Patrick Industries (PATK): Assessing Valuation After Mixed Q3 Results With Sales Up but Profits Down

Patrick Industries (PATK) just released its third quarter 2025 earnings, and the numbers caught the attention of investors. The company posted higher sales compared to last year; however, profits and earnings per share moved lower.

See our latest analysis for Patrick Industries.

PATRICK Industries’ share price has shown solid momentum in 2025, with a year-to-date gain of 27.35%. Notably, its total shareholder return over the past year stands at 20.76%, and the longer-term performance remains impressive, racking up a 206% gain in total returns over three years. While this quarter featured positive sales growth but slimmer profits, investor enthusiasm for Patrick’s long-term expansion potential appears to be holding steady, even as some are reassessing shorter-term risks following the latest earnings update and recent absence of buyback activity.

If you’re interested in casting a wider net in the industrials space, take this opportunity to discover See the full list for free.

With shares still trading below analyst targets and a significant intrinsic discount in play, the question now is whether Patrick Industries is undervalued or if the market has already taken into account all its future growth prospects.

Most Popular Narrative: 5.1% Undervalued

Patrick Industries’ prevailing narrative places its fair value estimate at $110.20, a modest 5.1% above the last close of $104.59. This small premium reflects both confidence in long-term growth drivers and a nod to the company’s current challenges navigating cyclical markets.

Ongoing innovation and product expansion, such as proprietary composite roofing systems, digital dashboards, integrated marine tower systems, and value-added content for utility vehicles, position Patrick to capture more content per unit. This drives both organic revenue growth and margin expansion through higher-value engineered offerings.

Curious about the high stakes behind this price target? The narrative's bold forecasts hinge on advanced product rollouts and transformative expansion moves. Find out which critical financial leaps are baked into these projections, and why consensus could change fast.

Result: Fair Value of $110.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent RV market weakness or a prolonged economic downturn could quickly disrupt these optimistic forecasts and challenge Patrick Industries’ growth outlook.

Find out about the key risks to this Patrick Industries narrative.

Another View: Multiples Tell a Different Story

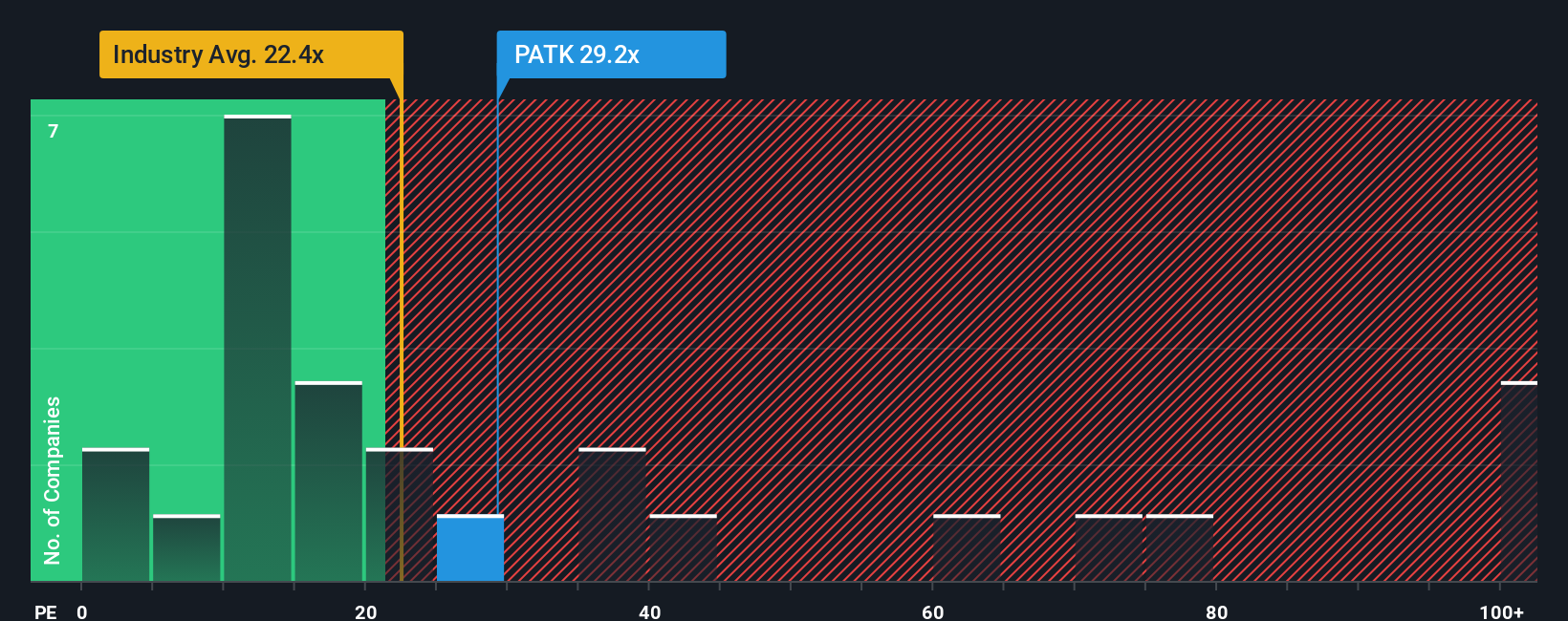

Looking beyond the consensus fair value, Patrick Industries trades at a price-to-earnings ratio of 28.9x, significantly above the US Auto Components industry average of 22.4x and the peer average of 18.3x. Even the fair ratio for Patrick is estimated at just 18.1x. This sizable gap suggests the market is pricing in hefty growth expectations, or perhaps ignoring potential valuation risks. Which outlook will win out in the months ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Patrick Industries Narrative

If you think there’s more to the story or want to test your own investing ideas, you can easily build your own narrative using the latest data in just a few minutes. Do it your way

A great starting point for your Patrick Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More High-Impact Stock Ideas?

Don’t let opportunity slip through your fingers. Take the lead and give your portfolio an extra edge by finding fresh ideas you might have missed.

- Unlock the potential of future tech by reviewing these 24 AI penny stocks, which are pushing the boundaries in artificial intelligence and machine learning.

- Position yourself early for long-term growth with these 865 undervalued stocks based on cash flows, where underappreciated companies could surprise the market.

- Capture income and stability by checking out these 16 dividend stocks with yields > 3%, featuring stocks with healthy yields over 3% for the savvy investor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal