Does First BanCorp’s Recent Price Dip Signal a Hidden Opportunity in 2025?

- Ever looked at First BanCorp and wondered if the price on the screen genuinely matches what the business is worth? You are not alone; deciphering value in banks like this can be both fascinating and rewarding.

- Over the past year, the stock has dipped slightly by 3%. Zooming out to five years, it has risen by 187.3%, suggesting significant growth potential and shifting market sentiment.

- First BanCorp has found itself in investor headlines lately as regional banks respond to industry trends and new regulatory developments. A combination of renewed confidence in the sector and updates around financial reforms has contributed to notable swings in many banking stocks.

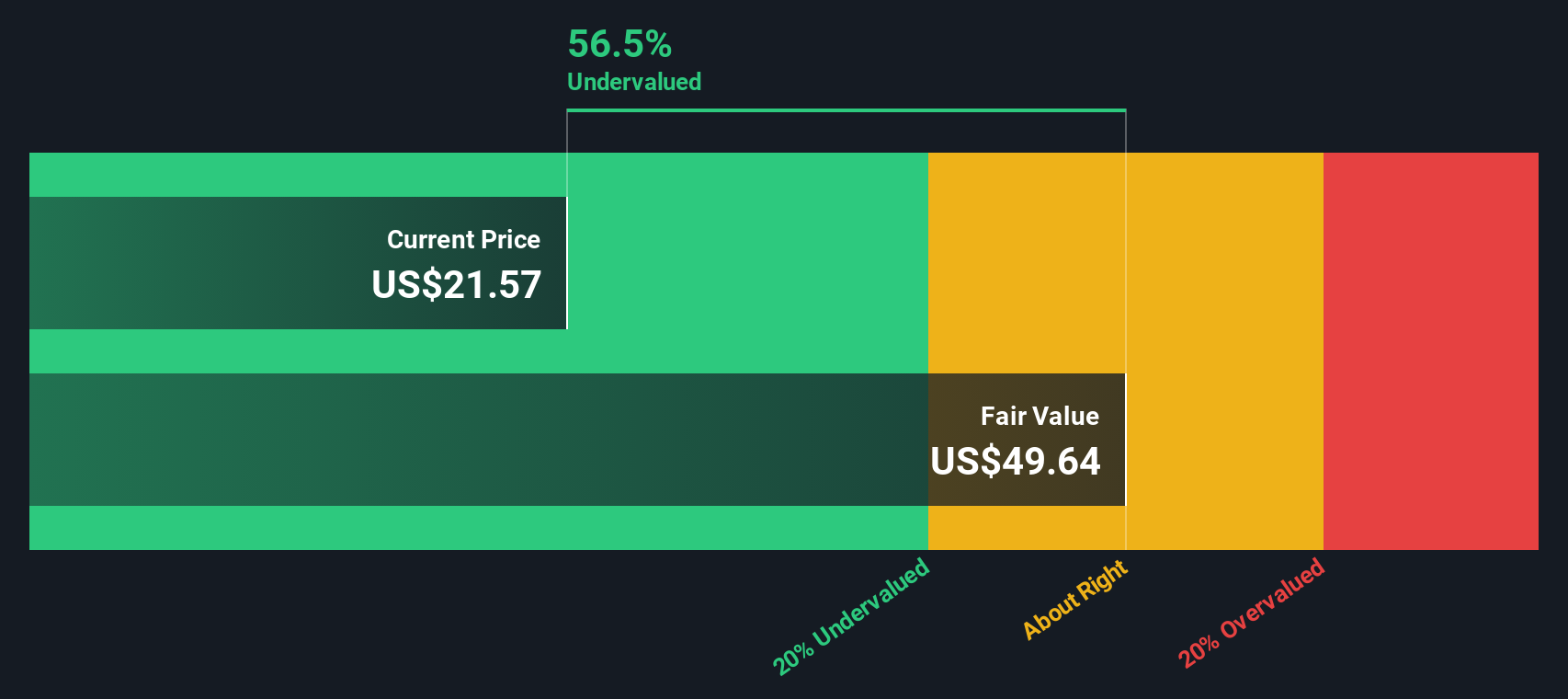

- On our valuation checks, First BanCorp scores a strong 5 out of 6 for being undervalued, making it a standout in its space. We will explore exactly how that’s calculated, and by the end, we will reveal an even more insightful way to truly judge the company’s value.

Find out why First BanCorp's -3.0% return over the last year is lagging behind its peers.

Approach 1: First BanCorp Excess Returns Analysis

The Excess Returns valuation model evaluates how effectively First BanCorp generates profits above its cost of equity. In essence, it focuses on how much value the company creates for shareholders relative to the capital it invests.

For First BanCorp, the model shows that the company has a Book Value of $12.13 per share and is projected to deliver Stable Earnings Per Share of $2.34, as estimated by a consensus of six analysts focusing on Return on Equity. The average Return on Equity over time is forecast to be a strong 16.98%. The cost of equity, representing the minimum return expected by investors, is $0.96 per share. Subtracting this cost from the earnings gives an Excess Return of $1.38 per share, indicating that the company is consistently generating profits above what investors minimally require.

The Stable Book Value is also expected to grow to $13.80 per share, according to four analysts who specialize in projecting sustainable value. This combination of strong excess returns and growth suggests an underlying strength in First BanCorp's business model.

Tying all these factors together, the implied intrinsic value per share is estimated at $51.22. With the stock currently trading at a discount of 60.3%, this suggests First BanCorp is substantially undervalued according to the Excess Returns approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests First BanCorp is undervalued by 60.3%. Track this in your watchlist or portfolio, or discover 863 more undervalued stocks based on cash flows.

Approach 2: First BanCorp Price vs Earnings

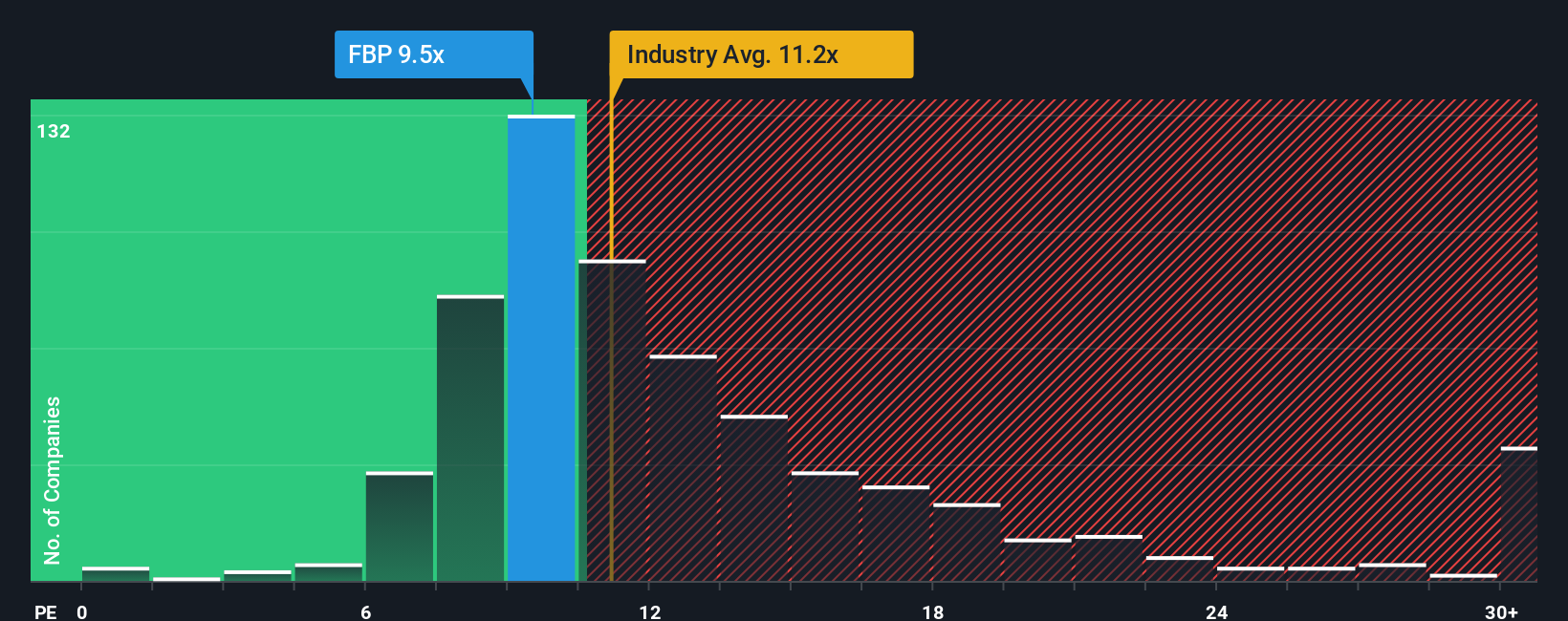

When valuing profitable companies like First BanCorp, the Price-to-Earnings (PE) ratio is often the preferred metric. It gives investors an immediate sense of how much they are paying for each dollar of company earnings, making it a practical tool for comparing stocks within the same sector.

The "normal" or "fair" PE ratio for any stock hinges on expectations for future growth and the risks involved. A higher expected growth rate typically justifies a higher PE ratio, while more risk or uncertainty pulls it lower. Industry standards can also affect what level is considered normal.

First BanCorp currently trades at a PE ratio of 9.57x. This is noticeably below the Banks industry average of 11.13x and the average among its closest peers at 11.83x. However, to get a more nuanced view, Simply Wall St applies a proprietary "Fair Ratio" model, which takes into account not just earnings but also factors like growth prospects, profit margins, market cap, and risk profile. In First BanCorp’s case, the Fair Ratio comes in at 9.80x.

Simply Wall St's Fair Ratio stands out because it tailors the expected PE to First BanCorp’s own fundamentals instead of relying solely on broad industry or peer comparisons. This makes it a more insightful benchmark, particularly when the company may have different risk or growth characteristics than its peers.

Comparing First BanCorp’s actual PE of 9.57x to the Fair Ratio of 9.80x shows the stock is trading very close to its fair value on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1400 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First BanCorp Narrative

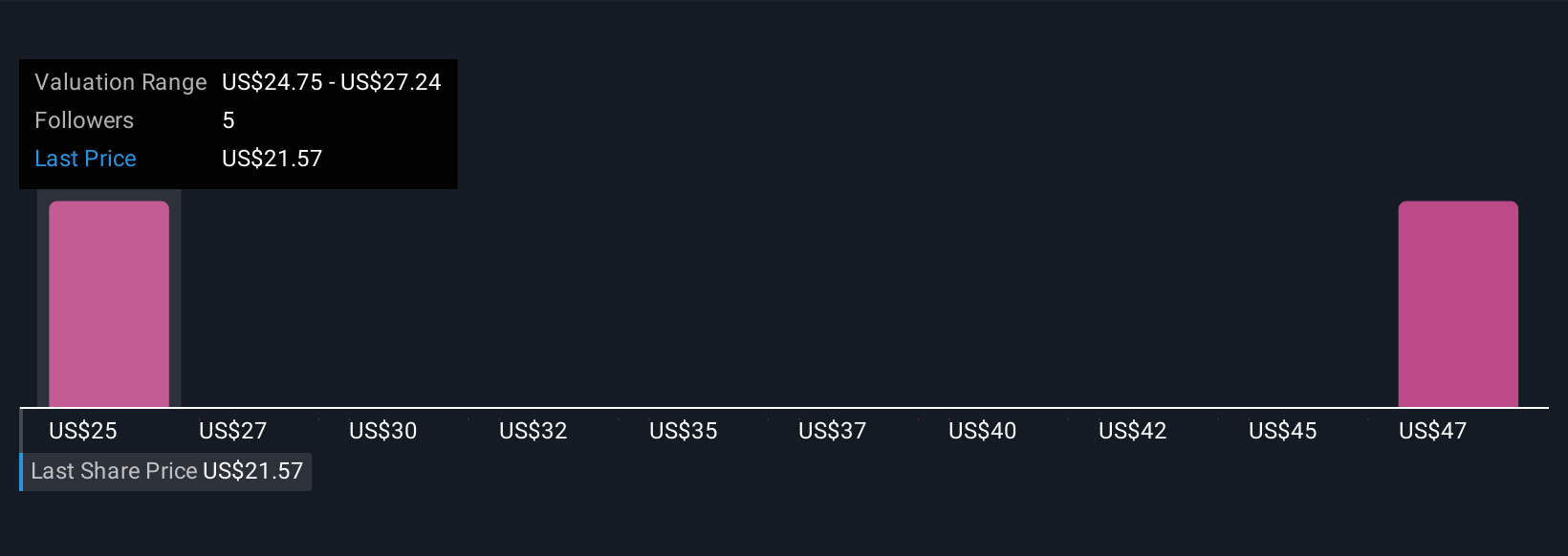

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your way of telling the story behind First BanCorp’s numbers, combining your personal view on its future with your financial assumptions, such as where earnings, revenues, and margins are going, and what fair value really means for you.

Unlike traditional ratios, Narratives make investing accessible and dynamic because they link your perspective on First BanCorp’s business drivers, such as digital growth or market risks, to a financial forecast and then to an up-to-date fair value estimate. Narratives are simple to build and use on Simply Wall St’s Community page, where millions of investors capture and compare their ideas.

This means you can decide whether to buy or sell by seeing how your own Fair Value stacks up against the latest price, and because Narratives update automatically with new earnings or news, your conclusions stay relevant without any extra effort. For example, one investor might build a bullish Narrative where they expect robust loan growth and assign a fair value above $25 per share, while another takes a cautious view on regulatory risks and lands at $21.75, demonstrating how the right Narrative can guide decisions in any market climate.

Do you think there's more to the story for First BanCorp? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal