Sleep Number (SNBR): Five-Year Losses Worsen, Turnaround Hopes Face Scrutiny From Investors

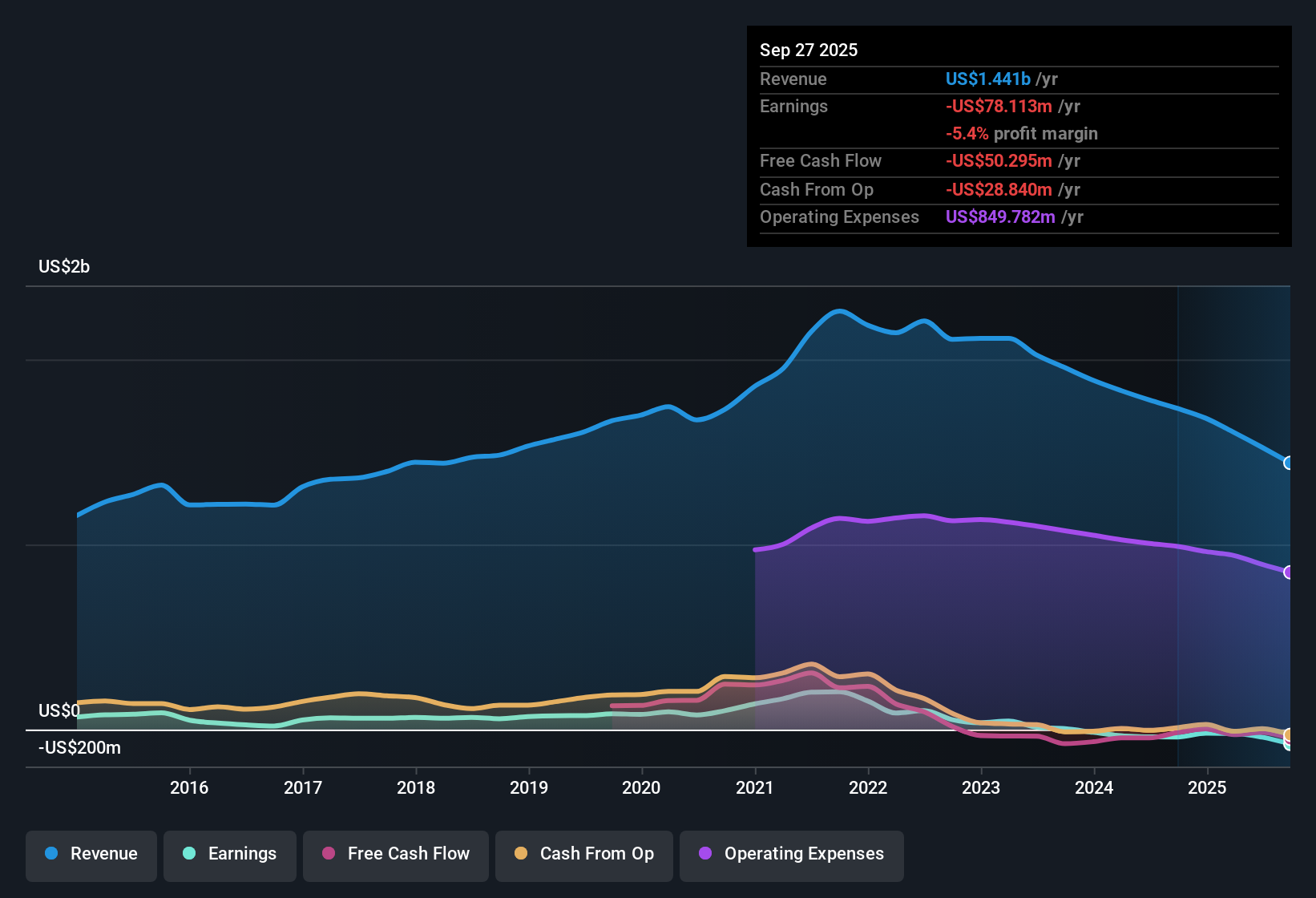

Sleep Number (SNBR) continues to face headwinds, reporting another year of rising losses, which have increased at an annual rate of 67.7% over the past five years. Despite a persistently negative net profit margin, the outlook has brightened with forecasts calling for annual earnings growth of 97.54% and a return to profitability within the next three years. This rate would outpace the broader market. Revenue is expected to grow at 3.6% per year, trailing the US average of 10.5%. However, shares trade well below estimated fair value, fueling positive sentiment about a potential turnaround.

See our full analysis for Sleep Number.Now that we have the latest numbers, let’s see how this performance matches up with the widely followed narratives. Some expectations may be confirmed, while others could be upended as we dig deeper.

See what the community is saying about Sleep Number

Margins Projected to Swing From -2.7% to 1.6%

- Analysts expect Sleep Number’s profit margin to increase from the current -2.7% to a positive 1.6% within three years, supported by aggressive cost-cutting and margin improvement strategies.

- Analysts’ consensus view notes this turnaround hinges on successful execution of cost discipline programs and margin recovery.

- EBITDA margin expansion is being driven by $130 million in targeted expense reductions through 2025, spanning G&A, R&D, and operational streamlining.

- However, the consensus highlights that no material top-line growth initiatives are expected until at least 2026. This means these margin gains may occur in a flat sales environment.

- Momentum in marketing efficiency, including a 24% increase in conversion rates year-over-year, further underpins expectations for a leaner cost structure and improving margins.

The consensus narrative calls out this margin story as a double-edged sword. If cost controls stick, Sleep Number could outperform, but any falter would leave little buffer for earnings growth. 📊 Read the full Sleep Number Consensus Narrative.

High Debt Levels Limit Flexibility

- Consensus narrative flags high debt and reliance on favorable lender negotiations as constraints on Sleep Number’s ability to invest in innovation or expand channels, intensifying the risk of future margin or earnings compression if economic or lending conditions worsen.

- Elevated debt means future interest expenses and capital allocation remain tightly restricted, directly impacting long-term profitability.

- The absence of negative equity avoids immediate balance sheet danger, but the debt load limits room for strategic pivots or large-scale product innovation.

- Bears argue that such a balance sheet, paired with a lack of near-term revenue growth drivers, puts forward valuation multiples at risk as competitive and macro pressures persist.

- Competitive threats from smart bed and connected home entrants could erode Sleep Number’s margins and premium positioning, particularly if it cannot fund innovation as easily as peers.

DCF Fair Value Far Outpaces Share Price

- Current Sleep Number share price of $5.29 trades at a steep discount to its DCF fair value of $21.86 and also below industry and peer price-to-sales averages.

- Analysts’ consensus view highlights this gap presents a clear value-driven argument, but only if projected earnings recovery and margin expansion actually materialize. Otherwise, the discount could reflect justifiably high risk.

- Consensus price target is $6.00, slightly above the market but still well below the long-term DCF estimate, reflecting skepticism about near-term turnaround.

- Consensus notes this setup leaves the upside case exposed to meaningful execution risk and the downside open in the event of further margin pressures or stalled top-line recovery.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sleep Number on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Curious how your perspective compares? If you spot something others don’t, you can shape your own narrative about Sleep Number in just a few minutes. Do it your way

A great starting point for your Sleep Number research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Sleep Number’s heavy debt load and constrained financial flexibility raise concerns about its capacity to invest, innovate, or withstand future economic headwinds.

If you want companies with stronger foundations, use solid balance sheet and fundamentals stocks screener (1979 results) to discover those with robust finances and less risk from debt or balance sheet stress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal