Does New Oriental Education (EDU) See Its First Dividend as a Shift in Capital Allocation Strategy?

- New Oriental Education & Technology Group recently announced first quarter results with sales of US$1.52 billion and net income of US$240.72 million, while approving an ordinary cash dividend of US$0.12 per common share (US$1.2 per ADS) to be paid in two installments, and initiating a US$300 million share repurchase program.

- The combination of solid quarterly performance, new capital return initiatives, and reaffirmed earnings guidance underscores management's emphasis on shareholder value and confidence in ongoing business momentum.

- We'll examine how the introduction of a sizeable cash dividend, a rare move for the company, shapes the current investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

New Oriental Education & Technology Group Investment Narrative Recap

To be a shareholder in New Oriental Education & Technology Group, an investor needs to believe in the company’s ability to drive long-term growth by expanding into new education segments, leveraging technology, and delivering consistent capital returns through buybacks and now, dividends. The latest dividend announcement and share repurchase program support the ongoing focus on returning capital, but they do not significantly affect the near-term catalyst, which remains the execution and margin impact in non-academic and K-12 tutoring amid competitive pressure; the biggest near-term risk, persistent weakness in non-academic and international segments, remains largely unaddressed by these moves.

Among recent announcements, the reaffirmed full-year revenue guidance (US$5.15 billion to US$5.39 billion, up 5% to 10% year over year) stands out. This guidance reflects continued management confidence in core business momentum, but it is particularly relevant since performance will hinge on execution in new initiatives and resilience in established segments, which remain crucial short-term catalysts for the stock.

Yet, despite a stronger capital return program, investors should be aware that intensifying K-12 and non-academic competition may still put pressure on...

Read the full narrative on New Oriental Education & Technology Group (it's free!)

New Oriental Education & Technology Group is projected to reach $6.5 billion in revenue and $628.5 million in earnings by 2028. This outlook assumes a 9.7% annual revenue growth rate and a $256.8 million increase in earnings from the current level of $371.7 million.

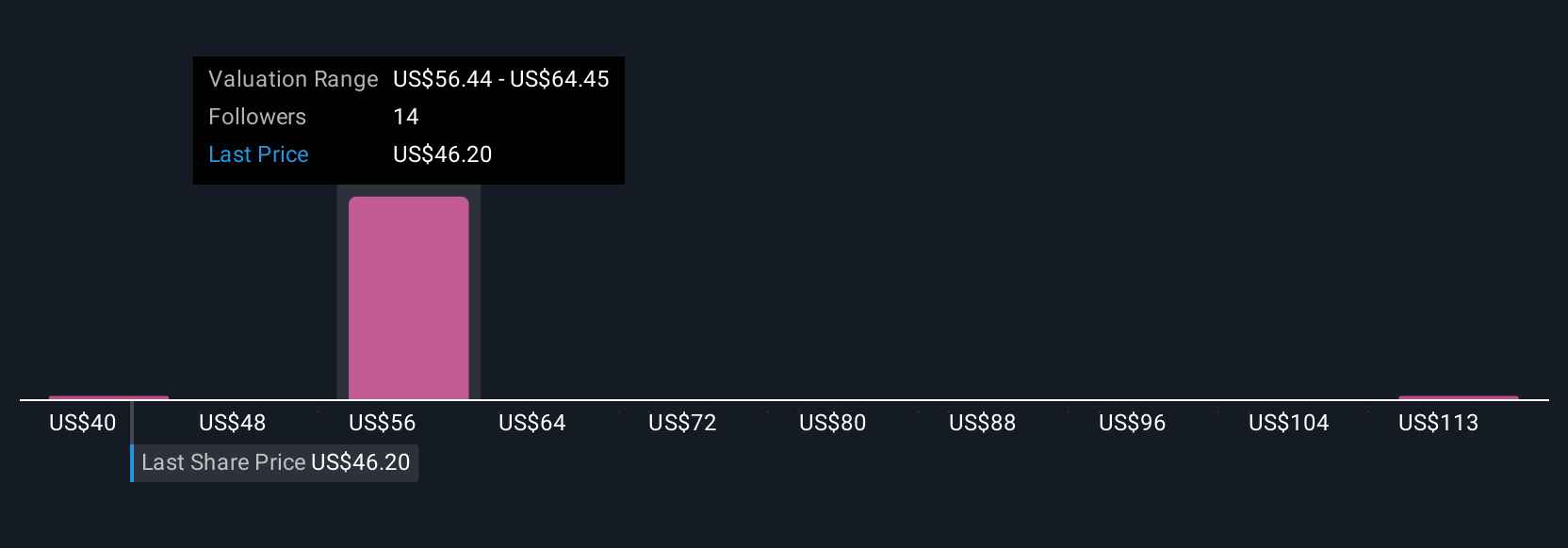

Uncover how New Oriental Education & Technology Group's forecasts yield a $63.77 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members shared four fair value estimates for EDU, ranging widely from US$38.90 to US$141.94. While many see upside, some remain cautious given the persistent margin and revenue pressure called out in recent analyst commentary, highlighting how opinions can differ when weighing competitive forces and future outlook.

Explore 4 other fair value estimates on New Oriental Education & Technology Group - why the stock might be worth over 2x more than the current price!

Build Your Own New Oriental Education & Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Oriental Education & Technology Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free New Oriental Education & Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Oriental Education & Technology Group's overall financial health at a glance.

No Opportunity In New Oriental Education & Technology Group?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal