Sanmina (SANM): Evaluating Valuation After Strong One-Year Shareholder Returns and Recent Stock Surge

See our latest analysis for Sanmina.

After a recent surge that saw the share price jump more than 24% in just the last week, Sanmina's momentum has only been underscored by a 1-year total shareholder return topping 104%. Over both the short and long term, the stock’s strong uptrend signals growing investor confidence in its outlook and value.

If Sanmina’s run has you thinking about what else is gaining traction, broaden your perspective and discover See the full list for free.

But with such rapid gains and solid financial growth, is Sanmina trading at an attractive valuation, or have investors already factored in all future upside? Is there still a buying opportunity here, or is the market already pricing in continued growth?

Most Popular Narrative: 10.4% Undervalued

Against Sanmina's last close of $170.31, the narrative calculation puts its fair value more than 10% higher at $190. This sets high expectations and reveals a valuation call driven by future growth and major strategic moves.

Strategic investments in automation, digital transformation, and the shift toward full system integration (highlighted by the buildout of end-to-end solutions for data center AI, liquid cooling, advanced circuit boards, etc.) are already showing benefits in operational efficiencies and gross margin expansion, which should compound over time and lift net margins.

Curious about what powers such a bullish outlook? There’s a crucial financial lever at play: a dramatic expansion plan projected to reshape earnings power at a pace usually reserved for the tech sector’s hottest names. The forecast is bold and the assumptions even bolder. Want to know what’s fueling these targets? Dive in to see which future trends and core metrics could make or break this valuation.

Result: Fair Value of $190 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain hiccups or difficulties integrating acquisitions such as ZT Systems could quickly challenge Sanmina's bullish growth outlook and margins.

Find out about the key risks to this Sanmina narrative.

Another View: What the SWS DCF Model Reveals

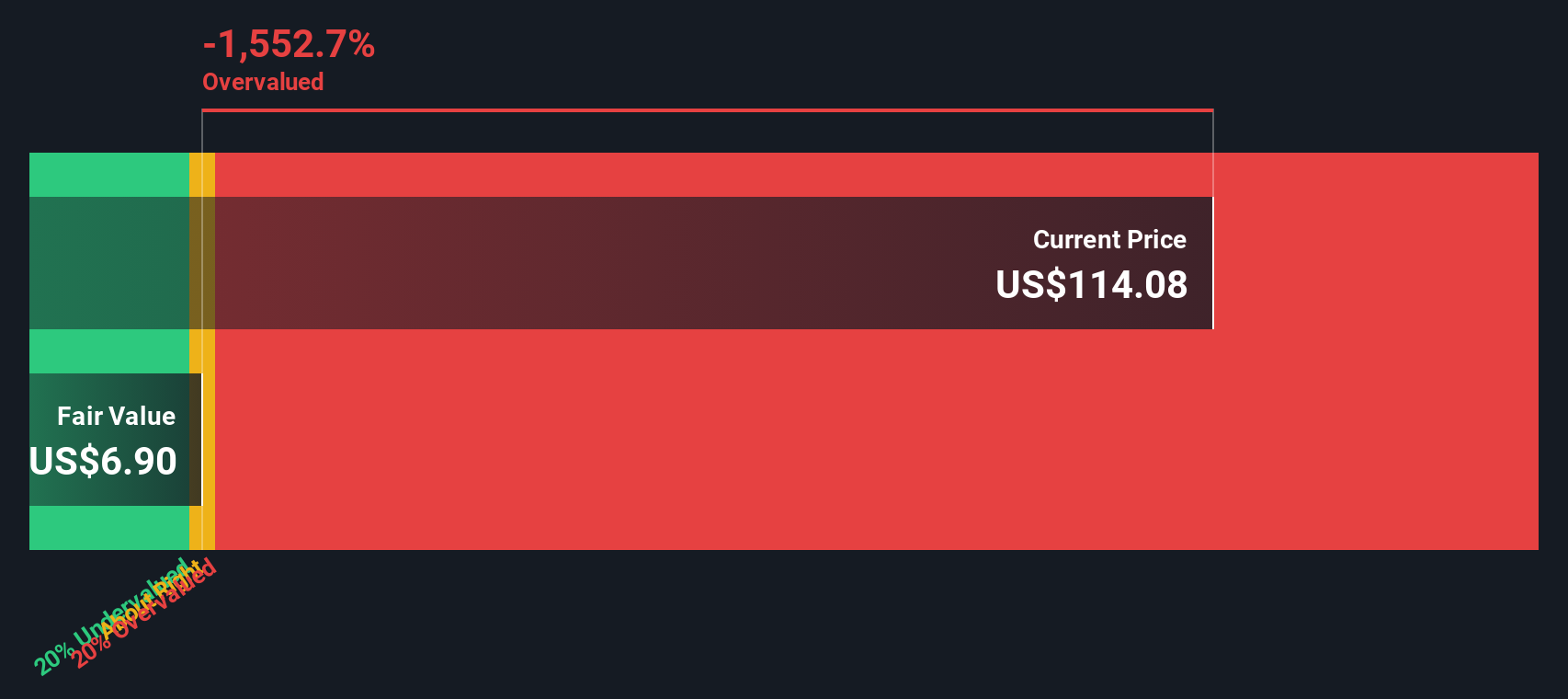

While multiples analysis points to Sanmina as undervalued, our SWS DCF model comes to a very different conclusion. The DCF estimate suggests that Sanmina, at $170.31, trades well above its calculated fair value of $25.25, which may imply potential overvaluation if future cash flows fall short. Does this leave little margin for error, or could the market see something the model does not?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sanmina Narrative

If you have your own take on Sanmina’s numbers or want to run the analysis yourself, you can build your own perspective in just a few minutes by using Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sanmina.

Looking for More Investment Ideas?

Don’t let your momentum stall. Push your investing further by checking out these top opportunities you might be missing.

- Boost your portfolio’s stability and returns by tapping into these 16 dividend stocks with yields > 3% with attractive yields and reliable income potential.

- Capture early upside as innovation increases by targeting these 24 AI penny stocks in a rapidly expanding sector.

- Find hidden value and discover stocks the market is overlooking with these 876 undervalued stocks based on cash flows, designed to spotlight bargains backed by strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal