Patrick Industries’ (PATK) Higher Sales but Lower Profits: What Do Margins Reveal About Its Strategy?

- Patrick Industries reported results for the third quarter and first nine months of 2025, showing sales growth to US$975.63 million and US$3.03 billion respectively, but with net income and diluted earnings per share both declining from the year prior.

- Although sales increased, the contrast with lower profitability may draw added attention to margin pressures or cost factors affecting overall earnings quality.

- We'll assess how the company’s mixed results, higher sales but lower net income, could inform its investment narrative and longer-term outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Patrick Industries Investment Narrative Recap

To be a shareholder in Patrick Industries, you likely believe in the long-term potential of its core markets and product innovation despite the inherent volatility of RV, marine, and manufactured housing demand. The latest report of rising sales but falling profits does not materially change the biggest short-term catalyst, recovery in end-market demand, or the primary risk of margin compression from elevated input costs and weakening profitability.

Among recent announcements, the company paused share repurchases last quarter after previously buying back over 4.25 million shares since 2020. This context underlines management’s evolving capital allocation decisions at a time when earnings are under pressure and margin risks remain visible for investors considering the near-term trajectory.

In stark contrast with rising sales, the persistence of margin pressure and its effects on earnings quality remain a factor investors should not ignore, as...

Read the full narrative on Patrick Industries (it's free!)

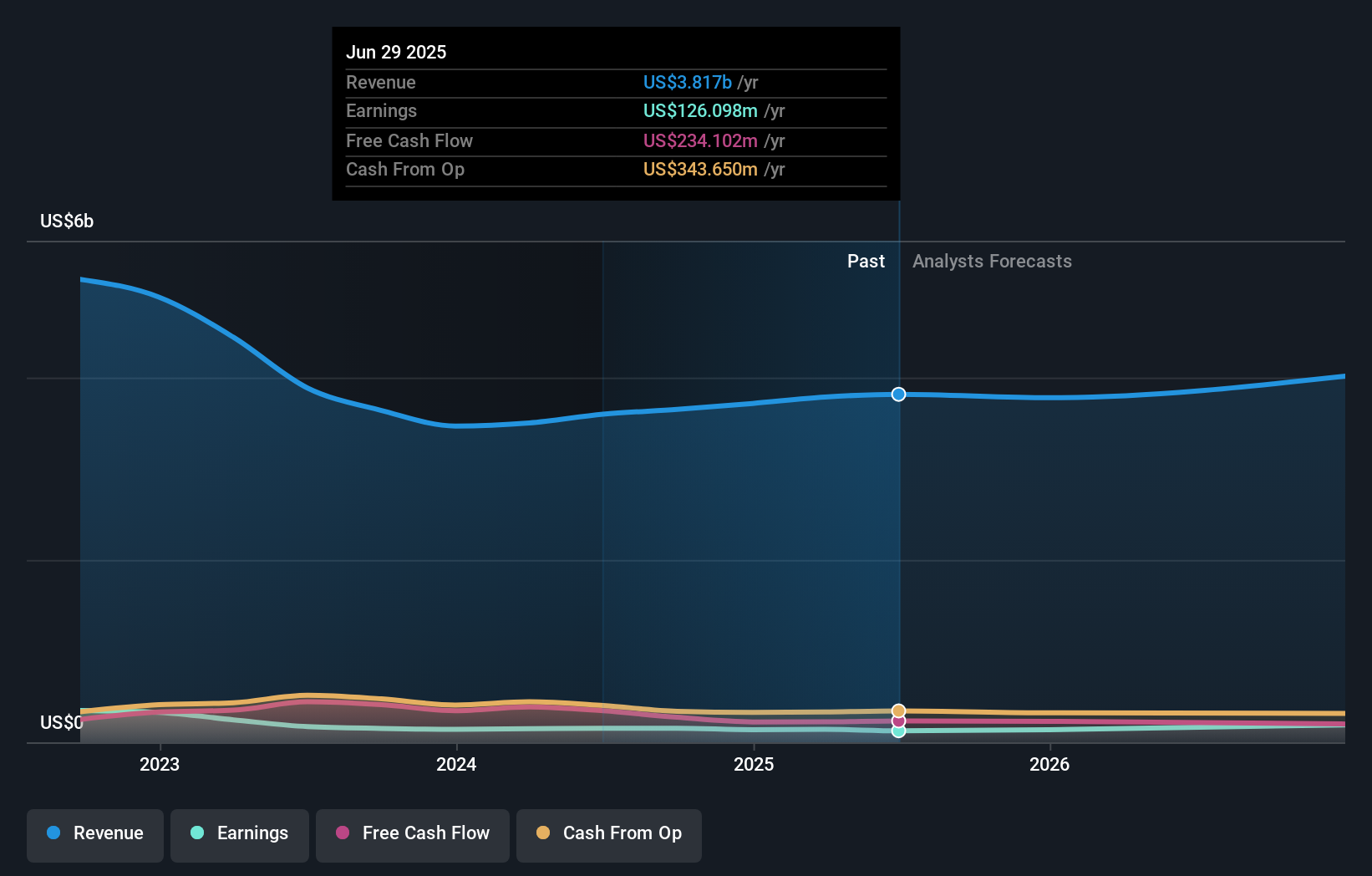

Patrick Industries is projected to reach $4.2 billion in revenue and $273.7 million in earnings by 2028. This outlook implies annual revenue growth of 3.2% and an earnings increase of $147.6 million from the current earnings of $126.1 million.

Uncover how Patrick Industries' forecasts yield a $110.20 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community estimates for Patrick Industries' fair value range from US$97.06 to US$110.20, drawn from two unique analyses. While analysts point to margin compression as a key risk, these varied perspectives suggest room for more debate on how cost trends may influence the stock's outlook.

Explore 2 other fair value estimates on Patrick Industries - why the stock might be worth 8% less than the current price!

Build Your Own Patrick Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patrick Industries research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Patrick Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patrick Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal