Trump's Trade Deal With China Could Send This Amazon Rival Soaring: Big Spike In Growth Metrics

Amid the trade truce between the U.S. and China early this week, potentially bringing an end to months of uncertainty, this Chinese e-commerce giant, and one of Amazon.com Inc.’s (NASDAQ:AMZN) biggest rivals, looks all set to surge over the next few months.

Amazon Rival Sees Big Surge In Growth Metrics

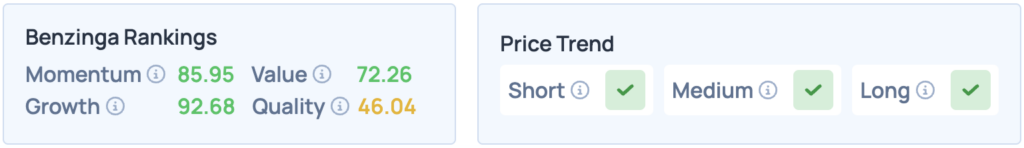

The stock in question has seen a big surge in its Growth score in Benzinga’s Edge Stock Rankings, within the span of the past week alone.

The Growth score in Benzinga’s Edge Rankings is assessed based on the pace of revenue and earnings growth at a company historically. It pays equal importance to both short and long-term trends, with a spike in the score indicating a strong recent quarterly earnings performance.

See Also: Amazon Strikes $38B OpenAI Deal, Wedbush Hikes Target To Street-High

1. Alibaba Group Holding

The stock we’re referring to is Alibaba Group Holding Ltd. (NYSE:BABA), one of the largest e-commerce and retail companies in the world.

Its Growth score in the Edge Rankings has surged from 65.51 to 92.28 within the span of a week, which can be attributed to the company’s recent fiscal first-quarter earnings performance, where it surpassed consensus estimates on revenue and profits.

The company has been seeing sentiments turn in its favor in recent months, with the stock up 97.40% year-to-date, and prominent investors such as Cathie Wood of Ark Invest making big bets on the company, owing to its recent advances in AI and cloud segments.

Alibaba shares were down 1.60% on Monday, closing at $167.69, and are down another 2.61% pre-market. The stock scores high on Momentum, Growth and Value in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Robert Way / Shutterstock.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal