Did Narrowing Losses and Conservative Guidance Just Shift Cohu’s (COHU) Investment Narrative?

- Cohu, Inc. recently released its third quarter 2025 results, reporting US$126.25 million in sales and a net loss of US$4.1 million, alongside sales guidance of US$122 million +/- US$7 million for the fourth quarter.

- While losses narrowed year-over-year, nine-month net losses increased despite higher sales, and no additional shares were repurchased in the latest buyback tranche.

- We will examine how the company's narrowing quarterly loss and conservative fourth-quarter outlook could influence the investment narrative for Cohu.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Cohu Investment Narrative Recap

For investors considering Cohu, the core belief centers on sustained demand for semiconductor test equipment, especially as automotive, mobile, and AI-driven applications grow more complex. The latest quarterly update, showing a narrower loss but projecting softer fourth-quarter sales, appears to have limited impact on the most important near-term catalyst: meaningful recovery in semiconductor end-markets. However, the main risk, revenue volatility linked to customer concentration and industry cycles, remains front and center following these results.

Among the recent announcements, Cohu’s fourth-quarter sales guidance of US$122 million +/- US$7 million stands out, as it sets the tone for short-term investor expectations. This cautious outlook, while not unexpected given industry conditions, suggests that the hoped-for cyclical upswing may still be vulnerable to continued "two steps forward, one step back" market dynamics.

In contrast, investors should be aware that concentrated exposure to a few large customers means ...

Read the full narrative on Cohu (it's free!)

Cohu's narrative projects $640.1 million revenue and $90.3 million earnings by 2028. This requires 17.6% yearly revenue growth and a $177.4 million increase in earnings from -$87.1 million today.

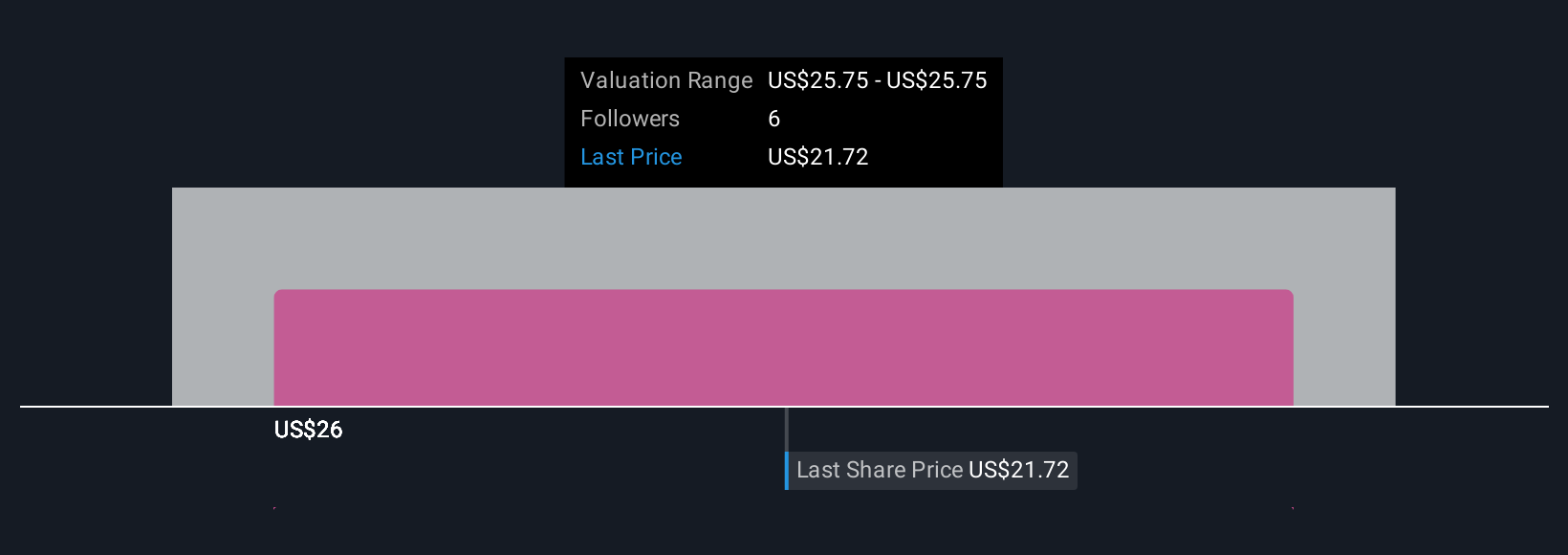

Uncover how Cohu's forecasts yield a $28.50 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community has shared a fair value estimate for Cohu, pegging it at US$28.50 per share. The ongoing risk of revenue volatility due to customer concentration may influence how much confidence future participants place in these valuations, inviting readers to consider a range of views.

Explore another fair value estimate on Cohu - why the stock might be worth as much as 19% more than the current price!

Build Your Own Cohu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cohu research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cohu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cohu's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal