What Genesis Energy (GEL)'s Return to Quarterly Profitability Means for Shareholders

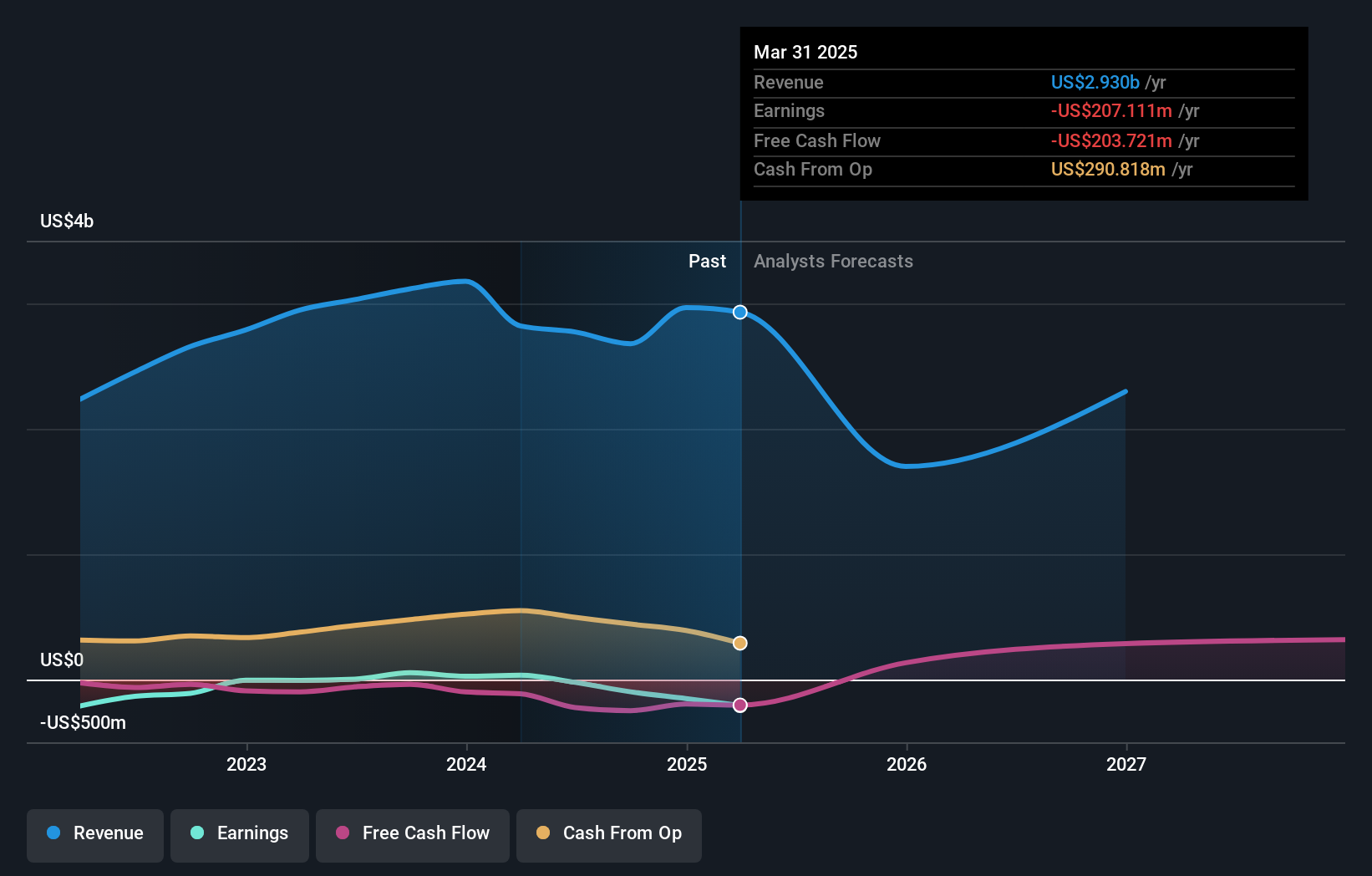

- Genesis Energy, L.P. recently reported its third quarter and nine-month results for the period ended September 30, 2025, showing third quarter revenue of US$414 million and net income of US$9.21 million, marking an improvement from a net loss in the same quarter last year.

- While quarterly results reflected a return to profitability, the company reported a substantial net loss of US$460.27 million for the nine-month period.

- We’ll explore how Genesis Energy’s move from a quarterly loss to profit adds new context to its longer-term investment outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is Genesis Energy's Investment Narrative?

For shareholders of Genesis Energy, the core investment story often centers on faith in the company’s ability to stabilize cash flows and return to consistent profitability, particularly given its essential infrastructure and recurring revenue streams. The recent third quarter earnings marked a notable return to profitability, which could influence sentiment around management’s turnaround efforts and near-term catalysts like improved cost controls and potential asset sales. Yet, despite this quarterly improvement, the sizable net loss over the past nine months signals that biggest risks, such as deteriorating cash flow coverage for dividends, weak revenue trends, and a limited cash runway, remain front and center. As a result, while the recent profit helps prospects, it does not fully resolve questions about the long-term sustainability of distributions or the impact of further revenue declines expected by analysts. Investors may reassess the importance of near-term profit versus structural risks given these developments.

But investors should contrast this quarter’s headline profitability with ongoing cash flow and dividend risks. Genesis Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Genesis Energy - why the stock might be worth just $19.33!

Build Your Own Genesis Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genesis Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Genesis Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genesis Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal