Is Carlisle’s (CSL) Leadership Shift and Flat Revenue Outlook Reshaping Its Investment Narrative?

- Carlisle Companies recently reported its third quarter 2025 earnings, revised its fiscal year outlook to flat revenue, affirmed a US$1.10 per share dividend, updated its buyback totals, and announced key leadership changes in its Construction Materials segment.

- An important insight is the company's decision to bring in a new President for its Construction Materials business, reflecting a focus on leadership continuity as it manages evolving industry and financial conditions.

- We'll explore how Carlisle's updated revenue outlook for 2025 could influence the company's investment narrative and projected growth path.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carlisle Companies Investment Narrative Recap

To be a Carlisle Companies shareholder, you need to believe in the resilience of the commercial reroofing market and the firm’s ability to offset cyclical headwinds through operational efficiency and product innovation. The recent executive transition in the Construction Materials segment, as well as the flat revenue outlook for 2025, do not appear to materially shift the company's most important short-term catalyst, the durability of recurring reroofing demand, but ongoing end-market softness remains the biggest near-term risk.

Among recent announcements, the decision to bring Jason Taylor in as President of Construction Materials is particularly relevant. Leadership continuity, deep industry relationships, and experience in driving both sales and margin growth could support Carlisle’s ongoing operational improvement programs as the company manages near-term market uncertainty.

Yet, offsetting market headwinds through self-help and efficiency initiatives requires consistent execution, and if these efforts fall short, investors should be aware...

Read the full narrative on Carlisle Companies (it's free!)

Carlisle Companies' outlook anticipates $5.8 billion in revenue and $997.0 million in earnings by 2028. This is based on analysts forecasting 4.9% annual revenue growth and a $193 million increase in earnings from the current $803.9 million.

Uncover how Carlisle Companies' forecasts yield a $374.75 fair value, a 18% upside to its current price.

Exploring Other Perspectives

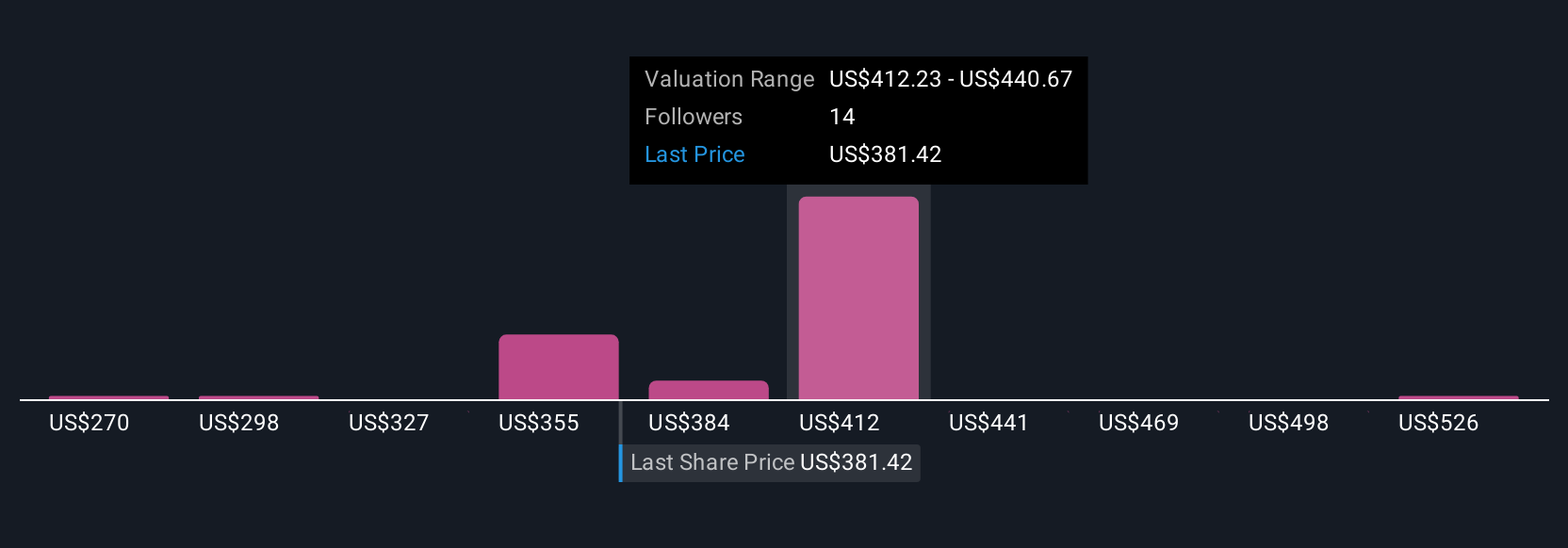

Fair value estimates from seven Simply Wall St Community members span from US$270 to US$554.45 per share. While these opinions vary, many are weighing whether execution risk on Carlisle’s efficiency initiatives could challenge future margin targets and overall performance, consider how your outlook fits within this wide range of independent perspectives.

Explore 7 other fair value estimates on Carlisle Companies - why the stock might be worth 15% less than the current price!

Build Your Own Carlisle Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlisle Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carlisle Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlisle Companies' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal