Horace Mann (HMN): Margin Rebound Reinforces Narrative of Improving Profitability Despite Slow Revenue Outlook

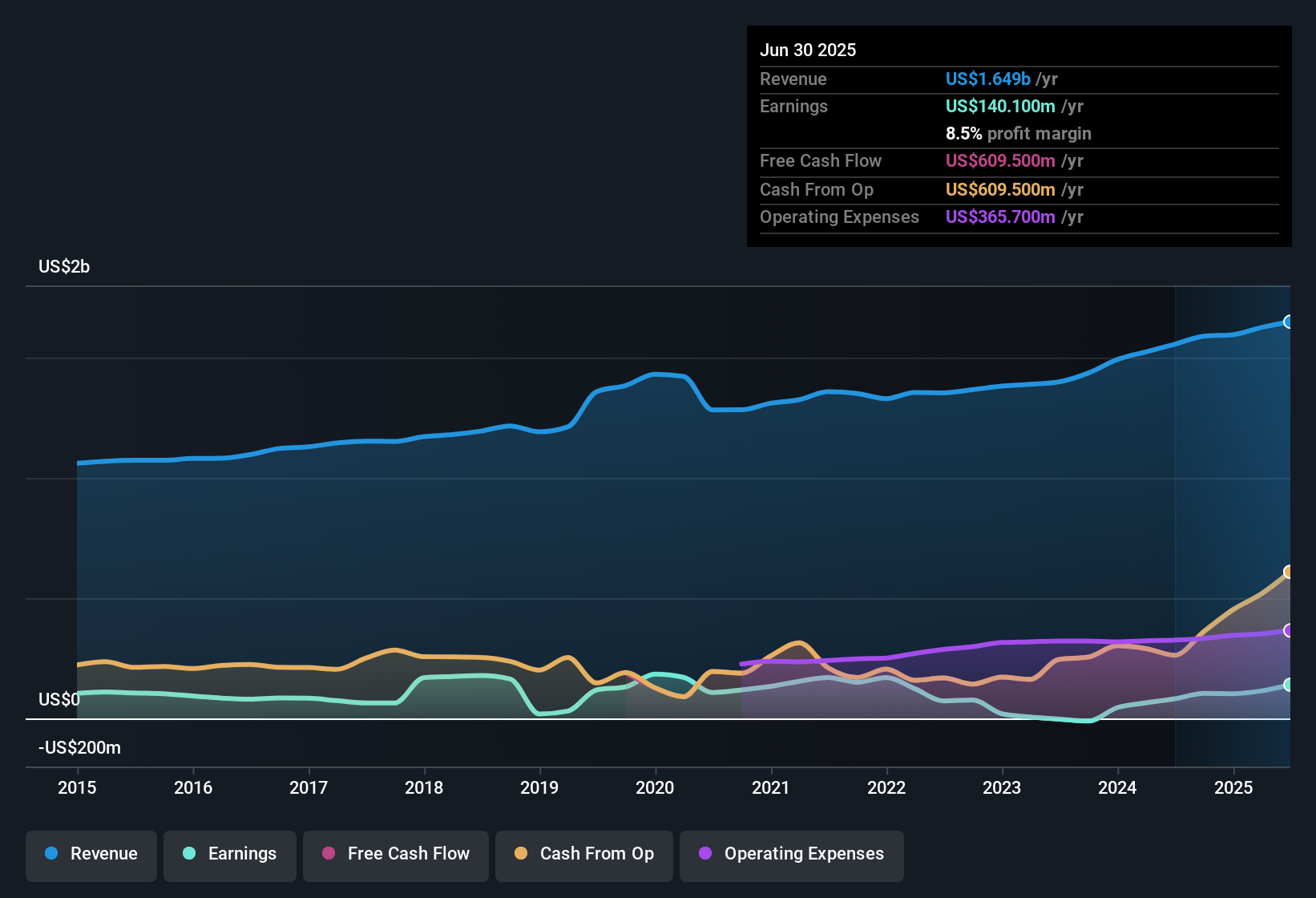

Horace Mann Educators (HMN) posted a notable turnaround in its latest results, with EPS margins climbing to 8.5% compared to 5.2% last year, and a dramatic 71.9% earnings growth over the prior period. This reverses a five-year trend of 14.4% annual declines. However, the revenue outlook is more subdued, with future growth expected at 5.7% per year, which lags behind the broader US market pace of 10.5%. The company’s improvement in profitability and rising EPS provide a positive setup for investors, though slower forecasted revenue growth may keep expectations in check.

See our full analysis for Horace Mann Educators.Next up, we will see how these headline results compare with the most widely held narratives about Horace Mann Educators, looking for both validation and surprises in the numbers.

See what the community is saying about Horace Mann Educators

Margins Expected to Hit 11.3% in Three Years

- Analysts project profit margins expanding from 8.5% now to 11.3% by 2027, pointing to further operational leverage as digital platforms and new products drive scale.

- The consensus narrative highlights that scalable technology like proprietary lead management and growing supplemental and retirement offerings are set to boost recurring fee income and steady margins.

- Enhancements in digital engagement are linked to higher agent productivity and improved customer retention. These factors are expected to support not only margins but also diversify revenue streams.

- Record supplemental sales and expanding product lines give Horace Mann Educators more stability as its traditional insurance operations face slower growth than the US market.

Consensus narrative notes the latest margin outlook reinforces optimism about Horace Mann's ability to weather slow growth while improving profitability. 📊 Read the full Horace Mann Educators Consensus Narrative.

Price-to-Earnings Ratio Sits Below Industry Average

- With shares priced at a 13.6x P/E, Horace Mann offers a valuation edge compared to the US insurance industry average of 14.3x, signaling the potential for relative value despite limited top-line growth.

- According to the consensus narrative, attractive P/E multiples and strong dividend support reward claims, but the current $46.75 share price trades well above DCF fair value of $22.67. This may challenge enthusiasm for new investors.

- Analysts’ consensus price target is $49.00, just 5.2% higher than the current share price, implying limited upside from here based on expected growth and market risks.

- This tight gap between price and analyst target suggests confidence in stable, but not high, forward returns given Horace Mann’s forecasted annual revenue growth of 5.7% versus the US market's 10.5%.

Retirement Product Growth Offsets Aging Customer Base

- Analysts expect annual revenue growth of 5.1% over the next three years, with rising contributions from retirement and annuity products mitigating slower momentum in traditional insurance segments.

- Consensus narrative underscores that despite a concentrated focus on an aging educator segment, which represents a long-term challenge for renewal premiums and annuity contributions, expansion into retirement planning and supplemental benefits is helping balance risk and support asset accumulation.

- Partnerships with educational organizations and growth in digital engagement are key drivers supporting deeper distribution and household retention, even as core educator demographics evolve.

- Ongoing investments in data and omnichannel tools are positioned to streamline acquisition and preserve margins amid demographic headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Horace Mann Educators on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from another angle? Take just a few minutes to shape your perspective into a unique financial story. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Horace Mann Educators.

See What Else Is Out There

Despite improved profitability, Horace Mann Educators faces limited upside because of sluggish revenue growth and shares trading significantly above DCF-estimated fair value.

If you want to focus on better-valued opportunities with stronger upside potential, discover these 836 undervalued stocks based on cash flows that may better fit your investment goals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal