SunOpta (STKL): One-Off $11.8M Loss Challenges Profit Growth Narrative Despite High Valuation

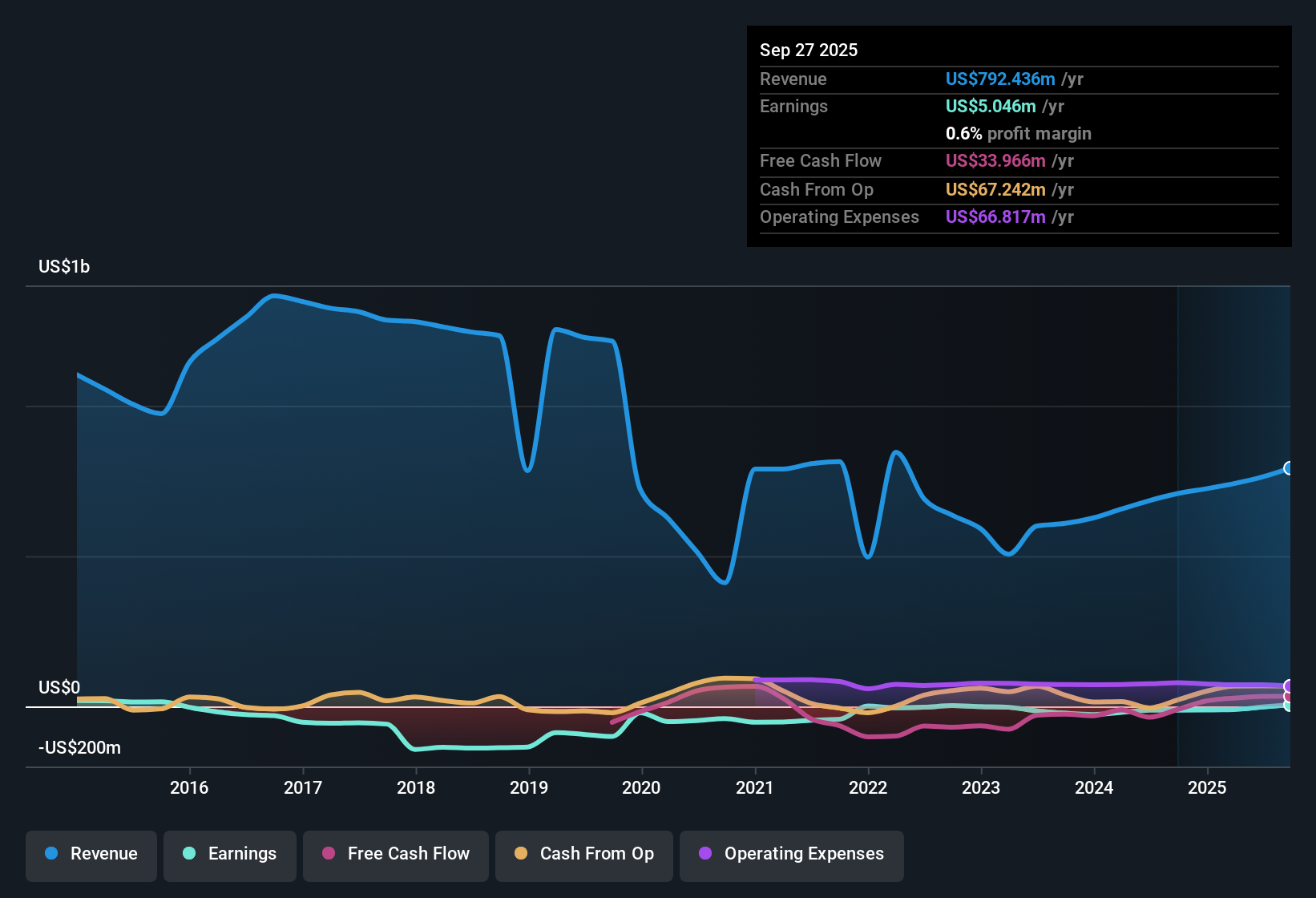

SunOpta (STKL) has turned profitable, posting average earnings growth of 39% per year over the last five years, though recent figures were affected by a one-off $11.8 million loss that weighed on reported results. Looking ahead, analysts expect the company’s earnings to accelerate at a striking 100.7% annual rate, outpacing the broader US market forecast of 15.8%. Meanwhile, revenue is projected to grow at a slower 7.5% per year compared to the market’s 10.4% average.

See our full analysis for SunOpta.With the headline figures in hand, it is time to see how SunOpta’s latest results compare to the most commonly discussed narratives about the company, and whether the current storylines hold up to scrutiny.

See what the community is saying about SunOpta

Manufacturing Expansion Drives Margin Outlook

- SunOpta’s analysts forecast profit margins to increase from -0.3% currently to 14.2% in 3 years. This shift is primarily attributed to expanding manufacturing capacity and a portfolio transition toward higher-margin products.

- According to the analysts' consensus view:

- Consensus notes that new manufacturing lines, which are already oversubscribed, are positioned to turn SunOpta's strong demand for plant-based and fruit products into higher efficiency and expanded gross margins.

- They argue that efforts to pass through input cost inflation have sustained earnings stability, supporting the expectation of improved margins even as the industry faces ongoing supply chain volatility.

- With a shift to higher-value products and a robust demand pipeline, margin growth and operational leverage are now pivotal in the analysts' overall positive outlook.

See whether SunOpta’s upgrades and margin improvements bring it closer to industry leaders, and dig deeper into Wall Street’s full perspective in the consensus narrative. 📊 Read the full SunOpta Consensus Narrative.

Heavy Capital Needs Raise Questions

- Major investments, such as a $25 million fruit snack manufacturing line and anticipated future expansions, will require significant capital outlays that could place stress on SunOpta’s free cash flow and increase net leverage if projected demand does not fully materialize.

- Bears highlight several persistent risks:

- Heavy reliance on fast-growing fruit snacks and plant-based beverages, combined with low brand recognition and a private-label focus, leaves SunOpta more vulnerable than peers if consumer tastes shift or key customers consolidate business elsewhere.

- Heightened exposure to tariffs, possible regulatory changes, and larger competitors entering core categories threatens margins and could undercut the narrative of steady profit growth.

Valuation: Price-to-Earnings at a Steep Premium

- At 105.4 times earnings, SunOpta trades at a significant premium to both its food industry average (17.8x) and direct peers (11x), despite its latest share price of $3.86 sitting well below the DCF fair value estimate of $46.26.

- Analysts' consensus view underscores this tension:

- While projected annual earnings growth of 100.7% over the coming years drives optimism for a rapid catch-up in valuation, reliance on forecasts and the one-off $11.8 million loss this year make the current P/E look aggressive compared to industry norms.

- Consensus expects future P/E to normalize (to around 10.0x in 2028) if the profit ramp materializes, but warns that if SunOpta does not deliver, today’s premium leaves little cushion for disappointment.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SunOpta on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on SunOpta's numbers? Build your perspective in just a few minutes and add your voice to the conversation. Do it your way

A great starting point for your SunOpta research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

SunOpta’s heavy capital needs and expensive valuation make its future highly dependent on flawless execution. This leaves little margin for error if growth slows or margins disappoint.

If you’d rather not take that risk, check out these 853 undervalued stocks based on cash flows to find companies trading at more attractive prices with potential for stronger upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal