Does Sensata Technologies' Goodwill Impairment and Net Loss Signal a Shift in ST's Investment Story?

- Sensata Technologies reported third quarter 2025 results, disclosing sales of US$931.98 million and a net loss of US$162.52 million, alongside a US$225.7 million goodwill impairment charge, and issued fourth quarter guidance with revenue expected between US$890 million and US$920 million.

- The company completed its US$217.6 million share buyback plan with only US$0.02 million repurchased during the third quarter, highlighting a slowdown in buyback activity amid recent financial headwinds.

- We'll examine how the sizable goodwill impairment charge and weak earnings performance may reshape Sensata Technologies' investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sensata Technologies Holding Investment Narrative Recap

For shareholders in Sensata Technologies, the investment argument hinges on the company’s ability to capture growth from electrification in auto and industrial markets, while defending margins from cyclical pressures and competitive threats. The recent goodwill impairment and soft earnings underscore ongoing headwinds in core end markets, but these issues do not materially alter the key short-term catalyst: new business from Chinese NEV OEMs, which remains critical to restoring revenue momentum. Persistently weak earnings and the evolving risk of margin compression still demand close attention from investors.

The sharp goodwill impairment charge announced in the third quarter most directly reflects the strain on Sensata’s profitability and may serve as a reminder of mounting pressure from price competition and shifting industry demands. While management’s guidance forecasts a return to net income in Q4, margin resilience will be tested if end market conditions remain soft, especially in automotive and HVOR segments, where Sensata sees significant exposure.

However, investors should also be aware that, despite signals of recovery in projected fourth-quarter income, Sensata’s ability to withstand continued pricing pressure from local Chinese competitors remains a key risk...

Read the full narrative on Sensata Technologies Holding (it's free!)

Sensata Technologies Holding's narrative projects $4.2 billion revenue and $495.4 million earnings by 2028. This requires 3.6% yearly revenue growth and a $384.1 million increase in earnings from $111.3 million today.

Uncover how Sensata Technologies Holding's forecasts yield a $39.07 fair value, a 26% upside to its current price.

Exploring Other Perspectives

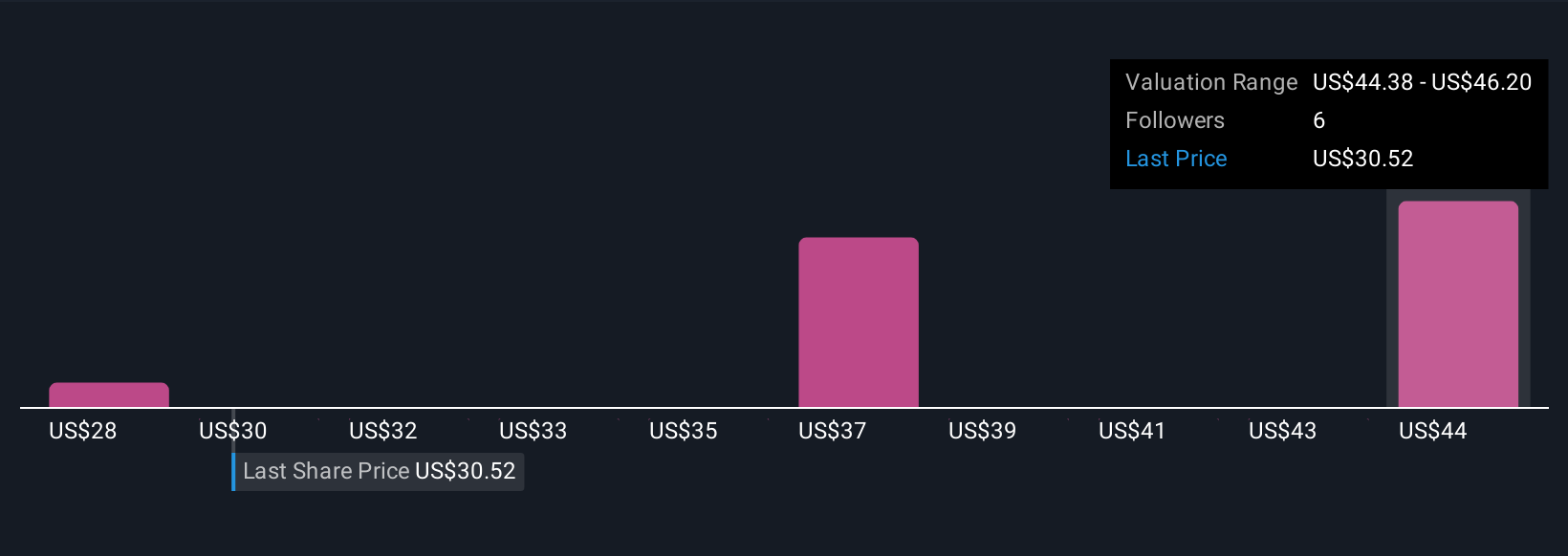

Three investor fair value estimates from the Simply Wall St Community span US$27.98 to US$39.42 per share, revealing a spread of over US$11. With many market participants highlighting margin pressure from price competition as a persistent risk, it is clear that opinions on Sensata’s future vary widely, offering you several alternative viewpoints to consider.

Explore 3 other fair value estimates on Sensata Technologies Holding - why the stock might be worth as much as 27% more than the current price!

Build Your Own Sensata Technologies Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sensata Technologies Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sensata Technologies Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sensata Technologies Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal