The Bull Case For Interface (TILE) Could Change Following Raised 2025 Outlook on Healthcare and Automation Momentum

- Earlier this week, Interface, Inc. revised its earnings guidance for fiscal year 2025, expecting net sales between US$1.375 billion and US$1.390 billion, up from its prior lower end forecast of US$1.370 billion.

- This update follows quarterly results that outpaced expectations, fueled by robust growth in the healthcare segment and further gains from automation and productivity improvements.

- We will explore how Interface’s raised full-year outlook, supported by healthcare and automation momentum, impacts its broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

Interface Investment Narrative Recap

To be a shareholder in Interface, I would need to see value in its ability to expand beyond its core U.S. market and maintain its edge in sustainable and innovative flooring, especially as global competition remains fierce. The latest upward guidance revision, while reflecting continued strength in healthcare and automation, is incremental, and does not materially alter the balance between near-term momentum from healthcare growth and the heightened risk of overreliance on the U.S. commercial market.

Among Interface's recent announcements, its Q3 2025 results stand out, with revenue and earnings exceeding expectations, again buoyed by healthcare segment gains. This performance aligns directly with the most important current catalyst: broadening end-market demand, particularly in healthcare, which complements ongoing automation-driven productivity improvements and provides a clearer path toward margin expansion.

But as demand shifts and international exposure remains limited, investors should also consider the implications if U.S. commercial real estate activity slows...

Read the full narrative on Interface (it's free!)

Interface's narrative projects $1.6 billion revenue and $133.7 million earnings by 2028. This requires 5.3% yearly revenue growth and a $37.7 million earnings increase from $96.0 million today.

Uncover how Interface's forecasts yield a $32.67 fair value, a 27% upside to its current price.

Exploring Other Perspectives

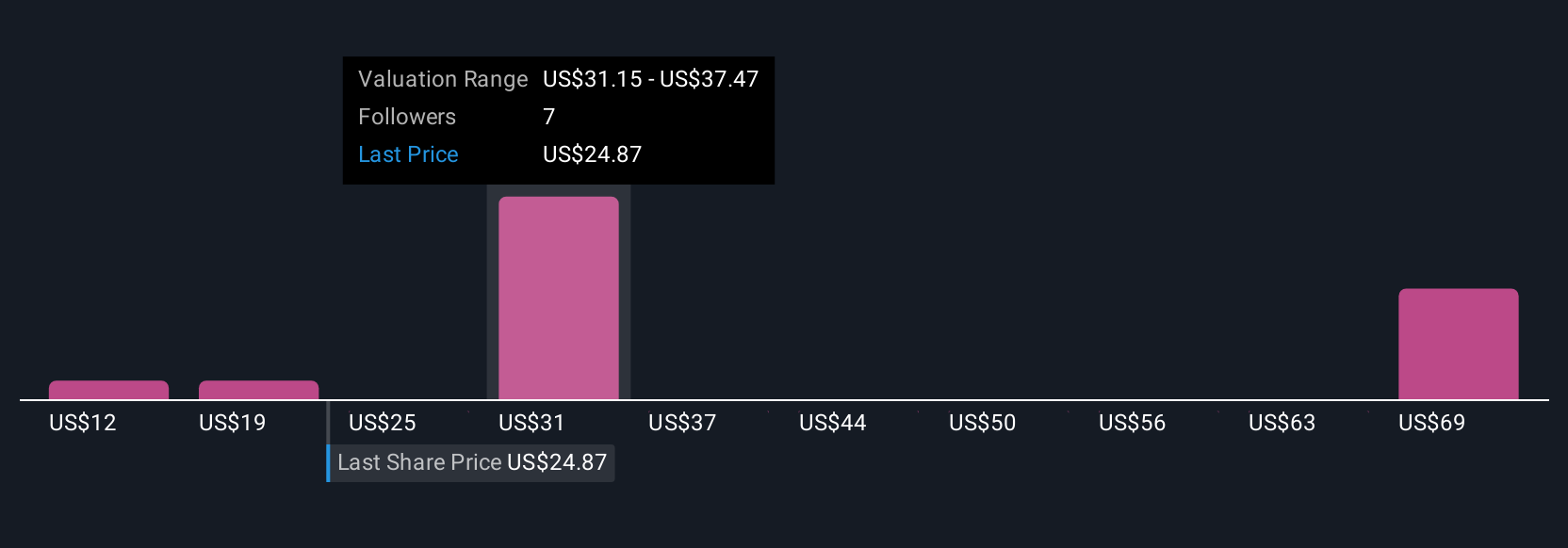

Simply Wall St Community members set TILE's fair value between US$19.82 and US$56.43, based on four independent estimates. With healthcare as an engine of interface's current momentum, these diverging appraisals underline the range of expectations around its future trajectory.

Explore 4 other fair value estimates on Interface - why the stock might be worth over 2x more than the current price!

Build Your Own Interface Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interface research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interface research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interface's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal