3 Stocks to Buy Now and Hold Forever

Key Points

Google Search has exceeded all expectations in 2025.

Taiwan Semiconductor is a key part of the AI race.

MercadoLibre has built an empire in Latin America.

Identifying stocks that are excellent buys now and intending to hold them forever is a wise investment strategy. It forces you to throw out some companies that are incredibly risky or are dependent on a single event occurring. These companies should also display resilience and be leaders in their industry. And they should have a history of beating the markets, as past strength can be an indicator of future success.

Three stocks that I'm confident I can buy now, hold forever, and crush the market with are Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Taiwan Semiconductor Manufacturing (NYSE: TSM), and MercadoLibre (NASDAQ: MELI). All three of these companies are leaders in their respective industries, and I think they are great buys now to reap long-term gains.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Alphabet

Alphabet is better known by some of the brands underneath its umbrella, like Google, YouTube, and the Android operating system. However, the backbone of the company is still Google Search.

Earlier this year, there was a lot of uncertainty surrounding Google Search. Companies like OpenAI were testing their own AI-first browser, the Justice Department was attempting to break up Alphabet due to its search monopoly, and investors were unsure if Google Search would stay relevant in the age of generative AI. A few months later, nearly all of these concerns have been allayed.

The judge presiding over the monopoly case didn't accept the Justice Department's breakup proposal and instead forced Alphabet to make a few concessions, but kept Alphabet intact. OpenAI's AI browser launched and was underwhelming. In fact, it was built on top of Alphabet's Chromium platform. Lastly, Google Search has seamlessly integrated generative AI through AI search overviews, allowing it to bridge the gap between traditional search and generative AI.

All of this added up to Alphabet's blowout third quarter, which saw its revenue rise 16% year over year to $102 billion and diluted earnings per share (EPS) increase 33% to $2.87. Alphabet is a resilient business that's built to thrive in the age of artificial intelligence and beyond, making it a great stock to buy now and hold forever.

Taiwan Semiconductor

Taiwan Semiconductor's dominance was never in question like Alphabet's. It's the world's leading chip foundry and produces chips for nearly every AI computing device in service. It got to this point by offering cutting-edge technology with strong yields, making it a no-brainer partner. Furthermore, it's a neutral party, as competitors all use TSMC as their main chip supplier.

This places Taiwan Semiconductor in an enviable position, and with chip demand only slated to rise over the next decade, it's in a great position to capture the lion's share of this growth. It's already reporting stellar growth, with Q3's revenue rising 41% to $33.1 billion.

An investment in Taiwan Semiconductor is a bet that we'll use more advanced chips in greater quantities in the future, which seems like an extremely safe gamble.

MercadoLibre

Last is MercadoLibre, which many have proclaimed to be the Amazon of Latin America. While this is partially true, it also includes elements of PayPal, due to its payment processing ecosystem.

Latin America is a vast and growing region, and has a population base far larger than that of the U.S. As a result, it's a potential gold mine as e-commerce rolls out. MercadoLibre is the most popular shopping platform and has developed a payment processing infrastructure system, essentially locking every Latin American consumer into its platform. That level of dominance can only be dreamed of by many American companies, and it has built a nearly unassailable moat in the region.

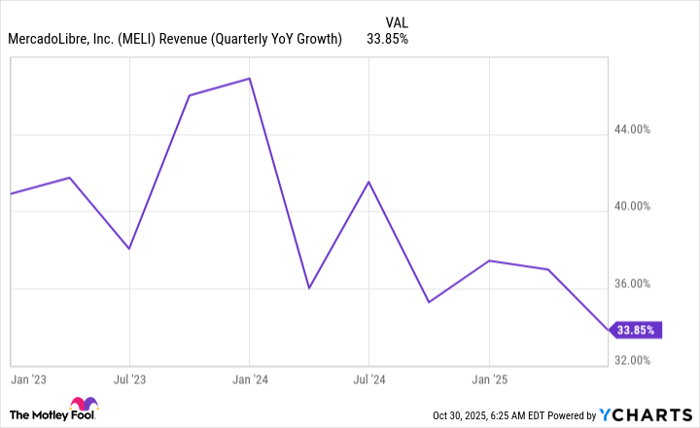

Despite this, the stock tends to respond negatively when international competitors decide to get involved. Amazon is starting to increase its presence in the region, which has some investors concerned that MercadoLibre's business could be harmed. However, MercadoLibre is still posting impressive revenue growth.

MELI Revenue (Quarterly YoY Growth) data by YCharts

I think it will be just fine over the long term, as this isn't the first time Amazon has ramped up its Latin American efforts. MercadoLibre is an excellent stock to buy and hold forever, as it's betting on the long-term prosperity of an emerging economic region.

Keithen Drury has positions in Alphabet, Amazon, MercadoLibre, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, MercadoLibre, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2025 $75 calls on PayPal. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal