Assessing Diodes (DIOD) Valuation After Sharp Post-Earnings Drop and 1-Year Return Weakness

See our latest analysis for Diodes.

Diodes’ sharp drop today comes after a tough stretch, with the stock’s 1-year total shareholder return now down 28.3% and momentum looking weak. Investors appear increasingly cautious as market sentiment has faded, even though the company’s underlying growth numbers remain. The share price is hovering near its year-to-date lows.

If the recent volatility has you thinking about what else is out there, now is a smart time to expand your investing perspective and discover fast growing stocks with high insider ownership

With Diodes’ valuation sitting well below analyst targets despite ongoing growth in revenue and net income, investors have to ask: Is this a case of the market overlooking potential, or has future upside already been priced in?

Most Popular Narrative: 24.5% Undervalued

Compared to the last close at $44.28, the most widely followed narrative assigns Diodes a fair value markedly higher, highlighting a sharp disconnect with current trading levels. This setup suggests bold expectations are baked into the numbers, despite recent share price weakness.

Rising demand for Diodes' solutions in AI-related computing and the broader ecosystem of connected devices (including data centers, servers, industrial automation, and IoT) is boosting revenue momentum and contributing to consistent market share gains. This trend is improving longer-term top-line growth visibility. Rapid electrification in automotive, particularly EVs in China, is leading to growing content per vehicle and an expanding set of design wins for Diodes' automotive-qualified products (such as protection devices, LED controllers, and power management ICs). These developments are supporting higher average selling prices and future margin expansion.

Curious what underpins this optimistic outlook? The numbers behind this valuation aren’t your typical Wall Street consensus. The narrative leans heavily on future growth levers and ambitious assumptions around margins and industry leadership. If you want to see just how far these expectations go, dive into the full breakdown.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high exposure to cyclical consumer demand and potential inventory imbalances could quickly undermine optimism surrounding Diodes' growth narrative.

Find out about the key risks to this Diodes narrative.

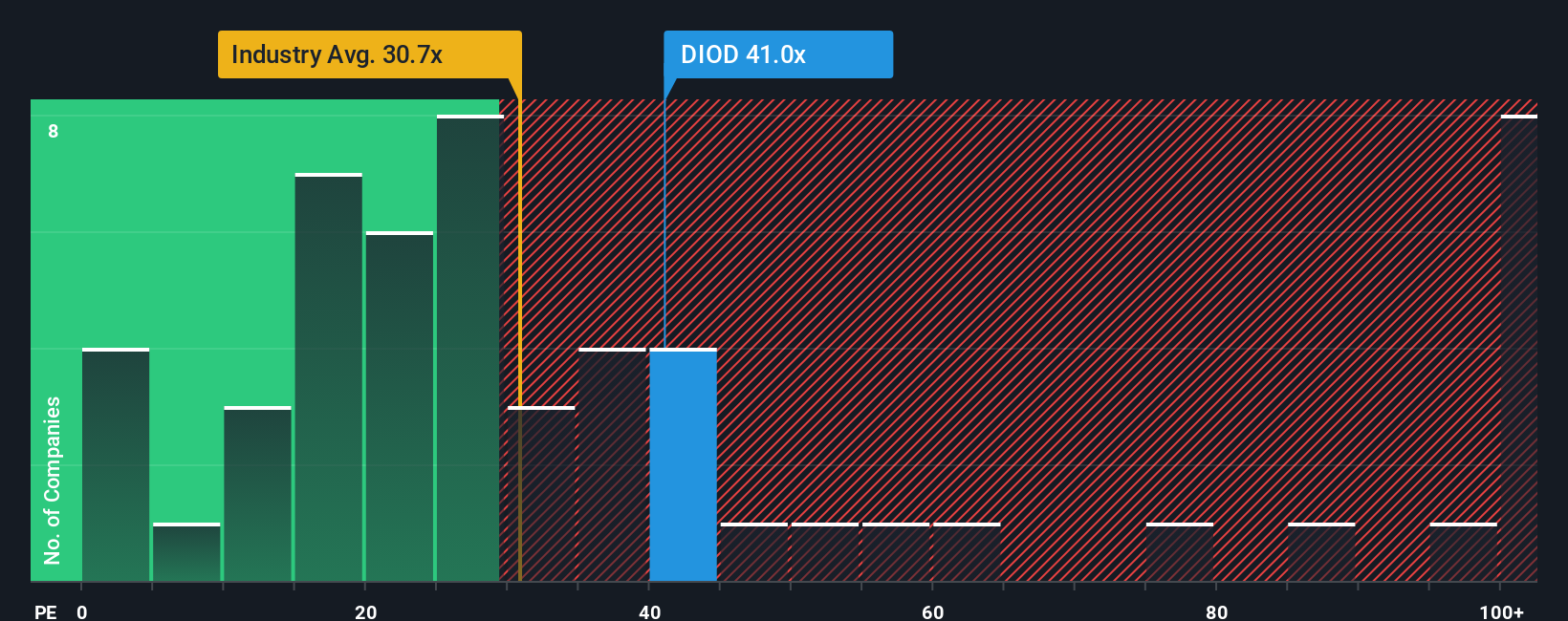

Another View: Market Multiples Tell a Different Story

Looking at where Diodes trades compared to other semiconductor companies, its price-to-earnings ratio of 32x looks reasonable, below both the industry average of 35.4x and well below its peer group at 59.7x. This suggests the market could be overlooking upside if sentiment turns. Could this gap highlight an underappreciated opportunity, or is the lower multiple a warning sign for risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diodes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diodes Narrative

If you want to dig deeper or think the story runs differently, you can easily form your own view in just a few minutes. Do it your way

A great starting point for your Diodes research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your next big opportunity by tapping into fresh, high-potential stock themes curated for today’s market. Don’t let the smartest picks pass you by while others get ahead.

- Spot companies generating consistent income and check out these 16 dividend stocks with yields > 3% with yields exceeding 3%. This can provide reliable cash flow potential for your portfolio.

- Ride the AI revolution by exploring these 25 AI penny stocks, where innovation and strong growth align with advancements in cutting-edge technology.

- Bolt ahead of the crowd with these 881 undervalued stocks based on cash flows, which features selections priced below their cash flow value and can offer unique opportunities for undervalued growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal