Edwards Lifesciences (EW): Exploring Current Valuation After Recent Gains and Innovation Momentum

See our latest analysis for Edwards Lifesciences.

After a robust run, Edwards Lifesciences' share price has delivered a healthy 14.9% gain year-to-date and a standout 25.9% total shareholder return over the past year. Momentum is building for the stock as investors respond to recent performance and innovation updates.

Looking for more opportunities in the healthcare space? Try our curated screener of standout companies and see who else is catching investors' attention: See the full list for free.

But with shares trading at a premium to their analyst price target and after a sustained rally, investors must ask whether Edwards Lifesciences is undervalued, or if the market has already priced in its future growth.

Most Popular Narrative: 6.1% Undervalued

Compared to the recent closing price of $83.39, the most widely cited narrative points to a fair value of $88.83 for Edwards Lifesciences. This signals a modest upside potential, fueled by enthusiasm for recent product launches and innovation momentum.

Strategic product launches, like the TAVR approval and EVOQUE, position Edwards for significant revenue growth and expanded market share. Investments in surgical innovation and operational efficiency mitigate financial threats, enhance global therapy adoption, and stabilize earnings.

Want to know what’s driving the current fair value? There’s a bold projection for future earnings growth and margin shifts. The narrative’s credibility depends on ambitious assumptions and strong catalysts. Will those projections hold up? Discover the full breakdown of what experts are betting on to set this price target.

Result: Fair Value of $88.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competitive pressure and potential margin impact from tariffs could challenge Edwards Lifesciences’ growth outlook if these issues are not managed effectively.

Find out about the key risks to this Edwards Lifesciences narrative.

Another View: Premium Valuation Signals Caution

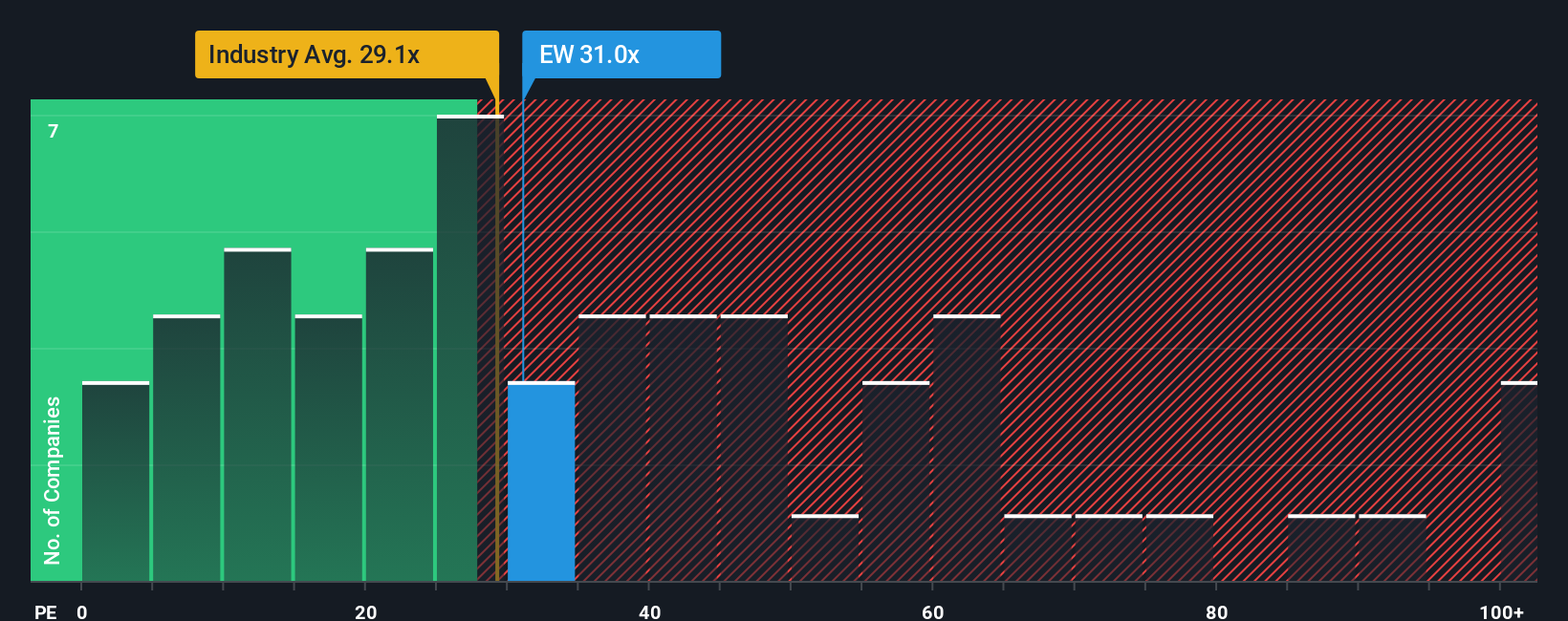

While many focus on future earnings growth, Edwards Lifesciences is currently priced at 36.1 times earnings. This is a clear premium to both its peer group average of 31.5x and the US Medical Equipment industry at 28.3x. The fair ratio, based on broader market trends, sits even lower at 28.9x. This raises questions about how much optimism is already reflected in today’s price and what needs to go right for this premium to hold up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Edwards Lifesciences Narrative

If you’d like to draw your own conclusions or challenge the current outlook, explore the data directly and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Edwards Lifesciences.

Ready to Uncover More Actionable Opportunities?

Bored of the usual picks? You could be missing out on fast movers and fresh angles. Get ahead with a few smart shortcuts below:

- Boost your returns by targeting proven income with stable yields in these 16 dividend stocks with yields > 3%, tailored for investors who want reliable payouts.

- Catch the next big opportunity by scanning these 876 undervalued stocks based on cash flows where market mispricings meet solid business fundamentals.

- Seize your edge early by seeing which innovators are pushing boundaries in artificial intelligence by browsing these 25 AI penny stocks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal