Perdoceo Education (PRDO): Valuation Discount Persists as Net Margin Narrows, Challenging Bullish Narratives

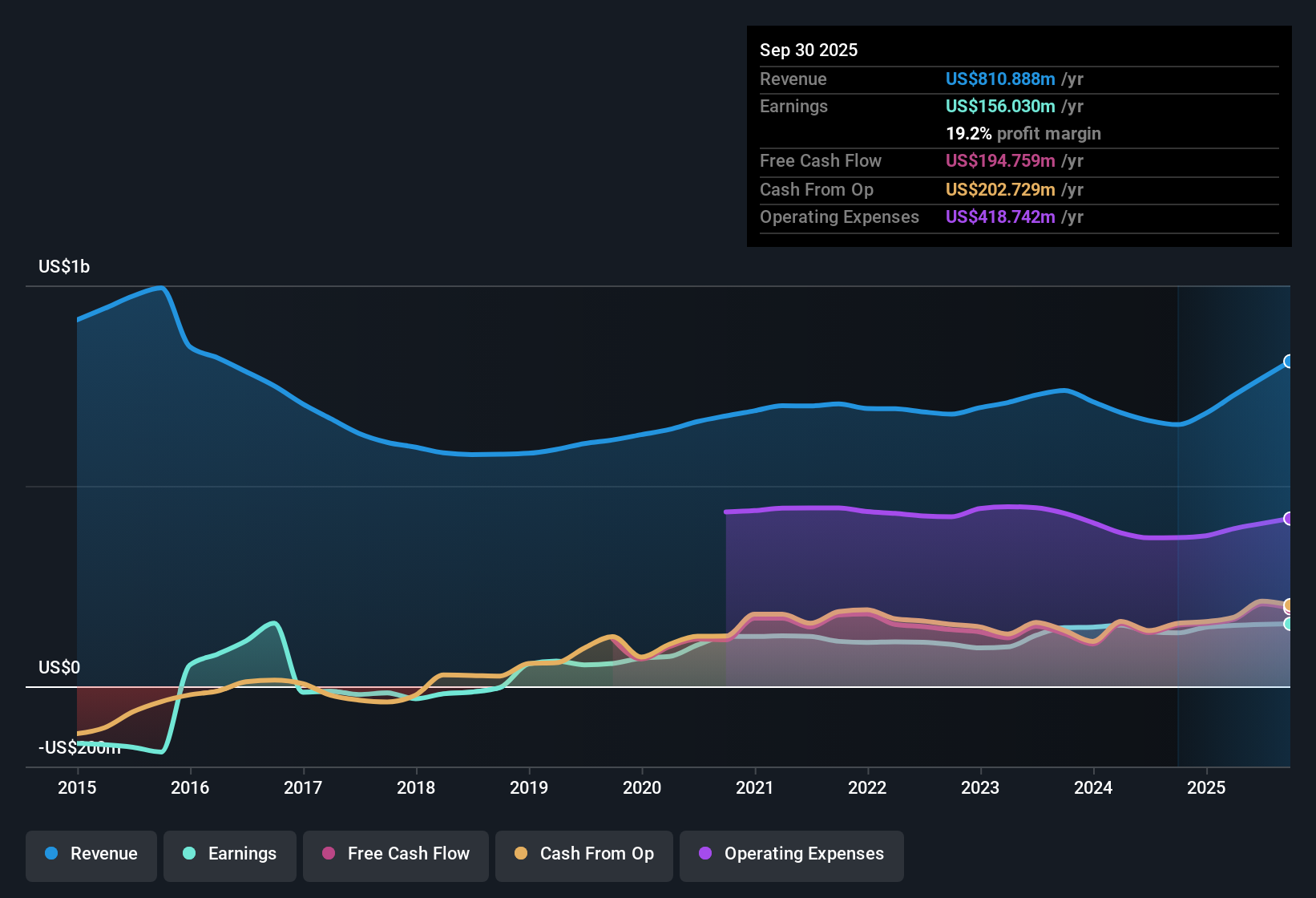

Perdoceo Education (PRDO) posted annual earnings growth of 13.3%, which pushed its five-year average to 6.2% per year. This signals an acceleration in profit expansion. The company’s net profit margin currently sits at 20.1%, down slightly from 20.6% last year. Its Price-To-Earnings ratio of 12.7x is noticeably lower than both its peer group and the broader US Consumer Services industry. With a robust margin profile and a valuation discount to peers, Perdoceo’s financial results offer plenty for value-focused investors to consider; however, the narrowing margin warrants monitoring.

See our full analysis for Perdoceo Education.Now, let's see how these earnings numbers compare with the dominant stories and expectations shaping the narrative around Perdoceo.

See what the community is saying about Perdoceo Education

Net Margin Holds Above 20% Despite Compression

- Net profit margin remains high at 20.1%, only a modest decrease from 20.6% last year, illustrating Perdoceo's ability to defend its profitability even as retention and enrollment dynamics evolve.

- Analysts' consensus view highlights constructive regulation and investments in student support, technology, and flexible learning formats as drivers behind industry-leading margins.

- Advantages include robust free cash flow and strong cost controls that have preserved margins above 20% for several years.

- However, the consensus narrative notes that further margin compression is expected, with projections of 18.2% in three years as the business scales and competition intensifies.

- Given the margin track record and evolving pressures, analysts conclude that profitability may moderate but remains a positive outlier among peers. Curious how this ties into their full narrative? 📊 Read the full Perdoceo Education Consensus Narrative.

Growth Relies on Acquisitions and Enrollment Gains

- Perdoceo’s five-year earnings growth sits at 6.2% annually, but the most recent year saw acceleration to 13.3%. This run rate is supported in part by contributions from the St. Augustine acquisition and sustained enrollment increases.

- The consensus narrative underscores that ongoing growth depends on continued momentum in both organic enrollments (driven by expanded industry-aligned programs and flexible formats) and successful integration of acquired institutions.

- A year-over-year enrollment gain of 17% and program expansion in high-demand fields are pinpointed as pillars for future revenue expansion through 2026.

- Still, the narrative warns that an overreliance on acquisitions, as opposed to organic growth, could expose the company to revenue volatility if future deals slow or integration falters.

Shares Trade at a Steep Valuation Discount

- With a Price-To-Earnings ratio of 12.7x, Perdoceo trades at a substantial discount to both its peer group (18.5x) and the broader US Consumer Services industry average (18.3x). This signals a value opportunity recognized in both the financial results and narrative context.

- The consensus view sees this discounted P/E multiple as an investor advantage versus sector peers, but stresses that the gap is partly warranted given expected margin compression and ongoing sector risks.

- While the current share price of $30.40 stands well below the analysts’ consensus price target of $42.00, the narrative cautions this upside potential hinges on future enrollment and sustained profit growth materializing as forecasted.

- As a result, investors are encouraged to sense check analyst assumptions on margins and growth rates, rather than simply following the valuation gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Perdoceo Education on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticed something others might have missed? Bring your insights to the table by creating your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Perdoceo Education.

See What Else Is Out There

Profit margins are compressing, and future earnings growth depends heavily on continued enrollment gains and acquisitions, which makes sustainability less certain.

If you prefer steadier growth and less earnings volatility, check out stable growth stocks screener (2073 results) for companies that consistently deliver strong performance across different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal