $391.97. This leaves the share price well below narrative-driven projections and invites closer scrutiny of the numbers behind this discount.

Strategic dealership acquisitions in fragmented U.S. and U.K. markets and disciplined portfolio management (balancing acquisitions and divestitures) are driving operational scale while preserving capital allocation flexibility. This supports steady top-line growth and enhances earnings power.

Want the breakdown behind this eye-opening fair value? The narrative leans on projected margin resilience and future profit expansion. Which bold financial assumptions justify a valuation premium like this? The full story could change the way you see GPI’s prospects.

Result: Fair Value of $483.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying online competition and accelerating electric vehicle adoption could undermine both market share and future profit margins for Group 1 Automotive.

Find out about the key risks to this Group 1 Automotive narrative.

Another View: How Do Multiples Stack Up?

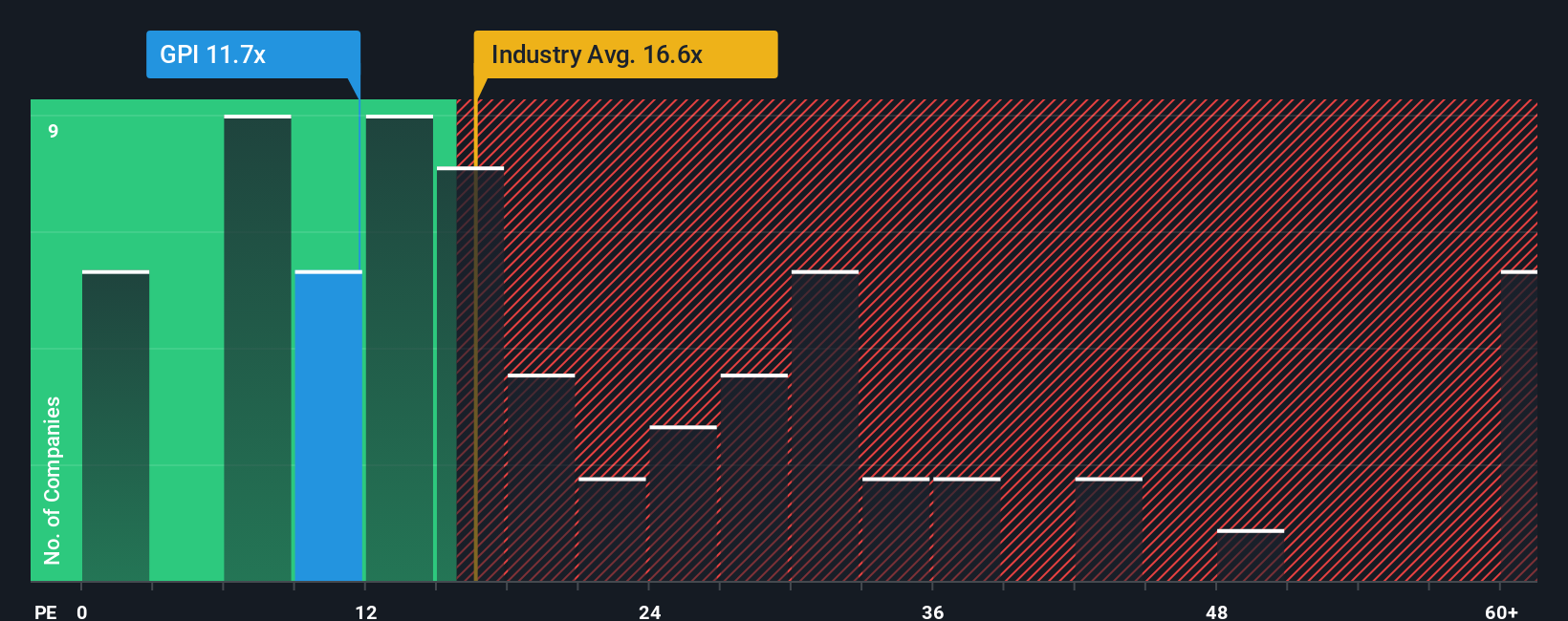

Looking at Group 1 Automotive’s price-to-earnings ratio, the stock trades at 13.1x earnings. That is above the peer average of 10x, yet below the US Specialty Retail sector’s 17.8x. Compared to its own fair ratio of 17.5x, there is a case for upside, but at this premium to peers, is the value real or just a mirage?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Group 1 Automotive Narrative

If you have a different take or want to put the numbers to the test yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Group 1 Automotive research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for Smarter Strategies? Find Opportunities Now

Thousands are using Simply Wall Street’s powerful screener to spot their next winning trade. Act now so you don’t miss timely, high-potential opportunities.

- Fuel your income goals by targeting these 15 dividend stocks with yields > 3% with yields above 3% and supported by strong fundamentals.

- Capture early growth by seeking out these 27 AI penny stocks that harness artificial intelligence for tomorrow’s breakthroughs and today’s rapid expansion.

- Tap into overlooked bargains, using these 878 undervalued stocks based on cash flows based on robust cash flow analysis to increase your chances of success.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal